IRS Instructions 1040 Schedule C 2018 free printable template

Get, Create, Make and Sign IRS Instructions 1040 Schedule C

Editing IRS Instructions 1040 Schedule C online

Uncompromising security for your PDF editing and eSignature needs

IRS Instructions 1040 Schedule C Form Versions

How to fill out IRS Instructions 1040 Schedule C

How to fill out IRS Instructions 1040 Schedule C

Who needs IRS Instructions 1040 Schedule C?

Instructions and Help about IRS Instructions 1040 Schedule C

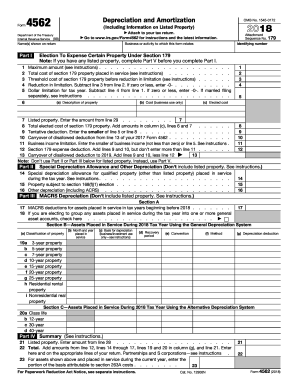

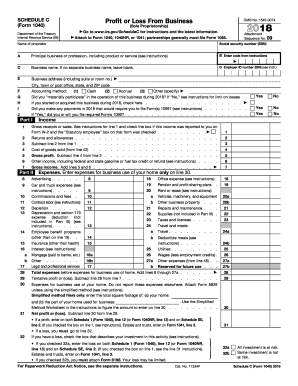

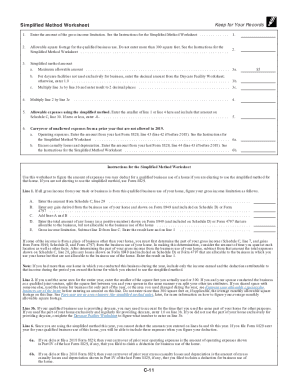

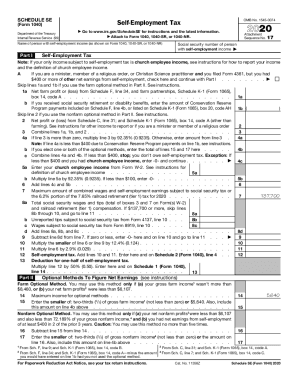

Hi this is John again with PDF tax were working with Schedule C today were going to try to give you an idea how this form looks works this is the form that you would use that you would attach to your individual income tax return 1040 if you had a business, and you were a sole proprietor in other words you were working you were the owner, and you're working by yourself you don't have any partners, and you didn't incorporate your business in any way, so you would fill this form out and attach it to your Schedule C is your form 1040 to show your profit or loss for the year so let's just start out by filling in some basic information here just take me a few minutes here to do this and were going to say that this that Jeff Jones has a manufacturing business where he creates leather purses so like that and his business name is leather works like that now we need to come up with a business code and to do that were going to go to the instructions for Schedule C which has the business code so if we go down here, and we look under leather and allied products the code we want is three one six nine oh so well go back up here and enter three one six nine anal like that whoops nine oh and the business address is I don't know some address we don't need an employer ID necessarily unless he applied for one you can just use your social security number if you don't have an employer ID now we need to fight, and we need to decide what the accounting method is and were going to say that this business has inventory so well need to use the accrual method which is that right there and then did you materially participate and what other words did you spend your time working in this business and Jeff certainly did because that's his it's his 100 business and that's what he does full-time so were going to say yes here did you start in 217 now did you make payments that would require filing to 1099 he probably did because he made payments to a purchase inventory so till say yes and did you file them and well say yes again, so that is the big basic information right there now lets go ahead and enter some numbers, so we can see how this form works and on line one we need to put our sales so well suppose that he had a 150 thousand dollars in sales for the year, and then he didn't necessarily have any returns he might have but well leave that blank and cost of goods sold is the next big thing that we need to look at so that's that comes from line 42, so lets scroll down here tie line 42 this section here where we have cost of goods sold and first thing we need to do is decide what method of inventory we use for valuing and inventory, and probably he's going to use the cost method which is the most and was there any change in the cost in valuing the inventory well say no there was no change so the inventory that began the year these would be the leather that he uses to make his purse so lets say he had five thousand dollars in inventory at the beginning the air and then how much...

People Also Ask about

How is Schedule C income taxed?

Can I fill out my own Schedule C?

Do you fill out your own Schedule C?

What is Schedule C on IRS form?

Do I have to have a business to file Schedule C?

How do I fill out a Schedule C tax form?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get IRS Instructions 1040 Schedule C?

How do I edit IRS Instructions 1040 Schedule C in Chrome?

How do I complete IRS Instructions 1040 Schedule C on an iOS device?

What is IRS Instructions 1040 Schedule C?

Who is required to file IRS Instructions 1040 Schedule C?

How to fill out IRS Instructions 1040 Schedule C?

What is the purpose of IRS Instructions 1040 Schedule C?

What information must be reported on IRS Instructions 1040 Schedule C?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.