Packlink Customs Invoice 2018 free printable template

Show details

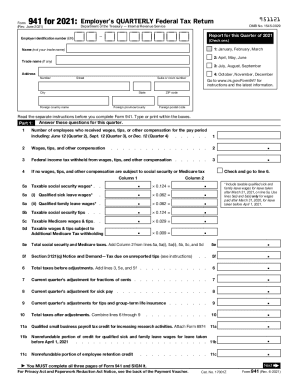

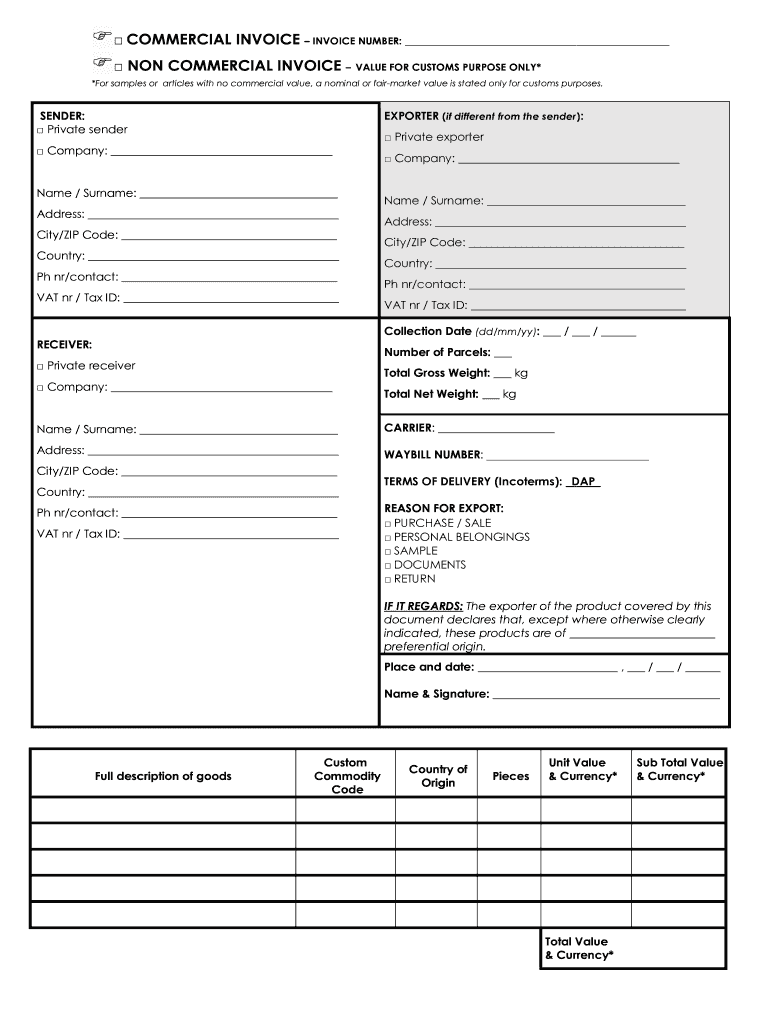

COMMERCIAL INVOICE NUMBER: NON-COMMERCIAL INVOICE VALUE FOR CUSTOMS PURPOSE ONLY* *For samples or articles with no commercial value, a nominal or fair market value is stated only for customs purposes.SENDER:

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign Packlink Customs Invoice

Edit your Packlink Customs Invoice form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your Packlink Customs Invoice form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing Packlink Customs Invoice online

Follow the steps below to take advantage of the professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit Packlink Customs Invoice. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

Packlink Customs Invoice Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out Packlink Customs Invoice

How to fill out Packlink Customs Invoice

01

Start by filling out the sender's information, including name, address, and contact details.

02

Provide the recipient's information, ensuring accuracy to avoid delivery issues.

03

List all items included in the shipment, including a detailed description for each item.

04

Indicate the quantity and value of each item in the shipment.

05

Specify the country of origin for each item to comply with customs regulations.

06

Include any necessary documentation, such as invoices or receipts, to support the declarations made.

07

Sign and date the customs invoice at the designated area.

08

Make copies of the customs invoice for your records and for the carrier, if required.

Who needs Packlink Customs Invoice?

01

Anyone sending packages internationally, including businesses and individuals, requires a Packlink Customs Invoice for customs clearance.

02

E-commerce sellers who are shipping goods across borders need it for compliance with customs regulations.

03

Logistics companies involved in international shipping processes also need this invoice to facilitate easy customs checks.

Fill

form

: Try Risk Free

People Also Ask about

What is example commercial value?

Commercial value means the fair market value that a good or service would have if it was offered for sale. For example, the commercial value of a travel via corporate aircraft is the fair market value that travel would have if purchased from a commercial airline.

What does a commercial value mean?

n. the amount a willing buyer would pay a willing seller in an unregulated market (View Citations)

What is non-commercial invoice?

Acronym used in proforma invoices and commercial invoices to express that the merchandise shipped, usually samples. do not have commercial value and therefore do not pay tariffs in customs clearance.

What is the difference between commercial and non-commercial goods?

Items for sale are commercial. Items that are not for sale, such as gifts, are non-commercial.

Who needs commercial invoice?

The commercial invoice is one of the most important documents in international trade and ocean freight shipping. It is a legal document issued by the seller (exporter) to the buyer (importer) in an international transaction and serves as a contract and a proof of sale between the buyer and seller.

What is the point of a commercial invoice?

A commercial invoice is a required document for the export and import clearance process. It is sometimes used for foreign exchange purposes. In the buyer's country, it is the document that is used by their customs officials to assess import duties and taxes.

What is commercial vs regular invoice?

A commercial invoice is a document created for international shipments containing important information about the export. It includes extra details than regular sales invoices to calculate tariffs and confirm the shipment is legal. Commercial invoices are also used to create a customs declaration.

What is commercial value and non commercial value?

The actual price at which a product is sold either to unrelated parties or to related parties at arm´s length. This is the opposite of no commercial value, a statement that should be shown on invoices covering shipments of samples that are being furnished without charge and are not intended for resale.

What is the difference between a commercial invoice and a regular invoice?

When shipping an order or offering a service, you need to use the right type of invoice. A commercial one is a popular option for international shipping because it contains information to assist with customs. But other invoices are useful for domestic and international orders.

What is the difference between commercial and non commercial invoice?

Unlike a regular sales invoice, a commercial invoice includes the necessary extra details for crossing the border, such as country of origin, harmonized system (HS) code, freights terms, and so on. In this guide, we will explain what a commercial invoice is, along with how to issue it and pack it for shipment.

What happens if there is no commercial invoice?

If no invoice or bill is available, a proforma invoice , as provided for in § 141.85, must be filed, and must contain sufficient information to determine admissibility, classification, and the amount of duties due.

Does ups need commercial invoice?

Required for all non-document shipments, it is one of the primary forms used for importation control, valuation and duty determination. Supplied by the shipper, the commercial invoice identifies the products being shipped, including a description and value of the goods, as well as shipper information.

When should a commercial invoice be issued?

The Commercial Invoice When the goods are ready to ship, the seller issues a commercial invoice. In addition to listing the amount owed by the buyer to the seller, including when and how payment must be made, the commercial invoice plays an important role in the export process.

What is commercial value or no commercial value?

No commercial value means real property, including related personal property, which has no reasonable prospect of producing any disposal revenues. No commercial value means property, including related personal property, which has no reasonable prospect of being disposed of at a consideration.

Can I ship without a commercial invoice?

When do I need a Commercial Invoice? The Commercial Invoice is required for all international commodity shipments. In other words, it's required for any international shipment with commercial value. Most non-document shipments are classified as commodity shipments.

What are the three types of invoice?

Here are the different types of invoices used in simple transactions between a buyer and a seller or service provider. Proforma invoice. Sales invoice (“Regular” Invoice) Overdue invoice. Consolidated invoice.

Can I make my own commercial invoice?

The easiest way to build a commercial invoice is to download a customizable template from a reputable site. You can use this commercial invoice form from the U.S. Department of Commerce, or this example from FedEx.

What is called commercial invoice?

In simple words, a commercial invoice is an export document that serves as legal evidence of a sale transaction between the buyer and the seller. It is mainly used for clearance purposes with regard to customs and helps in the determination and assessment of duties and taxes payable.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send Packlink Customs Invoice for eSignature?

When you're ready to share your Packlink Customs Invoice, you can swiftly email it to others and receive the eSigned document back. You may send your PDF through email, fax, text message, or USPS mail, or you can notarize it online. All of this may be done without ever leaving your account.

How do I edit Packlink Customs Invoice online?

pdfFiller not only lets you change the content of your files, but you can also change the number and order of pages. Upload your Packlink Customs Invoice to the editor and make any changes in a few clicks. The editor lets you black out, type, and erase text in PDFs. You can also add images, sticky notes, and text boxes, as well as many other things.

How do I fill out Packlink Customs Invoice using my mobile device?

The pdfFiller mobile app makes it simple to design and fill out legal paperwork. Complete and sign Packlink Customs Invoice and other papers using the app. Visit pdfFiller's website to learn more about the PDF editor's features.

What is Packlink Customs Invoice?

Packlink Customs Invoice is a document required for international shipments that provides details about the contents and value of the package for customs clearance.

Who is required to file Packlink Customs Invoice?

The sender or shipper of the package is required to file the Packlink Customs Invoice when sending goods internationally.

How to fill out Packlink Customs Invoice?

To fill out the Packlink Customs Invoice, you must provide accurate information about the items being shipped, including their description, value, quantity, and country of origin.

What is the purpose of Packlink Customs Invoice?

The purpose of the Packlink Customs Invoice is to facilitate the customs clearance process by providing authorities with necessary information about the shipment.

What information must be reported on Packlink Customs Invoice?

The information that must be reported on the Packlink Customs Invoice includes the item description, value, quantity, country of origin, and any relevant tariff codes.

Fill out your Packlink Customs Invoice online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Packlink Customs Invoice is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.