Get the free 10c form

Fill out, sign, and share forms from a single PDF platform

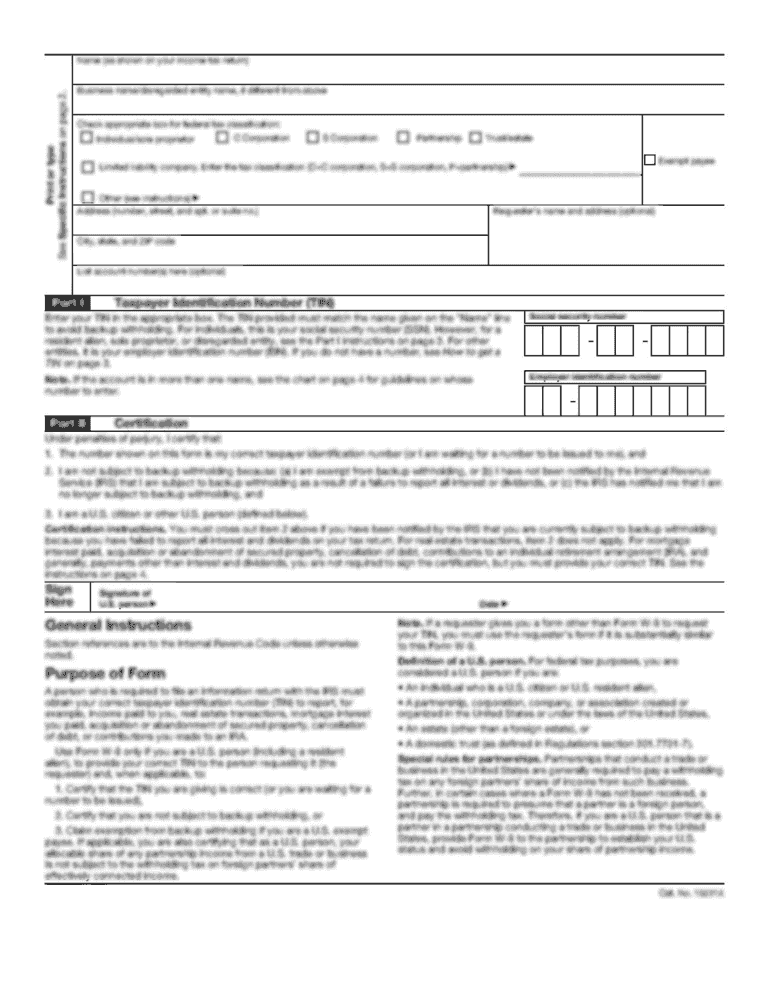

Edit and sign in one place

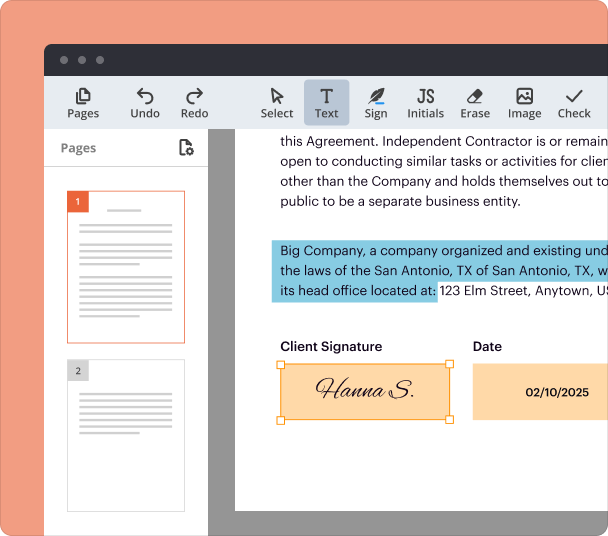

Create professional forms

Simplify data collection

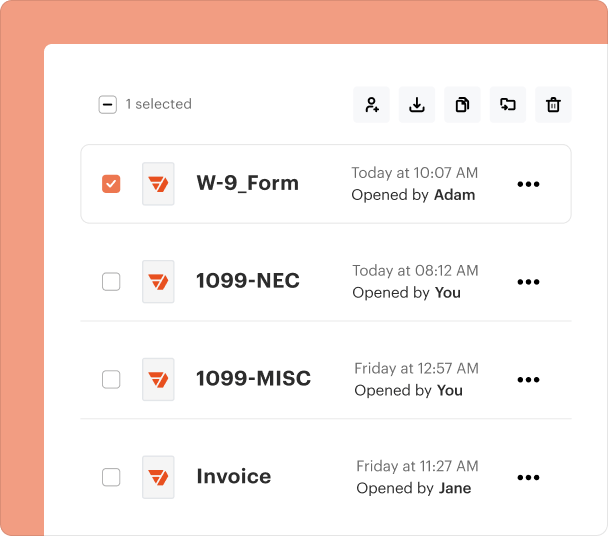

Manage forms centrally

Why pdfFiller is the best tool for your documents and forms

End-to-end document management

Accessible from anywhere

Secure and compliant

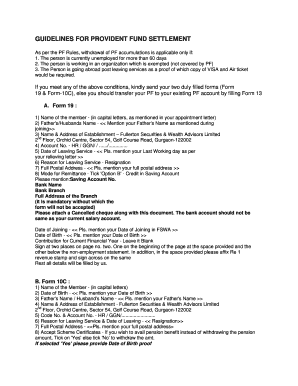

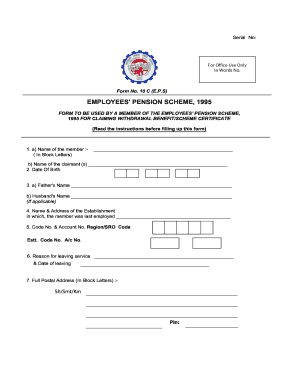

Comprehensive Guide to Form 10C in EPFO

Understanding Form 10C in EPFO

Form 10C is a crucial document issued under the Employees' Provident Funds Organisation (EPFO) in India. It is used primarily for claiming withdrawal benefits, particularly when an employee becomes ineligible for further contributions to the Employees' Pension Scheme (EPS) due to leaving their job. Understanding its purpose is essential for individuals looking to secure their retirement funds efficiently.

Key Features of Form 10C

The key features of Form 10C include provisions for the withdrawal of EPS benefits, options for payment methods (such as direct transfer to bank accounts), and specific eligibility checks for different employment scenarios. Importantly, this form facilitates easy access to pension funds, ensuring that beneficiaries can manage their money during transitional phases.

Who Needs Form 10C?

Form 10C is necessary for individuals who have worked under EPFO and wish to withdraw their pension contributions after leaving their job or when they are no longer eligible for EPS. This includes those who switch jobs, retire, or become unemployed. Employees across various sectors can benefit from this form.

Eligibility Criteria for Form 10C

To qualify for Form 10C, an individual must meet certain eligibility criteria. This typically includes having completed a minimum number of years of service under the EPS scheme, usually ten years, or being age sixty or above. The specific requirements can vary based on employment conditions and pension rules.

Required Documents for Form 10C

Submitting Form 10C requires several supporting documents. These often include a copy of the applicant's Aadhaar card, bank details for direct transfer of funds, and any employment-related certificates. Ensuring all documents are prepared in advance can streamline the processing of the application.

Steps to Fill Out Form 10C

Filling out Form 10C can be achieved through a straightforward process. The form requires personal details, information about the employment period, and specific bank account details for fund transfer. Careful attention to detail while completing each section aids in avoiding common mistakes.

Benefits of Using Form 10C

Using Form 10C provides significant advantages, including financial security during employment transitions, easy accessibility to pension funds, and the ability to manage retirement savings effectively. It also promotes a smooth transition to life post-employment by providing timely access to funds.

Frequently Asked Questions about form 10c

What happens if I submit my Form 10C incorrectly?

An incorrect submission can lead to delays in processing your claim. It is advisable to double-check all entries and ensure supporting documents are accurate to prevent complications.

Can I fill Form 10C online?

Yes, Form 10C can be filled out online through the EPFO portal, simplifying the submission process and reducing processing times.

pdfFiller scores top ratings on review platforms