NY DTF CT-3-M (formerly CT-3M/4M) 2018 free printable template

Show details

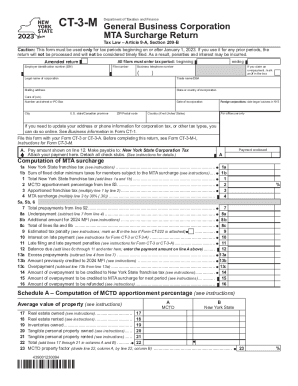

CT3MDepartment of Taxation and FinanceGeneral Business Corporation MTA Surcharge Return Tax Law Article 9A, Section 209BCaution: This form must be used only for tax periods beginning on or after January

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign new york state ct

Edit your new york state ct form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your new york state ct form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit new york state ct online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit new york state ct. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

NY DTF CT-3-M (formerly CT-3M/4M) Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out new york state ct

How to fill out NY DTF CT-3-M (formerly CT-3M/4M)

01

Gather necessary financial documents and information about your business.

02

Download the NY DTF CT-3-M form from the New York State Department of Taxation and Finance website.

03

Begin filling out the form by entering your business name, address, and identification number at the top.

04

Complete Part 1 by reporting your gross income and any deductions.

05

Move on to Part 2 to calculate your taxable income based on the information provided.

06

Fill out Part 3 by detailing your credits and prepayments to determine your total tax due.

07

Review the instructions for any additional schedules that may need to be completed based on your business activities.

08

Complete the signature section and date the form.

09

Submit the completed form by the due date either electronically or by mailing it to the appropriate address.

Who needs NY DTF CT-3-M (formerly CT-3M/4M)?

01

Businesses that operate as corporations or partnerships in New York State.

02

Entities that need to report their income, deductions, and tax credits for the 2023 tax year.

03

Tax professionals preparing returns for eligible businesses that must file form CT-3-M.

Instructions and Help about new york state ct

���doing��� !#%)+.1479;>?BEHJMPTVY[^_bdhjnpstwy{}����������������������������������

Fill

form

: Try Risk Free

People Also Ask about

What is form CT 2?

Use this form to report railroad retirement taxes imposed on compensation received by employee representatives.

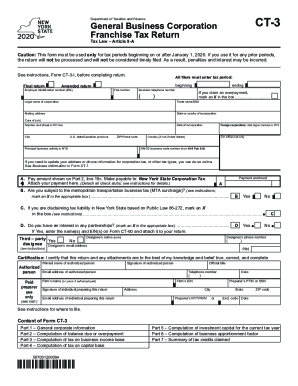

What is Form CT-3 New York?

New York's corporate franchise tax applies to both C and S corporations. To calculate and pay it, you must fill out and file Form CT-3, your New York corporate tax return. For many businesses, this tax ends up being somewhere around 6.5% of their business income earned in New York.

What is fixed dollar minimum tax?

The fixed dollar minimum tax is imposed at a flat rate if it will result in a higher payment than a tax based on business income or business capital. ( Sec. 11-654, N.Y.C.

What is CT 3s?

Once a corporation has approval from the New York State Tax Department to be treated as a New York S corporation, it is required to file Form CT-3-S instead of Form CT-3, General Business Corporation Franchise Tax Return. Form CT-3-S is used to pay the entity level franchise tax under Article 9-A.

What is form CT-3 New York?

New York's corporate franchise tax applies to both C and S corporations. To calculate and pay it, you must fill out and file Form CT-3, your New York corporate tax return. For many businesses, this tax ends up being somewhere around 6.5% of their business income earned in New York.

Who needs to file CT 3M?

A taxpayer filing Form CT-3, CT-3-A, or CT-4 under Article 9-A, that does business, employs capital, owns or leases property, or maintains an office in the Metropolitan Commuter Transportation District (MCTD), must also file Form CT-3M/4M and pay a metropolitan transportation business tax surcharge on business done in

What is a form CT-3?

Form CT-3-A/BC provides individual group member detail concerning each member's: general information, fixed dollar minimum tax, prepayments, capital base, investment capital, and apportionment.

Who is subject to New York MTA surcharge?

MTA Surcharge Filing If a taxpayer has $1 million or more of MTA receipts, it is subject to the MTA surcharge. … The computation of the MTA Surcharge increases to 25.6% of New York tax from 17%, and is now computed before credits; however, it now uses the actual tax rather than a recomputed New York tax. …

Who must file CT-3 m?

Most corporations are required to electronically file this form either using tax software or online, after setting up an online services account, through the department's website. For more information, see Form CT-400-I, Instructions for Form CT-400.

What does a negative amount on tax return mean?

A positive number means you still owe income taxes. A negative number means a refund. If the IRS owes you a refund, it can mail you a check or direct deposit your money in up to three different accounts.

Who is subject to MTA surcharge tax?

MTA Surcharge Filing If a taxpayer has $1 million or more of MTA receipts, it is subject to the MTA surcharge. …

What is form CT 3M?

A taxpayer filing Form CT-3, General Business Corporation Franchise Tax Return, or Form CT-3-A, General Business Corporation Combined Franchise Tax Return, under Article 9-A that does business, employs capital, owns or leases property, maintains an office, or derives receipts from activity, in the Metropolitan Commuter

Who must file NY CT-3?

Taxable DISCs must file Form CT-3 on or before the 15th day of the ninth month after the end of the tax year. Such a DISC is subject to the tax on apportioned capital or the fixed dollar minimum, whichever is larger. Write DISC after the legal name of the corporation in the address section of the return.

What is a CT-3?

Department of Taxation and Finance. General Business Corporation. Franchise Tax Return.

Who must file CT-3?

Taxable DISCs must file Form CT-3 on or before the 15th day of the ninth month after the end of the tax year. Such a DISC is subject to the tax on apportioned capital or the fixed dollar minimum, whichever is larger.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify new york state ct without leaving Google Drive?

People who need to keep track of documents and fill out forms quickly can connect PDF Filler to their Google Docs account. This means that they can make, edit, and sign documents right from their Google Drive. Make your new york state ct into a fillable form that you can manage and sign from any internet-connected device with this add-on.

How do I execute new york state ct online?

With pdfFiller, you may easily complete and sign new york state ct online. It lets you modify original PDF material, highlight, blackout, erase, and write text anywhere on a page, legally eSign your document, and do a lot more. Create a free account to handle professional papers online.

How do I make edits in new york state ct without leaving Chrome?

Install the pdfFiller Google Chrome Extension in your web browser to begin editing new york state ct and other documents right from a Google search page. When you examine your documents in Chrome, you may make changes to them. With pdfFiller, you can create fillable documents and update existing PDFs from any internet-connected device.

What is NY DTF CT-3-M (formerly CT-3M/4M)?

NY DTF CT-3-M is a tax form used by New York corporations to report their franchise tax liabilities. It is an updated version of the previous CT-3M/4M form.

Who is required to file NY DTF CT-3-M (formerly CT-3M/4M)?

Corporations doing business in New York State that are classified as S corporations, or are organized or authorized to do business in New York are required to file this form.

How to fill out NY DTF CT-3-M (formerly CT-3M/4M)?

To fill out NY DTF CT-3-M, corporations need to provide detailed financial information, including income, deductions, and tax credits. Instructions for specific line items can be found in the form instructions provided by the New York Department of Taxation and Finance.

What is the purpose of NY DTF CT-3-M (formerly CT-3M/4M)?

The purpose of NY DTF CT-3-M is to calculate and report the corporation's franchise tax owed to New York State, allowing the state to assess the business activities and income generated within New York.

What information must be reported on NY DTF CT-3-M (formerly CT-3M/4M)?

The information that must be reported includes total income, total deductions, credits claimed, and the franchise tax calculation based on the corporation's financial activities during the year.

Fill out your new york state ct online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

New York State Ct is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.