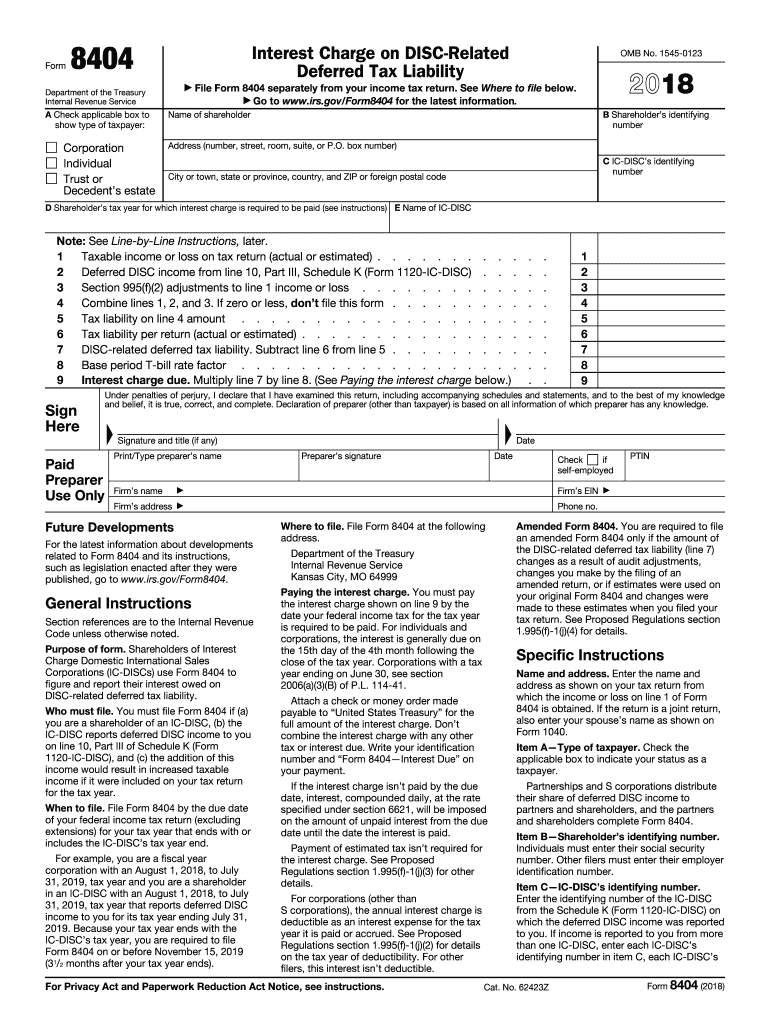

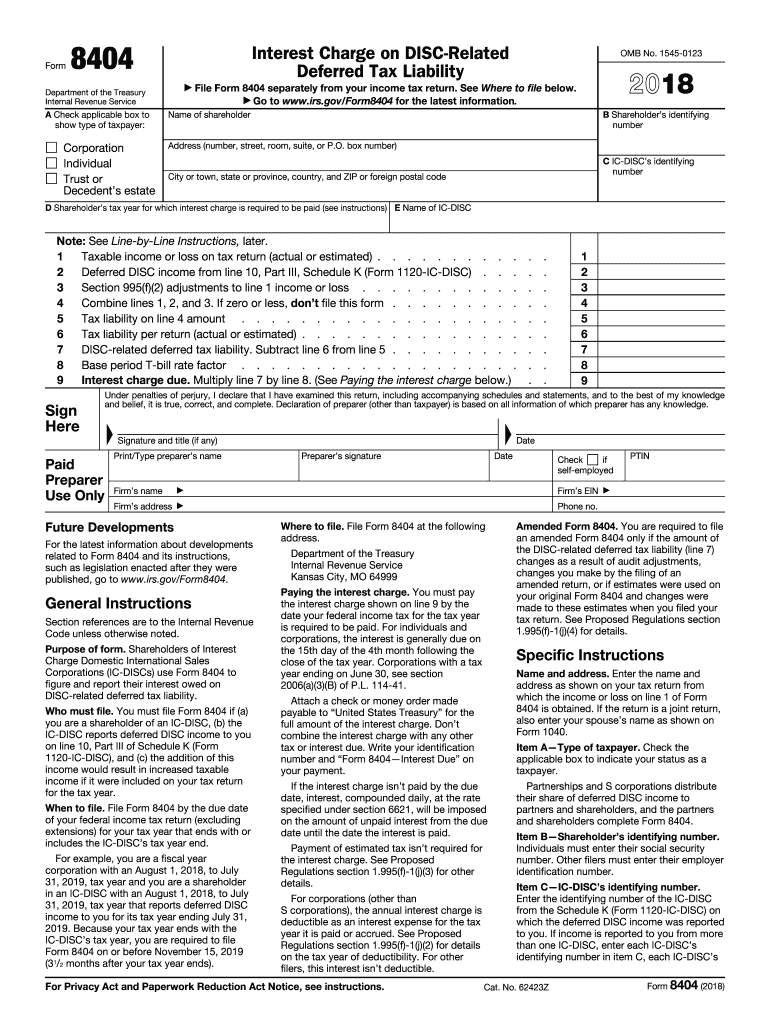

IRS 8404 2018 free printable template

Show details

PTIN Amended Form 8404. You are required to file an amended Form 8404 only if the amount of the DISC-related deferred tax liability line 7 changes as a result of audit adjustments changes you make by the filing of an amended return or if estimates were used on your original Form 8404 and changes were made to these estimates when you filed your tax return. See Proposed Regulations section 1. The base period T-bill rate factor for 2018 is 0. 020813051 for a 365-day tax year. Enter the...

pdfFiller is not affiliated with IRS

Get, Create, Make and Sign turbo tax 2017

Edit your turbo tax 2017 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your turbo tax 2017 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit turbo tax 2017 online

Use the instructions below to start using our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit turbo tax 2017. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, dealing with documents is always straightforward. Try it now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

IRS 8404 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out turbo tax 2017

How to fill out IRS 8404

01

Begin by downloading Form 8404 from the IRS website.

02

Fill in your name and taxpayer identification number at the top of the form.

03

Indicate the tax year for which you are filing this form.

04

In Section A, provide the details of the property that is subject to recapture.

05

If applicable, complete Section B, listing any exceptions to the recapture of excess deductions.

06

Calculate your recapture amount based on the instructions provided.

07

Review the form for accuracy before submitting.

08

Submit the completed form with your federal tax return.

Who needs IRS 8404?

01

Individuals or entities that have taken deductions for depreciation on certain properties and are now subject to recapture rules.

02

Taxpayers who have sold or otherwise disposed of property that was previously subject to depreciation deductions.

Instructions and Help about turbo tax 2017

Fill

form

: Try Risk Free

People Also Ask about

What is the formula for calculating income tax?

Step 5: Calculating Income Tax Liability Income SlabRate of TaxationAmount to be PaidBelow Rs. 2.5 lakhNo tax0Between Rs. 2.5 lakh and Rs. 5 lakh5%5% of (Rs. 4,88,500 less Rs. 2.5 lakh) = Rs. 11,925Between Rs. 5 lakh and Rs. 10 lakh20%0Rs. 10 lakh and above30%02 more rows • Jun 9, 2020

How do you calculate tax on salary?

Generally, income tax is calculated as the product of a tax rate multiplied by the amount of taxable income. Taxation rates may vary by the type or characteristics of the taxpayer and the type of income.

How do u calculate tax?

What is the sales tax formula? Sales tax rate = Sales tax percent / 100. Sales tax = List price x Sales tax rate.

How much is the tax for 50000 pesos salary in Philippines?

If you make ₱ 50,000 a year living in Philippines, you will be taxed ₱ 4,327. That means that your net pay will be ₱ 45,673 per year, or ₱ 3,806 per month. Your average tax rate is 8.7% and your marginal tax rate is 4.8%. This marginal tax rate means that your immediate additional income will be taxed at this rate.

How to calculate income tax on salary with example Philippines?

An annual salary of not over Php 250, 000 = 0 % An annual salary of over Php 250, 000 but not over Php 400, 000 = 15 % of the excess over Php 250, 000. An annual salary of over Php 400, 000 but not over Php 800, 000 = Php 22, 500 + 20 % of the excess over Php 400, 000.

How to calculate tax?

What is the sales tax formula? Sales tax rate = Sales tax percent / 100. Sales tax = List price x Sales tax rate.

What is the basic tax formula?

Understanding the Tax Base To calculate the total tax liability, you must multiply the tax base by the tax rate: Tax Liability = Tax Base x Tax Rate.

How income tax is calculated with example?

As his taxable income is Rs. 3,77,500, he falls in the slab of 2.5 lakhs – 5 lakhs of income tax. Thus he has to pay 10% of his net income as income tax.Example. Basic Salary25000 * 12= 3,00,000DA4500 * 12= 54,000EA2250 * 12= 27,000Gross Salary= 3,81,000Professional Tax35001 more row • Aug 3, 2022

How Canada tax is calculated?

Example: If your taxable income was $50,000 in 2021, you would calculate your federal tax as follows: Pay 15% on the amount up to $49,020, or $7,353.00. Pay 20.5% on the amount between $49,020 to $98,040, or $200.90. Total federal tax payable: $7,553.90.

How do I calculate my overall tax rate?

The average tax rate is calculated by dividing total tax by taxable income. For an individual, this is taken from form 1040, line 24 (total taxes) paid and divided by line 15 (total taxable income).

What are the federal and provincial tax rates for 2022?

Federal tax brackets and rates have been updated as follows for 2022: 15% on the first $50,197, plus. 20.5% on income over $50,197 up to $100,392, plus. 26% on income over $100,392 up to $155,625, plus. 29% on income over $155,625 up to $221,708, plus. 33% on income over $221,708.

How do you calculate tax in Canada?

Can you calculate your average federal tax rate?Example: If your taxable income was $50,000 in 2021, you would calculate your federal tax as follows: Pay 15% on the amount up to $49,020, or $7,353.00. Pay 20.5% on the amount between $49,020 to $98,040, or $200.90. Total federal tax payable: $7,553.90.

What will the tax rate be in 2022?

The 2022 Income Tax Brackets (Taxes due April 2023) For the 2022 tax year, there are seven federal tax brackets: 10%, 12%, 22%, 24%, 32%, 35% and 37%. Your tax bracket is determined by your filing status and taxable income.

What is the tax rate in Canada 2022?

Canada's federal income tax rates for the 2022 Tax Year Tax RateTax BracketsTaxable Income15%on the first $50,197$50,19720.5%on the next $50,195$50,197 up to $100,39226%on the next $55,233$100,392 up to $155,62529%on the next $66,083$155,625 up to $221,7081 more row • Aug 12, 2022

How do I calculate income for tax?

In a nutshell, to estimate taxable income, we take gross income and subtract tax deductions. What's left is taxable income. Then we apply the appropriate tax bracket (based on income and filing status) to calculate tax liability.

What is the formula to calculate the tax?

We will calculate the tax rate using the below formula: Tax rate = (Tax amount/Price before tax) × 100% = 5/20 × 100% = 25%. Therefore, Tax rate is 25% on the T-shirt.

How much tax will I pay on my income in Canada?

Federal Tax Bracket Rates for 2021 15% on the first $49,020 of taxable income, and. 20.5% on the portion of taxable income over $49,020 up to $98,040 and. 26% on the portion of taxable income over $98,040 up to $151,978 and. 29% on the portion of taxable income over $151,978 up to $216,511 and.

How is tax calculated in salary Philippines?

An annual salary of not over Php 250, 000 = 0 % An annual salary of over Php 250, 000 but not over Php 400, 000 = 20 % of the excess over Php 250, 000. An annual salary of over Php 400, 000 but not over Php 800, 000 = Php 30, 000 + 25 % of the excess over Php 400, 000.

How much tax is deducted from salary Philippines?

1.16%-1.19% (per employee per month). The Payroll Tax is separated from employer social security.Tax Figures. Grossed incomeTax Rate (%)Php 30,000 – 70,00015%Php 70,000 – 140,00020%Php140,000 – 250,00025%Php 250,000 – 500,00030%3 more rows

How can I calculate my tax?

What is the sales tax formula? Sales tax rate = Sales tax percent / 100. Sales tax = List price x Sales tax rate.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send turbo tax 2017 to be eSigned by others?

When you're ready to share your turbo tax 2017, you can send it to other people and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail. You can also notarize your PDF on the web. You don't have to leave your account to do this.

How do I complete turbo tax 2017 on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. If you have a subscription to the service, create an account or log in to an existing one. After completing the registration process, upload your turbo tax 2017. You may now use pdfFiller's advanced features, such as adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

How do I fill out turbo tax 2017 on an Android device?

Use the pdfFiller mobile app and complete your turbo tax 2017 and other documents on your Android device. The app provides you with all essential document management features, such as editing content, eSigning, annotating, sharing files, etc. You will have access to your documents at any time, as long as there is an internet connection.

What is IRS 8404?

IRS Form 8404 is used by corporations, partnerships, or individuals who are required to report certain transactions involving the surrender or exchange of stock for cash or property.

Who is required to file IRS 8404?

Any corporation or partnership that engages in a stock surrender or exchange that meets specific criteria must file IRS 8404.

How to fill out IRS 8404?

To fill out IRS 8404, you need to provide information about the entity making the exchange, the details of the exchanged stock, and the transaction amount. Follow the instructions provided on the form.

What is the purpose of IRS 8404?

The purpose of IRS 8404 is to help the IRS track and assess transactions that involve the surrender or exchange of stock for cash or property to ensure proper tax compliance.

What information must be reported on IRS 8404?

The form must report details such as the name and address of the entity, the type of transaction, the number of shares exchanged, and the value of the exchanged shares or property.

Fill out your turbo tax 2017 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Turbo Tax 2017 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.