Get the free scs pooled trust

Show details

P: (718) 971 2509F: (844) 6230481www.scspooledtrust.gorge: info scspooledtrust. Senior COMMUNITY SERVICES SUPPLEMENTAL NEEDS TRUST JOINER AGREEMENT The undersigned hereby establishes a Trust Account

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign scs trust services form

Edit your scs pooled trust reviews form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your scs pooled trust login form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit scs pool trust login online

To use the professional PDF editor, follow these steps below:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit scs trust services reviews form. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to work with documents. Check it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out scs pool trust form

How to fill out scs pooled trust

01

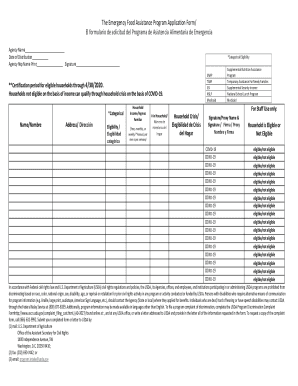

Gather all the necessary information and documents required to fill out the SCS Pooled Trust. This may include information about the beneficiary, the trustee, and any assets to be placed in the trust.

02

Obtain the SCS Pooled Trust application form from the appropriate source, such as the SCS Pooled Trust website or a trusted legal advisor.

03

Carefully read through the instructions on the application form to understand the requirements and process for filling it out.

04

Begin filling out the application form by providing the requested information in the designated fields. This may include personal information about the beneficiary, such as their name, address, and Social Security number.

05

Provide information about the trustee who will be responsible for managing the trust. This may include their name, contact information, and any relevant qualifications or experience.

06

Indicate any assets or funds that will be placed into the trust, if applicable. Provide detailed information about these assets, such as their value, ownership, and any associated paperwork or legal documentation.

07

Review the completed application form to ensure all required fields have been filled out accurately and completely.

08

Attach any supporting documents or paperwork that may be required, such as identification documents, financial statements, or legal agreements.

09

Submit the completed application form and any accompanying documents to the appropriate address or email provided on the form.

10

Follow up with the SCS Pooled Trust office or organization to confirm receipt of the application and to inquire about any additional steps or information needed to finalize the trust setup.

Who needs scs pooled trust?

01

SCS Pooled Trust is typically needed by individuals who have special needs and disabilities.

02

It is beneficial for those who are receiving government benefits such as Medicaid or Supplemental Security Income (SSI).

03

The trust allows the individual to place their assets into a pooled trust managed by a trustee, ensuring that these assets do not interfere with their eligibility for government benefits.

04

It can be used to protect and manage funds for the benefit of the individual with special needs, providing them with financial security and support.

05

Family members or legal guardians of individuals with special needs may also opt for SCS Pooled Trust to ensure proper management and protection of the individual's assets.

06

Consultation with a legal advisor or financial planner is recommended to determine if SCS Pooled Trust is suitable for a particular individual's circumstances.

Fill

form

: Try Risk Free

People Also Ask about

How do I protect my assets from Medicaid in NY?

Benefits of MAPTs This type of trust can shield your assets from Medicaid, allowing you to preserve them to pass on to your family. A MAPT is an irrevocable trust, so once you transfer assets to the trust ownership, you cannot under most circumstances transfer them back.

Is a pooled trust taxable?

Note that there is no special tax treatment for payments to the donor from a pooled income fund. The IRS considers trust income distributions to be ordinary income, subject to income tax. Upon the death of the last income beneficiary, the fund's remaining balance goes to his or her 501(c)(3) charity of choice.

What is the Theresa Foundation Pooled trust of New York?

The Theresa Foundation Pooled Trust of New York is a special type of trust that allows a beneficiary of any age to become financially eligible for public assistance benefits, such as Medicaid home care, while preserving their monthly income in trust for living expenses and supplemental needs.

What are pooled income trusts commonly used for?

Pooled trusts give people with disabilities a way to access vital health benefits while utilizing the excess funds they deposit into the trust to pay for items and services not covered by those benefits. In ance with Federal statute, first party pooled trust accounts close upon the death of the beneficiary.

What can I spend money on from a pooled trust?

Pooled Trust Allowable Expenses personal needs allowance. health insurance premiums for the disabled individual. medically necessary medical expenses. family or spouse's maintenance allowance. legal and professional expenses, including trustee, accounting, guardian, conservator and attorney fees. prepaid burial expenses.

What is the downside of a pooled trust?

And if the beneficiary passes away, most trusts can pass their remaining assets to another family beneficiary, while pooled trust are likely to keep the assets. Some pooled trusts can be very expensive, with set-up fees, annual fees and other expenses. These costs must be well understood before committing to a pool.

How does a pooled trust work in New York?

Pooled trusts give people with disabilities a way to access vital health benefits while utilizing the excess funds they deposit into the trust to pay for items and services not covered by those benefits. In ance with Federal statute, first party pooled trust accounts close upon the death of the beneficiary.

What is a pooled trust in California?

A Pooled Trust can be established for a disabled individual of any age, and must be established and managed by a non-profit association. A separate account is maintained for each beneficiary, but funds are “pooled” together for investment purposes.

What are the disadvantages of a pooled trust?

Disadvantages of a Pooled Pay-Back Trust: Funds are not readily available to the grantor/beneficiary; payments to providers must be requested and justified as reasonable and necessary. Fees and Medicaid costs must be paid before remaining assets are distributed to those named Remainder Beneficiaries.

What is the purpose of a pooled trust?

Pooled trusts give people with disabilities a way to access vital health benefits while utilizing the excess funds they deposit into the trust to pay for items and services not covered by those benefits. In ance with Federal statute, first party pooled trust accounts close upon the death of the beneficiary.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my scs pooled trust form in Gmail?

scs pooled trust form and other documents can be changed, filled out, and signed right in your Gmail inbox. You can use pdfFiller's add-on to do this, as well as other things. When you go to Google Workspace, you can find pdfFiller for Gmail. You should use the time you spend dealing with your documents and eSignatures for more important things, like going to the gym or going to the dentist.

How do I edit scs pooled trust form online?

With pdfFiller, the editing process is straightforward. Open your scs pooled trust form in the editor, which is highly intuitive and easy to use. There, you’ll be able to blackout, redact, type, and erase text, add images, draw arrows and lines, place sticky notes and text boxes, and much more.

Can I create an eSignature for the scs pooled trust form in Gmail?

With pdfFiller's add-on, you may upload, type, or draw a signature in Gmail. You can eSign your scs pooled trust form and other papers directly in your mailbox with pdfFiller. To preserve signed papers and your personal signatures, create an account.

Fill out your scs pooled trust form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Scs Pooled Trust Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.