NC E-595CF 2018-2026 free printable template

Show details

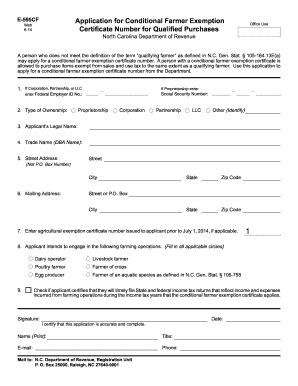

E595CFApplication for Conditional Farmer Exemption Certificate Number for Qualified PurchasesWebFill 9184PRINTCLEARNorth Carolina Department of RevenueOffice Used person who does not meet the definition

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign nc farmer exemption form

Edit your ncdor form e 595cf form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your NC E-595CF form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit NC E-595CF online

Use the instructions below to start using our professional PDF editor:

1

Sign into your account. In case you're new, it's time to start your free trial.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit NC E-595CF. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, it's always easy to deal with documents. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

NC E-595CF Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out NC E-595CF

How to fill out NC E-595CF

01

Obtain the NC E-595CF form from the North Carolina Department of Revenue website or your local office.

02

Fill in your name, address, and other contact information in the designated fields.

03

Specify the type of property or service for which the exemption is being claimed.

04

Provide the purchaser's name and details, if applicable.

05

Indicate the reason for the exemption, referring to the specific statutory citation.

06

Sign and date the form to certify the information provided is accurate.

07

Submit the completed NC E-595CF form to the appropriate vendor or supplier.

Who needs NC E-595CF?

01

Businesses or individuals who purchase items exempt from sales tax in North Carolina.

02

Entities that need to document their tax-exempt status for qualifying purchases.

03

Nonprofit organizations and government entities that make exempt purchases.

Fill

form

: Try Risk Free

People Also Ask about

How do I get a tax exempt number in NC?

Contact the Taxpayer Assistance and Collection Center at 1-877-252-3052 (toll-free) or fax your request to (919) 715-2999. Include in the request, your name or company name, address, telephone number, and exemption number.

How many acres do you need to be considered a farm for taxes in NC?

To qualify, parcels must be at least a certain number of acres (5 acres if used for horticulture, 10 acres if used for crops or livestock, 20 acres if used for forestry).

What qualifies as a farm in North Carolina?

What is the definition of a farm? A farm is a tract of land cultivated for the purpose of agricultural production. A farm is classified of having $1,000 or more of agricultural products being produced or sold.

How do I qualify for farm tax exemption in North Carolina?

North Carolina law allows farmers who gross over $10,000 in a given year, or who have average gross income of $10,000/year over three years to purchase certain items they need for their farm operations without paying sales tax.

What is a E 595E form?

North Carolina Form E-595E, Streamlined Sales and Use Tax Certificate of Exemption, is to be used for purchases for resale or other exempt purchases.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my NC E-595CF directly from Gmail?

You can use pdfFiller’s add-on for Gmail in order to modify, fill out, and eSign your NC E-595CF along with other documents right in your inbox. Find pdfFiller for Gmail in Google Workspace Marketplace. Use time you spend on handling your documents and eSignatures for more important things.

Can I create an eSignature for the NC E-595CF in Gmail?

You can easily create your eSignature with pdfFiller and then eSign your NC E-595CF directly from your inbox with the help of pdfFiller’s add-on for Gmail. Please note that you must register for an account in order to save your signatures and signed documents.

How do I edit NC E-595CF straight from my smartphone?

The best way to make changes to documents on a mobile device is to use pdfFiller's apps for iOS and Android. You may get them from the Apple Store and Google Play. Learn more about the apps here. To start editing NC E-595CF, you need to install and log in to the app.

What is NC E-595CF?

NC E-595CF is a certificate that allows certain exempt organizations and purchasers to buy tangible personal property or certain services without paying sales tax in North Carolina.

Who is required to file NC E-595CF?

Exempt organizations and certain purchasers who wish to make tax-exempt purchases in North Carolina are required to file NC E-595CF.

How to fill out NC E-595CF?

To fill out NC E-595CF, include your name, address, type of exemption, and a detailed description of the property or service being purchased.

What is the purpose of NC E-595CF?

The purpose of NC E-595CF is to provide a legal basis for exempt organizations and purchasers to avoid paying sales tax on qualifying purchases.

What information must be reported on NC E-595CF?

The information that must be reported on NC E-595CF includes the purchaser's name, address, the type of exemption, and a description of the items being purchased.

Fill out your NC E-595CF online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

NC E-595cf is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.