CT DRS CT-1040 2018 free printable template

Show details

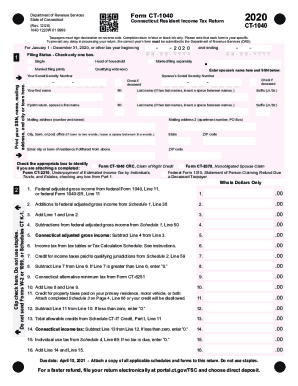

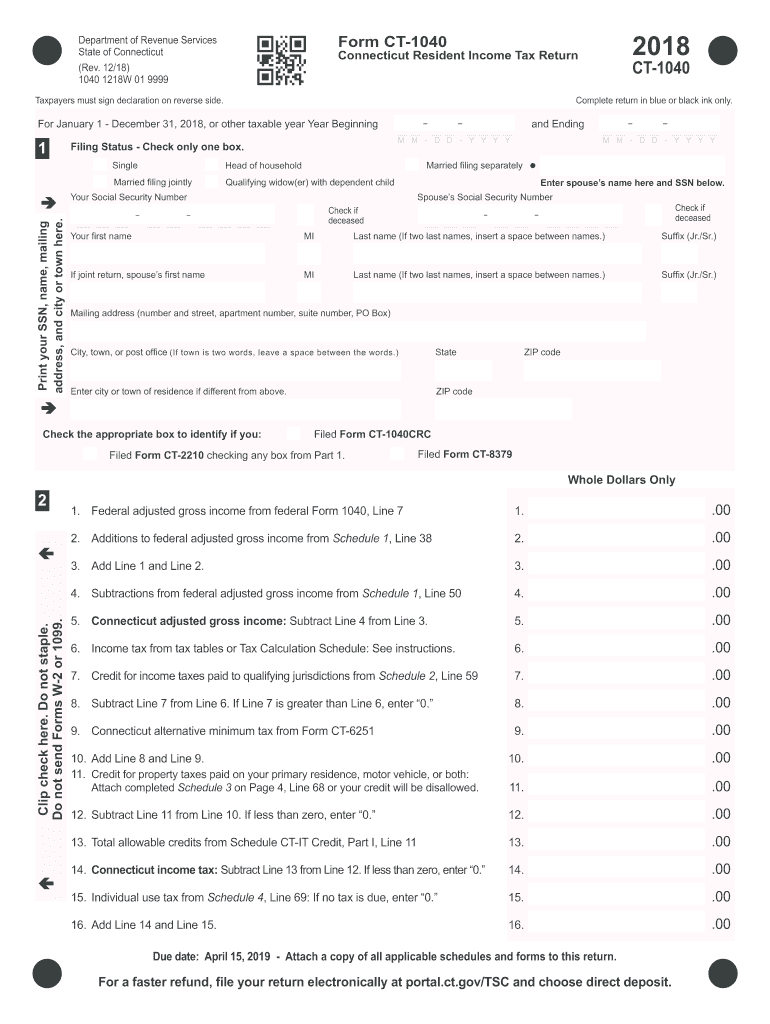

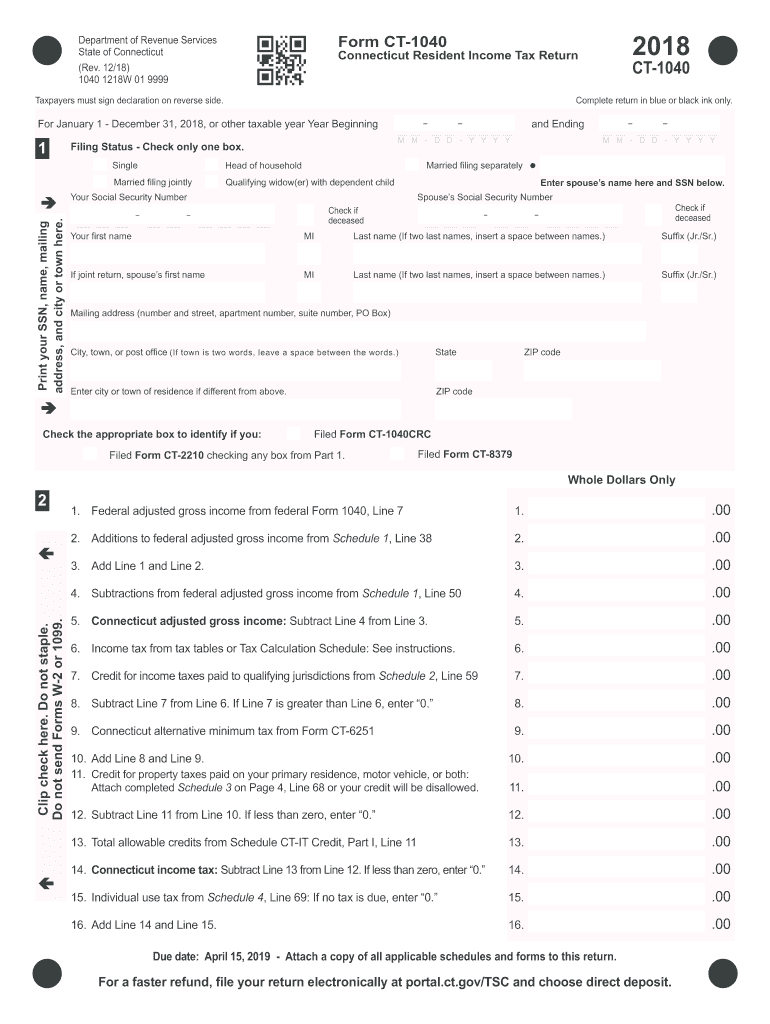

CT-1040 Complete return in blue or black ink only. For January 1 December 31 2018 or other taxable year Year Beginning Form CT-1040 Department of Revenue Services State of Connecticut Rev. 12/18 1040 1218W 01 9999 and Ending M M - D D - Y Y Y Y Filing Status - Check only one box. 19. All 2018 estimated tax payments and any overpayments applied from a prior year 20. Payments made with Form CT-1040 EXT request for extension of time to file 20a. Connecticut earned income tax credit From...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign ct income tax forms

Edit your ct income tax forms form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your ct income tax forms form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit ct income tax forms online

Follow the steps below to benefit from the PDF editor's expertise:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit ct income tax forms. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

The use of pdfFiller makes dealing with documents straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

CT DRS CT-1040 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out ct income tax forms

How to fill out CT DRS CT-1040

01

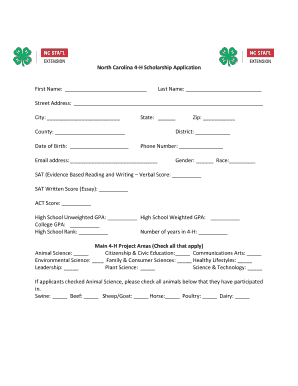

Collect your personal information, including your Social Security number, filing status, and the dependents you are claiming.

02

Gather all required documents, such as W-2s, 1099 forms, and any other income records.

03

Complete the top section of the CT-1040 form, entering your name, address, and Social Security number.

04

Report your total income on the designated lines, including wages, interest, and any additional income.

05

Calculate your adjusted gross income (AGI) by subtracting any adjustments, if applicable.

06

Claim deductions you qualify for, such as standard or itemized deductions, by filling in the respective sections.

07

Fill out the Connecticut tax calculation section, using the appropriate tax tables or calculation methods.

08

Complete the payment section, indicating if you owe taxes or will receive a refund.

09

Sign and date the form before submitting it to the Connecticut Department of Revenue Services.

Who needs CT DRS CT-1040?

01

Individuals who are residents of Connecticut and earned income during the tax year.

02

Part-time residents or non-residents who have income sourced from Connecticut.

03

Individuals who need to file a state tax return in addition to their federal tax return.

Fill

form

: Try Risk Free

People Also Ask about

How do I file my Connecticut state taxes for free?

Department of Revenue Services Phone: 860-297-5962 (from anywhere); 800-382-9463 (within CT, outside Greater Hartford area only); Monday through Friday, 8:30 a.m. to 4:30 p.m., or 860-297-4911 (Hearing Impaired, TDD/TT users only).

Is there a form to fill out for taxes?

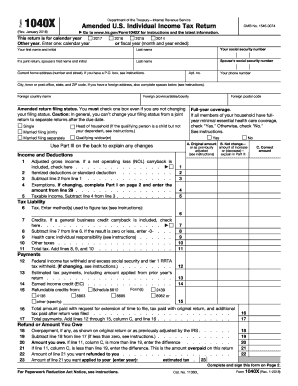

Form 1040 is used by U.S. taxpayers to file an annual income tax return.

Is a 1040 the same as a w2?

"No, 1040 is not the same as a W-2. W-2 is a form provided by the employer to the employee that states the gross wages in a given year and all the tax withheld and deductions," says Armine Alajian, CPA and founder of the Alajian Group, a company providing accounting services and business management for startups.

Where can I get Connecticut state income tax forms?

Request a U.S. mailed copy of a CONNECTICUT TAX FORM from the CT DRS: Click here. You can also call the CT DRS, Monday - Friday, 8:30 a.m. - 4:30 p.m. at 860-297-5962 to order forms by U.S. mail. Request a U.S. mailed copy of a FEDERAL TAX FORM from the IRS: Click here.

Does Connecticut have an efile form?

Connecticut Income Taxes. Connecticut State Income Taxes for Tax Year 2022 (January 1 - Dec. 31, 2022) can be prepared and e-Filed now along with an IRS or Federal Income Tax Return (or you can learn how to only prepare and file a CT state return).

Can I fill out a 1040 form myself?

Where To Find Form 1040. The IRS offers a PDF version of Form 1040 that you can fill out manually. You'll need to input your personal information, income and deductions to complete the form.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my ct income tax forms directly from Gmail?

It's easy to use pdfFiller's Gmail add-on to make and edit your ct income tax forms and any other documents you get right in your email. You can also eSign them. Take a look at the Google Workspace Marketplace and get pdfFiller for Gmail. Get rid of the time-consuming steps and easily manage your documents and eSignatures with the help of an app.

Can I create an electronic signature for the ct income tax forms in Chrome?

Yes, you can. With pdfFiller, you not only get a feature-rich PDF editor and fillable form builder but a powerful e-signature solution that you can add directly to your Chrome browser. Using our extension, you can create your legally-binding eSignature by typing, drawing, or capturing a photo of your signature using your webcam. Choose whichever method you prefer and eSign your ct income tax forms in minutes.

How do I edit ct income tax forms on an Android device?

You can make any changes to PDF files, such as ct income tax forms, with the help of the pdfFiller mobile app for Android. Edit, sign, and send documents right from your mobile device. Install the app and streamline your document management wherever you are.

What is CT DRS CT-1040?

CT DRS CT-1040 is the Connecticut Personal Income Tax Return form used by residents of Connecticut to report their income and calculate their state income tax liability.

Who is required to file CT DRS CT-1040?

Individuals who are residents of Connecticut and have a certain level of income or meet specific conditions are required to file the CT DRS CT-1040.

How to fill out CT DRS CT-1040?

To fill out the CT DRS CT-1040, gather necessary financial documents, complete the sections for personal information, income, deductions, and tax credits, and calculate your total tax owed or refund due.

What is the purpose of CT DRS CT-1040?

The purpose of the CT DRS CT-1040 is to allow Connecticut residents to report their annual income, claim deductions and credits, and determine the amount of state income tax they owe.

What information must be reported on CT DRS CT-1040?

CT DRS CT-1040 requires reporting personal information, total income, adjustments to income, taxable income, credits, and the total tax liability.

Fill out your ct income tax forms online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Ct Income Tax Forms is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.