Get the free deed of trust to secure assumption texas form

Show details

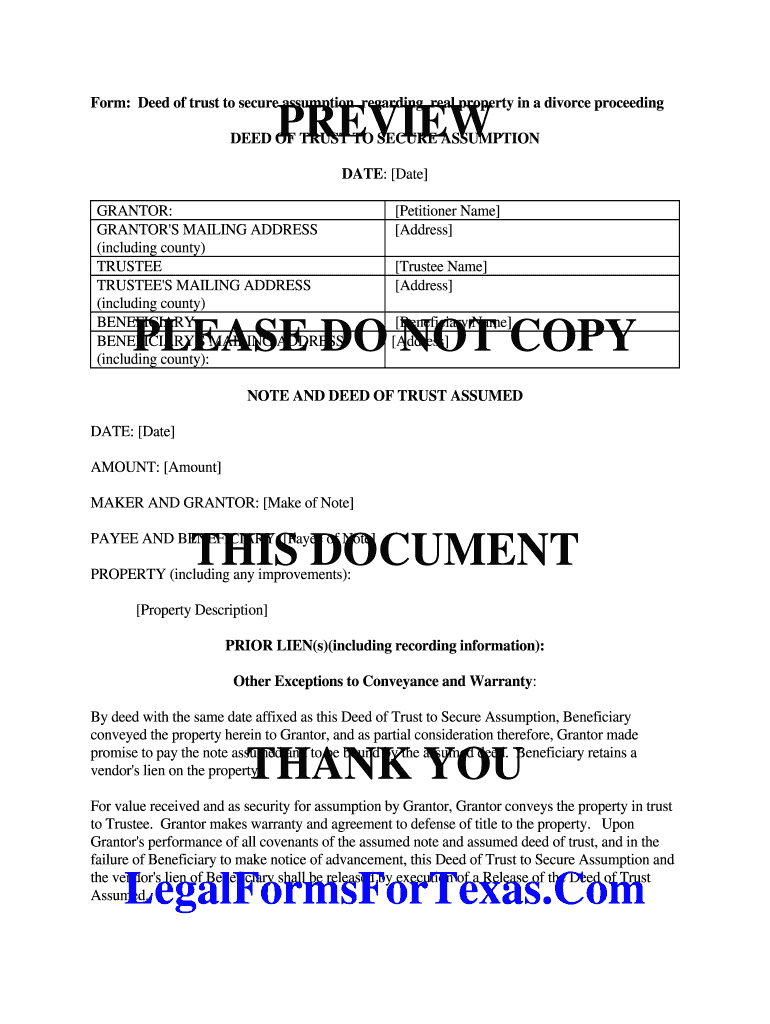

Form: Deed of trust to secure assumption regarding real property in a divorce proceeding PREVIEW DEED OF TRUST TO SECURE ASSUMPTION DATE: Date GRANTER: GRANTER IS MAILING ADDRESS (including county)

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign deed of trust to secure assumption form

Edit your deed of trust to secure assumption texas form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your deed of trust to form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit deed of trust to online

Follow the guidelines below to use a professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit deed of trust to. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out deed of trust to

How to fill out a deed of trust:

01

Begin by obtaining the necessary deed of trust form, which can be found online or obtained from a legal professional.

02

Gather all the required information, including the names and addresses of all parties involved, such as the trustor (the borrower), trustee (a neutral third party), and beneficiary (the lender).

03

Fill in the legal description of the property being used as collateral for the loan, including its address and any relevant identifying details.

04

Specify the terms of the loan, such as the loan amount, interest rate, repayment schedule, and any applicable late fees or penalties.

05

Include any additional provisions or special conditions that both parties agree upon, such as insurance requirements or certain restrictions on the property.

06

Sign and date the deed of trust, ensuring that all parties involved sign in the appropriate spaces.

07

Have the document notarized if required by the jurisdiction.

08

Make copies of the completed deed of trust for all parties involved, keeping the original for safekeeping and record-keeping purposes.

Who needs a deed of trust:

01

Individuals or businesses seeking to borrow money and use real estate as collateral for the loan.

02

Lenders or financial institutions providing loans secured by real estate.

03

Any party involv

Fill

form

: Try Risk Free

People Also Ask about

What is the function of a deed of trust?

What Is A Deed Of Trust? A deed of trust is an agreement between a home buyer and a lender at the closing of a property. The agreement states that the home buyer will repay the home loan and the mortgage lender will hold the property's legal title until the loan is paid in full.

Who is the beneficiary in a deed of trust to secure assumption?

Deed of Trust to Secure Assumption In this document, the spouse responsible for the mortgage assumes the payment of the mortgage. The spouse who does not get the house becomes the beneficiary, which leads us to asking, what happens if the spouse who gets the house doesn't make the mortgage payments?

What is the difference between a deed and a deed of trust in Texas?

The main difference between a deed and a deed of trust is that a deed is a transfer of ownership, while a deed of trust is a security interest. A deed of trust is used to secure a loan, while a deed is used to transfer ownership of a property.

What is a deed of trust in Texas?

In Texas, a deed of trust, also known as a trust deed, is the commonly used instrument for the purpose of creating mortgage liens on real estate. A mortgage is an executed contract in which the legal or equitable owner of the real property pledges the title thereto as security for performance of an obligation.

What is an assumption to lien?

A mortgage assumption involves a buyer and seller of real estate and occurs when the buyer agrees to assume or 'take over' the seller's loan and mortgage obligations. An assumption may be attractive if the present interest rates for new loans are higher than the interest rate on the current loan.

What is a deed of trust to secure assumption in Texas?

Texas Assumption Deed of Trust As the title indicates, in a deed of trust to secure assumption, another person assumes the note already in place, guaranteeing payment to the grantor in the deed. The agreement means that the buyer or grantee in the deed takes the property, assuming the debt currently on the property.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify deed of trust to without leaving Google Drive?

By integrating pdfFiller with Google Docs, you can streamline your document workflows and produce fillable forms that can be stored directly in Google Drive. Using the connection, you will be able to create, change, and eSign documents, including deed of trust to, all without having to leave Google Drive. Add pdfFiller's features to Google Drive and you'll be able to handle your documents more effectively from any device with an internet connection.

How do I edit deed of trust to online?

With pdfFiller, the editing process is straightforward. Open your deed of trust to in the editor, which is highly intuitive and easy to use. There, you’ll be able to blackout, redact, type, and erase text, add images, draw arrows and lines, place sticky notes and text boxes, and much more.

How do I edit deed of trust to on an iOS device?

You can. Using the pdfFiller iOS app, you can edit, distribute, and sign deed of trust to. Install it in seconds at the Apple Store. The app is free, but you must register to buy a subscription or start a free trial.

What is deed of trust to?

A deed of trust is a legal document used in real estate transactions that secures a loan by transferring the title of the property to a third-party trustee until the loan is repaid.

Who is required to file deed of trust to?

Typically, the lender or the borrower is required to file the deed of trust with the appropriate county office where the property is located.

How to fill out deed of trust to?

To fill out a deed of trust, include the names of the trustor (borrower), beneficiary (lender), and trustee. Provide a legal description of the property, the loan amount, and terms, and then sign and notarize the document.

What is the purpose of deed of trust to?

The purpose of a deed of trust is to secure a loan by providing the lender a security interest in the property, ensuring that they can recover the loan amount in case of default.

What information must be reported on deed of trust to?

The deed of trust must report the names of the parties involved, the legal description of the property, the loan amount, interest rate, and terms, as well as the signatures of the involved parties.

Fill out your deed of trust to online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Deed Of Trust To is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.