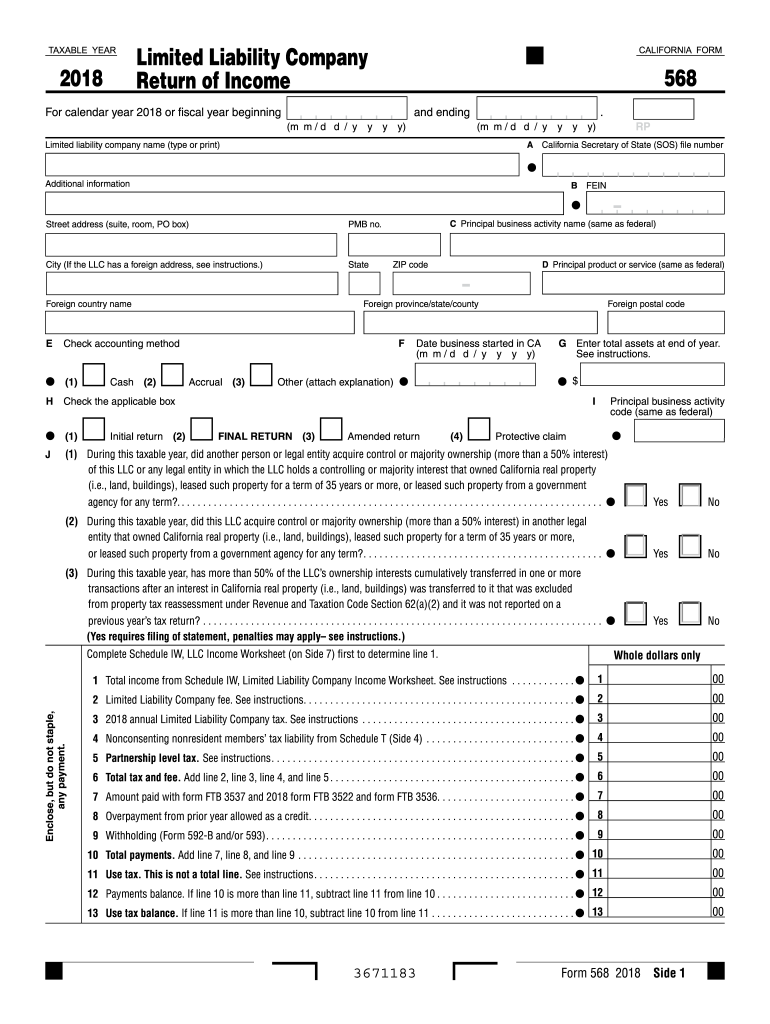

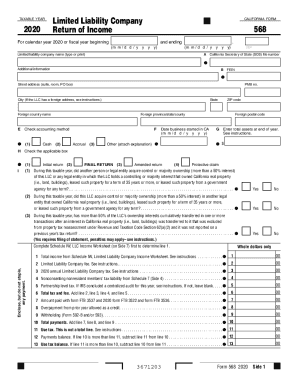

Who needs a form 568?

Limited Liability Companies can be classified as partnerships, disregarded entities, or treated as corporations. In California, they have to file different types of income returns to the IRS office. Only LCS classified as partnerships have to complete and send form 568.

What is form 568 for?

This is a basic income tax return for an LLC. It should be filed annually to report the income, determine the amount of LLC fee, pay non-resident members tax (if any) and report the deductions, gains and losses of the entity over the year.

Is it accompanied by other forms?

Form 568 should not be accompanied by any other forms.

When is form 568 due?

As the instructions state, form 568 is to be filed by April, 15th. As it is an annual return it should report the numbers from the previous year. So, a form for 2014 must be filed by April, 15th, 2015.

How do I fill out form 568?

There are 7 pages of this form. You should answer the questions listed on these pages. There is a table for the amounts of total income, LLC fee, annual LLC tax, nonresident members’ tax, total tax and fee, overpayment, refund and use tax on page 1. After you answer the questions on pages 2 and 3, use further sheets to specify your answers: schedule A for cost of goods sold, schedule B for income and deductions, schedule T for nonconsenting nonresident tax liability, schedule K for members’ shares of income, deductions, credits, schedule L for balance sheets, schedule M-1 for reconciliation of income, M-2 for analysis of members capital accounts, and finally schedule O for amounts of liquidation used to capitalize LLC.

Where do I send from 568?

File this form and make the payment to Franchise Tax Board, PO box 942857, Sacramento CA 94257-0501.