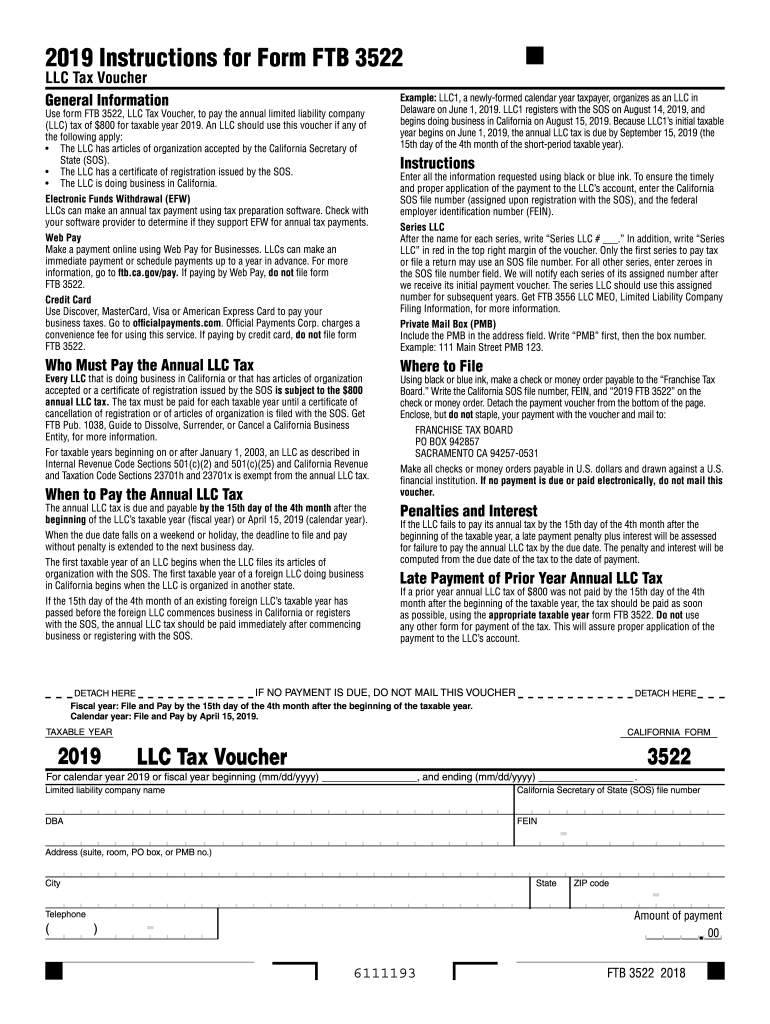

Who needs an FT 3522 Form?

Every LLC doing business in California must be registered with the California Secretary of State and must file and complete and pay the Annual Tax and also LLC Fee. To pay the first, an LLC is required to use FT 3522 Form if choosing to pay in any way but by a credit card, the amount of tax is standard $800.

What is FT 3522 Form for?

Form FT 3622 serves as an LLC Tax Voucher that should be submitted by an LLC, that:

- Has articles of organization accepted by the California SOS (Secretary of State), or

- Possess a registration certificate issued by the SOS, and

- Is doing business in California

Is Form FT 3522 accompanied by other forms?

It is mandatory that an LLC Tax Voucher should be accompanied by either Form 565, which is Partnership Return of Income, or Form 568, which is Limited Liability Company Return of Income.

When is FT 3522 due?

Concerning the Form (565 or 568) that should be filed along with the FT 3522, the yearly LLC tax is due by the 15th day of the 4th month after the beginning of the fiscal year. Typically, this day falls on April 15th, but when the 15th falls on a holiday or a weekend, the deadline gets extended until the next business day.

How do I fill out LLC Tax Voucher 3522 Form?

The 3522 Voucher Form must contain such information:

- Term of the fiscal year

- Name of LLC

- DBA

- Full address and phone number

- SOS file number

- Federal EIN

- Amount of payment

Where do I send FT 3522 Form?

The completed fillable FT 3522 along with the payment must be directed to the Franchise Tax Board at this address: Franchise Tax Board, PO Box 942857, Sacramento CA 94257-0531.