Get the free w4 form 2020 nj

Show details

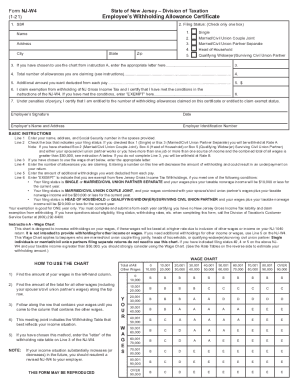

State of New Jersey - Division of Taxation Form NJ-W4 Employee s Withholding Allowance Certificate 7-18 R-14 1. If you have questions about eligibility filing status withholding rates etc. when completing this form call the Division of Taxation s Customer Service Center at 609-292-6400. Instruction A - Wage Chart This chart is designed to increase withholdings on your wages if these wages will be taxed at a higher rate due to inclusion of other wages or income on your NJ-1040 return. It is...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign w4 form 2020 nj

Edit your w4 form 2020 nj form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your w4 form 2020 nj form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit w4 form 2020 nj online

Follow the guidelines below to use a professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit w4 form 2020 nj. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out w4 form 2020 nj

How to fill out NJ DoT NJ-W4

01

Obtain the NJ DoT NJ-W4 form from the New Jersey Department of Transportation website or your employer.

02

Fill in your personal information, including your full name, address, and Social Security number.

03

Indicate your filing status (single, married, etc.) as directed on the form.

04

Provide the number of dependents you are claiming to ensure accurate withholding.

05

Specify any additional withholding, if applicable.

06

Review the completed form for accuracy and sign where indicated.

07

Submit the completed NJ-W4 form to your employer's payroll department.

Who needs NJ DoT NJ-W4?

01

Employees working in New Jersey who need to adjust their state income tax withholding.

02

New hires requiring a state withholding certificate for tax purposes.

03

Individuals who have experienced life changes, such as marriage or having a child, affecting their tax situation.

Fill

form

: Try Risk Free

People Also Ask about

How do you fill out a W-4 properly?

How to fill out a W-4: step by step Step 1: Enter your personal information. Step 2: Account for all jobs you and your spouse have. Step 3: Claim your children and other dependents. Step 4: Make other adjustments. Step 5: Sign and date your form.

What is the new W-4 Form 2020?

The IRS released a new version of the Form W-4 at the beginning of 2020, which is intended to assist payroll departments with determining how much federal income tax to withhold from your paycheck. Here are the important things you need to know about this new form: Am I required to complete this form?

How to fill out a W-4 form in NJ?

Here's a step-by-step look at how to complete the form. Step 1: Provide Your Information. Provide your name, address, filing status, and Social Security number. Step 2: Indicate Multiple Jobs or a Working Spouse. Step 3: Add Dependents. Step 4: Add Other Adjustments. Step 5: Sign and Date Form W-4.

Does NJ have a W-4 form?

Employee's Withholding Allowance Certificate (Form NJ-W4)

How do I fill out a W-4 2020?

How to fill out a W-4: step by step Step 1: Enter your personal information. Step 2: Account for all jobs you and your spouse have. Step 3: Claim your children and other dependents. Step 4: Make other adjustments. Step 5: Sign and date your form.

Do I claim 0 or 1 on my W4?

By placing a “0” on line 5, you are indicating that you want the most amount of tax taken out of your pay each pay period. If you wish to claim 1 for yourself instead, then less tax is taken out of your pay each pay period.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in w4 form 2020 nj?

With pdfFiller, it's easy to make changes. Open your w4 form 2020 nj in the editor, which is very easy to use and understand. When you go there, you'll be able to black out and change text, write and erase, add images, draw lines, arrows, and more. You can also add sticky notes and text boxes.

Can I sign the w4 form 2020 nj electronically in Chrome?

You can. With pdfFiller, you get a strong e-signature solution built right into your Chrome browser. Using our addon, you may produce a legally enforceable eSignature by typing, sketching, or photographing it. Choose your preferred method and eSign in minutes.

How can I edit w4 form 2020 nj on a smartphone?

You may do so effortlessly with pdfFiller's iOS and Android apps, which are available in the Apple Store and Google Play Store, respectively. You may also obtain the program from our website: https://edit-pdf-ios-android.pdffiller.com/. Open the application, sign in, and begin editing w4 form 2020 nj right away.

What is NJ DoT NJ-W4?

NJ DoT NJ-W4 is a form used by employees in New Jersey to indicate their tax withholding preferences. It allows employees to declare their withholding allowances and any additional amount they want to have withheld from their wages.

Who is required to file NJ DoT NJ-W4?

Employees who work in New Jersey and have income that is subject to state income tax are required to file NJ DoT NJ-W4 to ensure the correct amount of taxes is withheld from their pay.

How to fill out NJ DoT NJ-W4?

To fill out NJ DoT NJ-W4, an employee should provide their personal information such as name, address, and Social Security number, indicate their filing status, claim the number of allowances they are entitled to, and specify any additional withholding amount if desired.

What is the purpose of NJ DoT NJ-W4?

The purpose of NJ DoT NJ-W4 is to help employers determine the correct amount of state income tax to withhold from an employee's paycheck, ensuring compliance with New Jersey tax laws.

What information must be reported on NJ DoT NJ-W4?

The NJ DoT NJ-W4 must report the employee's name, address, Social Security number, marital status, number of withholding allowances, and any additional withholding amount.

Fill out your w4 form 2020 nj online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

w4 Form 2020 Nj is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.