Get the free lic life certificate form

Fill out, sign, and share forms from a single PDF platform

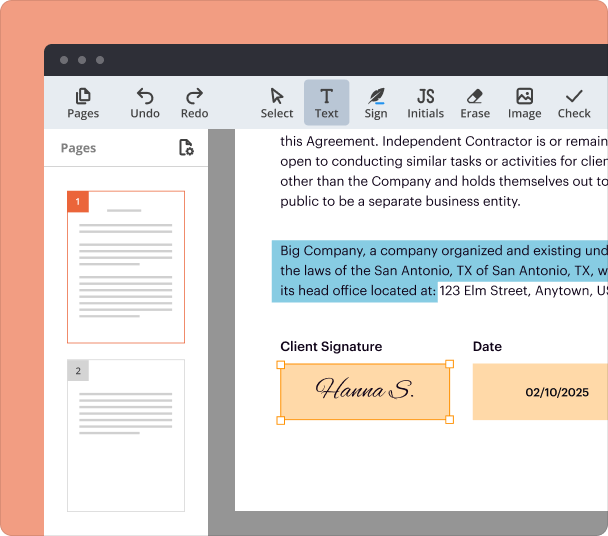

Edit and sign in one place

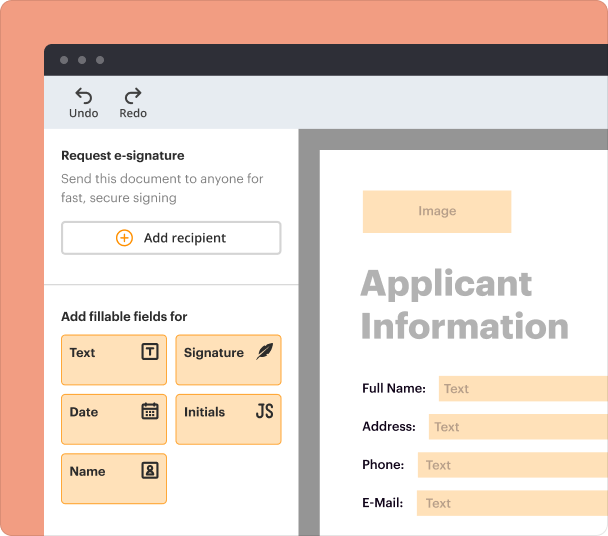

Create professional forms

Simplify data collection

Manage forms centrally

Why pdfFiller is the best tool for your documents and forms

End-to-end document management

Accessible from anywhere

Secure and compliant

Everything You Need to Know About the Life Certificate Form

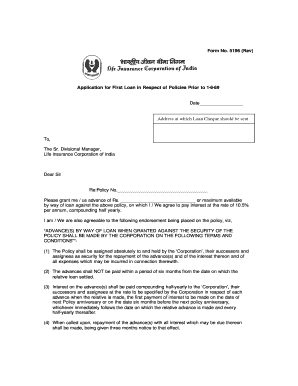

If you're required to maintain your life certificate for annuity or pension benefits, filling out the LIC Life Certificate form correctly is essential. This guide will walk you through each necessary step, ensuring that your submission is accurate and complete.

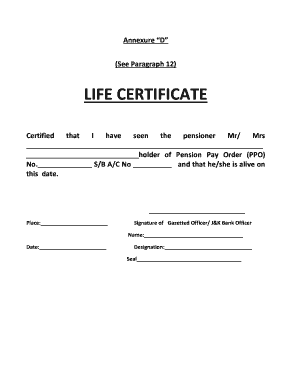

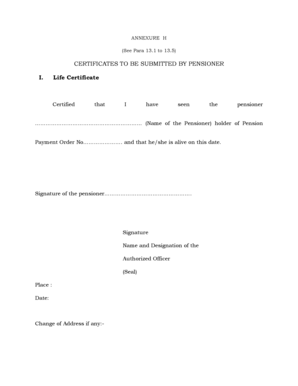

What is the life certificate form?

The LIC Life Certificate form, often referred to as the Existence Certificate, serves a crucial role in validating the life status of an individual who receives pension or annuity benefits. It reassures the insurance provider that the beneficiary is still alive and eligible for these payments.

-

It's essential for preventing fraudulent claims and ensuring that benefits are issued to living individuals.

-

Typically, it is required by pensioners, annuity holders, and their dependents who must submit proof of life on an annual basis.

-

Failure to present this certificate can lead to suspension of payments, causing financial stress.

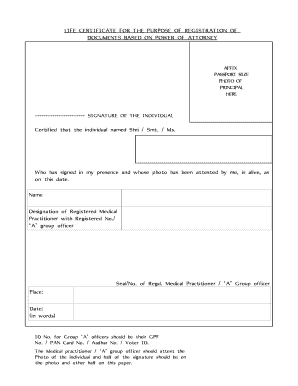

What information do you need to provide on the form?

Accurate completion of the LIC Life Certificate form requires specific personal and financial details to authenticate the identity of the applicant.

-

This is your personal identification number that links you to your pension plan.

-

You'll need to provide your name, date of birth, address, and other identifying information.

-

Your signature should match the records with the LIC. It's vital for authentication purposes.

-

Authorized individuals, such as LIC officers or specified personnel at banks, must certify the form.

How do you fill out the life certificate form?

Filling out the LIC Life Certificate form may seem daunting; however, following a systematic approach makes it manageable. Ensure you have all the required documents on hand before you begin.

-

Start by entering your annuity number, followed by personal details, and ensure you provide a clear signature.

-

Double-check your entries for any mistakes, especially numerical data and signatures.

-

Omitting required signatures or incorrect annuity numbers can cause delays; always review the checklist.

How can pdfFiller help with the life certificate form?

Navigating the complexities of the LIC Life Certificate form is simpler with pdfFiller's interactive features that streamline the process of document management.

-

You can easily fill in the blanks, add relevant documents, and maintain an organized structure.

-

This is especially useful for enterprises where multiple stakeholders may need access or input.

-

Access your documents securely from any device, ensuring that everything is at your fingertips when you need it.

What is the submission and certification process?

Once the form is properly filled out, knowing where and how to submit it is vital for timely processing of the life certificate.

-

Forms can be submitted at your nearest LIC divisional office or through designated bank branches.

-

Generally, the processing time can vary from a few days to weeks, depending on the volume of submissions.

-

Always keep a copy of your submitted form and any related documents to avoid future discrepancies.

How can find contact information for assistance?

If you encounter any issues or have questions regarding the LIC Life Certificate form, access to the right resources can significantly ease the process.

-

You can locate your nearest LIC office by visiting the official website for detailed information.

-

Utilizing the online platform for queries can save you time; support emails are often readily available.

-

Consult these officials if you're unsure about the completion process or certification requirements.

What are the legal and compliance notes?

Understanding the legal framework surrounding the LIC Life Certificate is crucial for ensuring compliance and avoiding potential pitfalls.

-

Be informed about the laws governing the issuance of life certificates to streamline interactions with the insurance agency.

-

Nationalized banks often play a significant role by certifying the life certificate; knowing their specific functions can be beneficial.

-

Make sure to familiarize yourself with any regional specifics that could affect the submission and certification process.

Frequently Asked Questions about lic life certificate form

What is a LIC Life Certificate?

A LIC Life Certificate verifies that the pension or annuity holder is alive, crucial for maintaining uninterrupted benefits. It must be submitted annually to ensure continued eligibility.

How often do I need to submit the LIC Life Certificate?

Typically, LIC asks for this certificate on an annual basis, coinciding with your policy's renewal cycle or payment intervals.

What happens if I fail to submit my LIC Life Certificate?

Failure to submit the life certificate on time may result in the suspension of your pension or annuity benefits until compliance is achieved.

Can I submit the LIC Life Certificate form online?

Currently, the submission process primarily requires in-person delivery at designated offices, but check LIC's official site for any online submission updates.

Who can certify my LIC Life Certificate?

Authorized LIC Class-I Officers or selected bank officials can certify the life certificate, ensuring validity before submission.

pdfFiller scores top ratings on review platforms