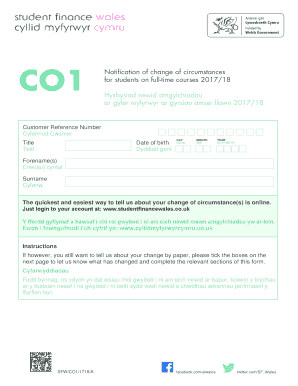

IRS 8332 2018-2025 free printable template

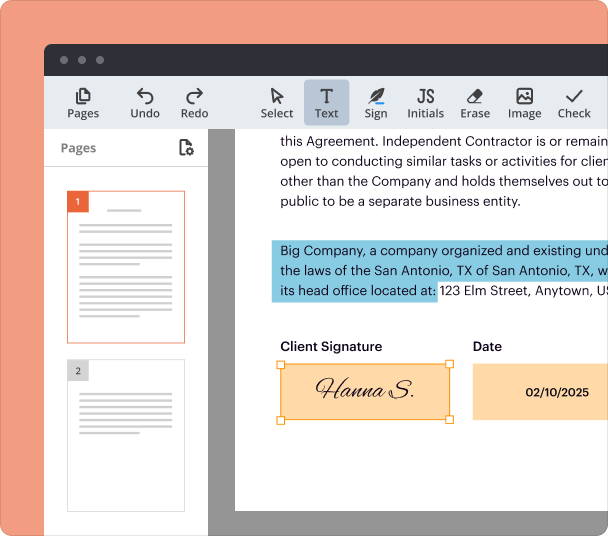

Fill out, sign, and share forms from a single PDF platform

Edit and sign in one place

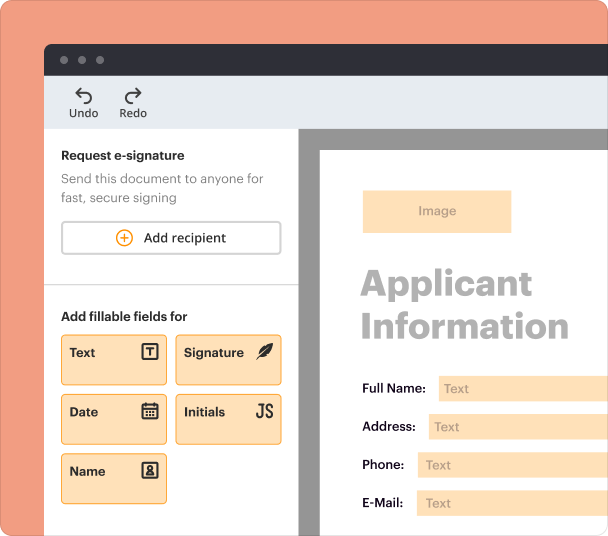

Create professional forms

Simplify data collection

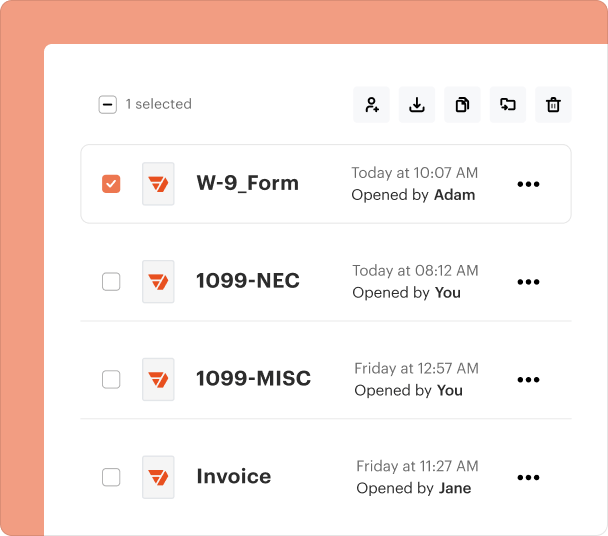

Manage forms centrally

Why pdfFiller is the best tool for your documents and forms

End-to-end document management

Accessible from anywhere

Secure and compliant

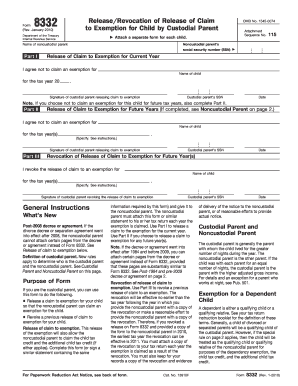

Understanding the IRS 8332 Form for Tax Purposes

What is the IRS 8332 Form?

The IRS 8332 form, officially known as the Release of Claim to Exemption for Child by Custodial Parent, is a crucial document for parents dealing with child dependency claims. This form allows custodial parents to release their claim to a child's exemption to a noncustodial parent for tax purposes. This arrangement can impact both parents' eligibility for certain tax benefits, and the IRS considers these agreements under federal tax law.

When to Use the IRS 8332 Form

The IRS 8332 form should be used in situations where the custodial parent agrees not to claim a child as a dependent for tax purposes, allowing the noncustodial parent to take this claim instead. This typically occurs following divorce or separation. Parents must understand when and how to use the form to ensure compliance with IRS regulations and maximize potential tax benefits.

Eligibility Criteria for the IRS 8332 Form

To be eligible to use the IRS 8332 form, the custodial parent must meet specific criteria. Primarily, they must have legal custody of the child and be the one receiving any child support. Moreover, both parents must agree on the dependency arrangement and complete the form accordingly. It is essential for the custodial parent to be aware that releasing the claim will affect their exemption status.

Best Practices for Accurate Completion

Accurate completion of the IRS 8332 form is vital to avoid complications with tax returns. Parents should ensure that all fields are filled out completely and accurately. It's recommended to keep copies of the completed form for personal records and future reference. Additionally, consulting a tax professional can provide tailored advice and help navigate complex situations surrounding child exemptions.

Common Errors and Troubleshooting

Common errors when filling out the IRS 8332 form include incomplete information, incorrectly stated social security numbers, and failing to send the form to the relevant party. Parents should double-check all entries before submission and make sure both parties involved understand their responsibilities concerning the signed form. Addressing any discrepancies or misunderstandings early can prevent issues during tax season.

Submission Methods and Delivery

Once the IRS 8332 form is completed, it can be submitted in several ways. The custodial parent typically provides the form to the noncustodial parent, who must keep it for their records when filing their taxes. It is essential to file tax returns accurately, as the IRS may request verification of the exemption. Keeping proof of delivery is advised to guard against potential disputes.

Frequently Asked Questions about irs form 8332

Who needs to complete the IRS 8332 form?

The custodial parent needs to complete the IRS 8332 form if they agree to allow the noncustodial parent to claim the child as a dependent on their tax return.

How many times can the IRS 8332 form be used?

The IRS 8332 form can be used for each eligible child, but a new form must be completed for each tax year in which the custodial parent allows the noncustodial parent to claim the exemption.

pdfFiller scores top ratings on review platforms