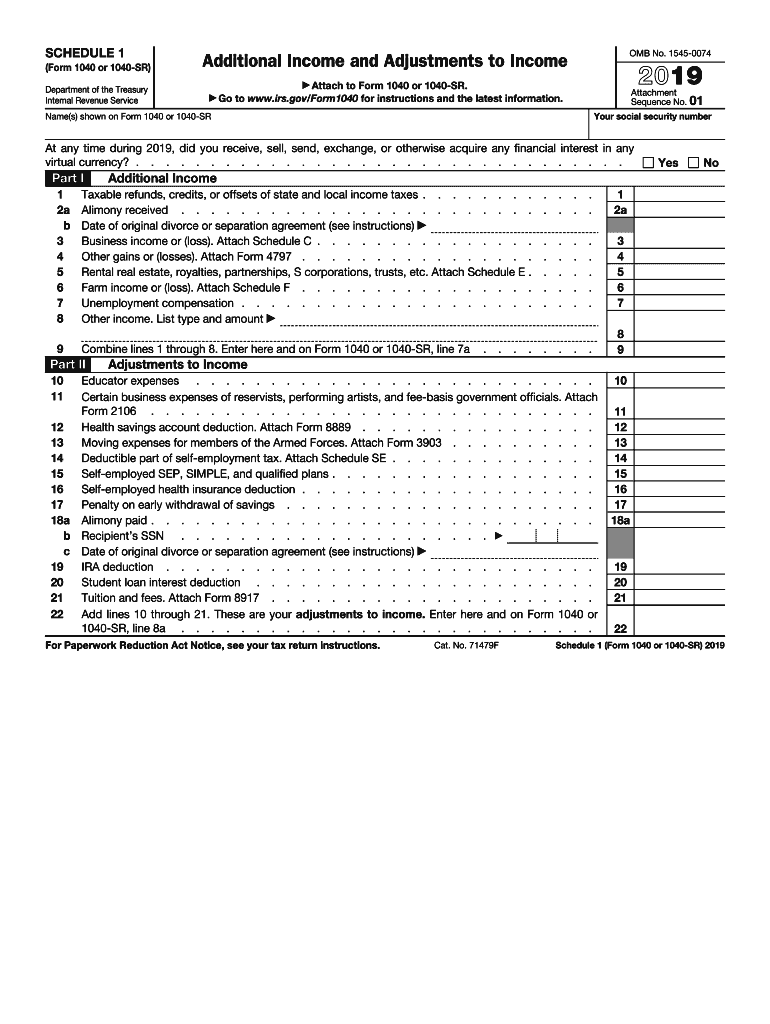

IRS 1040 - Schedule 1 2019 free printable template

Show details

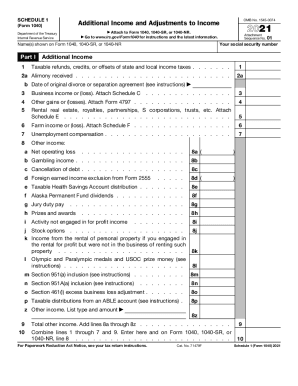

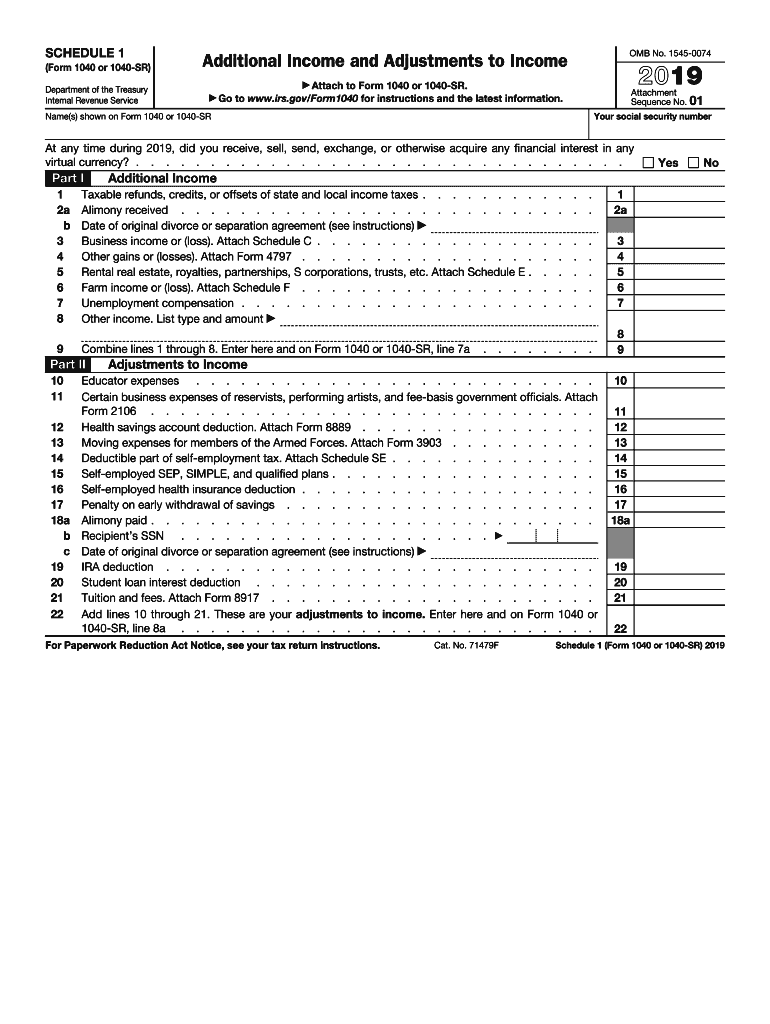

SCHEDULE 1OMB No. 15450074Additional Income and Adjustments to Income(Form 1040) Department of the Treasury Internal Revenue Service Go19b 10 11 12 13 14 15a 16a 17 18 19 20a 21 22Adjustments to Income23

pdfFiller is not affiliated with IRS

Get, Create, Make and Sign IRS 1040 - Schedule 1

Edit your IRS 1040 - Schedule 1 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your IRS 1040 - Schedule 1 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit IRS 1040 - Schedule 1 online

Use the instructions below to start using our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit IRS 1040 - Schedule 1. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

IRS 1040 - Schedule 1 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out IRS 1040 - Schedule 1

How to fill out IRS 1040 - Schedule 1

01

Gather necessary documents, such as W-2s, 1099s, and any other income statements.

02

Start with Part I of Schedule 1 and enter any additional income you need to report, such as business income, rental income, or unemployment compensation.

03

Follow the instructions for each line item to ensure correct reporting of income.

04

Move to Part II of Schedule 1 to report any adjustments to income, like educator expenses, student loan interest deduction, or health savings account contributions.

05

Fill in the pertinent amounts for each adjustment, ensuring you adhere to the limits provided by the IRS.

06

Ensure all calculations are accurate and double-check the math.

07

Transfer the total amounts from Schedule 1 to the appropriate lines on your IRS Form 1040 when filing your taxes.

Who needs IRS 1040 - Schedule 1?

01

Anyone who has additional income to report outside of what is captured on the standard Form 1040.

02

Individuals claiming specific adjustments to income, such as educators, students, or those with health savings accounts.

03

Taxpayers who received unemployment compensation or certain other incomes that need to be listed separately.

Fill

form

: Try Risk Free

People Also Ask about

Where can I find Schedule 2 on 1040?

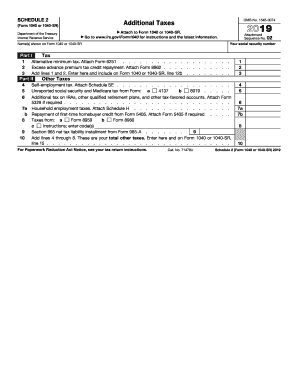

Prior to the Tax Cuts and Jobs Act, this "Tax" section was included on lines 45 and 46 of Form 1040. This information is now included on lines 1 and 2 of Form 1040 Schedule 2.

What is Schedule 1 on the 1040 form?

Schedule 1 is used to report types of income that aren't listed on the 1040, such as capital gains, alimony, unemployment payments, and gambling winnings. Schedule 1 also includes some common adjustments to income, like the student loan interest deduction and deductions for educator expenses.

Is Schedule 1 required for 1040?

Not everyone needs to attach Schedule 1 to their federal income tax return. The IRS trimmed down and simplified the old Form 1040, allowing people to add on forms as needed. You only need to file Schedule 1 if you have any of the additional types of income or adjustments to income mentioned above.

What is Schedule 1 and 2 on 1040?

The first part of Schedule 1 is Additional Income. This can include alimony, gambling, business revenue, tax refund, cancellation of debt, and more. All income in Part I is totaled and goes on Form 1040. Part II is Adjustments to Income.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send IRS 1040 - Schedule 1 to be eSigned by others?

Once your IRS 1040 - Schedule 1 is ready, you can securely share it with recipients and collect eSignatures in a few clicks with pdfFiller. You can send a PDF by email, text message, fax, USPS mail, or notarize it online - right from your account. Create an account now and try it yourself.

How do I fill out IRS 1040 - Schedule 1 using my mobile device?

On your mobile device, use the pdfFiller mobile app to complete and sign IRS 1040 - Schedule 1. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to discover more about our mobile applications, the features you'll have access to, and how to get started.

How do I complete IRS 1040 - Schedule 1 on an iOS device?

pdfFiller has an iOS app that lets you fill out documents on your phone. A subscription to the service means you can make an account or log in to one you already have. As soon as the registration process is done, upload your IRS 1040 - Schedule 1. You can now use pdfFiller's more advanced features, like adding fillable fields and eSigning documents, as well as accessing them from any device, no matter where you are in the world.

What is IRS 1040 - Schedule 1?

IRS 1040 - Schedule 1 is a form used to report additional income and adjustments to income that are not reported directly on the main IRS 1040 form. This can include items such as capital gains, unemployment compensation, and educator expenses.

Who is required to file IRS 1040 - Schedule 1?

Taxpayers who have additional income (like unemployment compensation or capital gains) or claim certain adjustments to income (such as student loan interest or the educator expense deduction) need to file IRS 1040 - Schedule 1 along with their Form 1040.

How to fill out IRS 1040 - Schedule 1?

To fill out IRS 1040 - Schedule 1, taxpayers enter their additional income in Part I and their adjustments to income in Part II. Each item must be documented accurately, and the totals are then carried over to Form 1040.

What is the purpose of IRS 1040 - Schedule 1?

The purpose of IRS 1040 - Schedule 1 is to provide a separate space for taxpayers to report additional types of income and deductions. This helps ensure accurate reporting and calculation of taxable income.

What information must be reported on IRS 1040 - Schedule 1?

Information that must be reported on IRS 1040 - Schedule 1 includes various types of income such as unemployment benefits, business income, and rental income, as well as adjustments like IRA contributions and student loan interest.

Fill out your IRS 1040 - Schedule 1 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

IRS 1040 - Schedule 1 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.