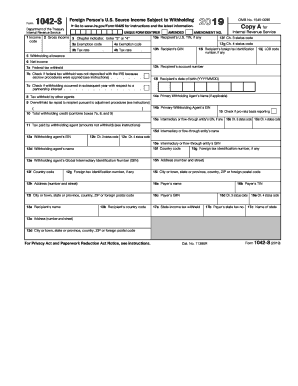

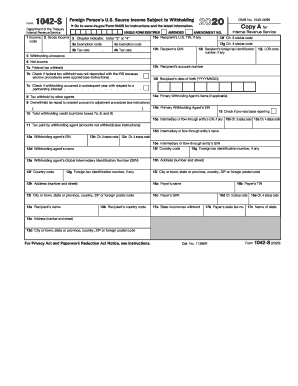

IRS Instruction 1042-S 2019 free printable template

Get, Create, Make and Sign IRS Instruction 1042-S

Editing IRS Instruction 1042-S online

Uncompromising security for your PDF editing and eSignature needs

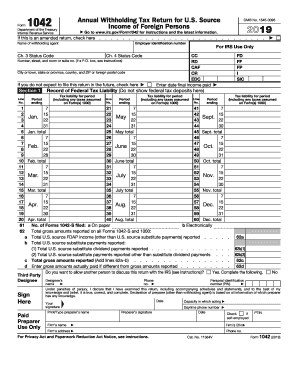

IRS Instruction 1042-S Form Versions

How to fill out IRS Instruction 1042-S

How to fill out IRS Instruction 1042-S

Who needs IRS Instruction 1042-S?

Instructions and Help about IRS Instruction 1042-S

Good morning and welcome to todays webcast forms 10 42 and 10 42 s what you need to know before filing before we begin Im going to play a brief housekeeping video welcome and thanks for joining us were pleased to present another in our ongoing series of continuing professional education webcasts to help companies and individuals conquer challenges as they plan for whats next our presentation will start in a few moments before you begin here are a few things to keep in mind you can customize how you both view our presentation and interact with the presenter for better viewing close all other applications and turn up your speaker volume you can also adjust window size and placement or enter full-screen mode using the controls at the top of the window or dragging the bottom right hand corner to resize at the bottom of your screen youll see a series of icons each relating to a different aspect of our session you can download the group attendance sheet and a PDF copy of todays slides from the slide deck and handouts widget to the right of the slide view you can ask our presenter questions during the webcast by typing a question in the Q&A window below the slide view and clicking submit well do our best to answer all questions during the presentation or follow up via email if you experience technical difficulty during todays presentation refresh your browser by hitting the f5 key todays session will offer you 1 CPE credit to receive credit you must meet the requirements as specified by the National Association of state boards of Accountancy you must attend at least 50 minutes of the session and respond to at least 75 of the polling questions which will ask throughout todays presentation to respond to a poll click the button next to your answer will track your progress and alert you when youve earned CPE credit you can then click the certificate icon in the CPE progress widget to open a PDF file that you can save to your computer dont worry if you cant download your PDF certificate today will email a copy to you in two weeks if youre attending this webcast in a group you must complete our attendance sheet to receive CPE credit the attendance sheet is available in the slide deck and handouts widget please have all group members sign it and send only one sheet per group also note that CPE credit can be awarded only to participants as themselves and isnt available to participants who view the on-demand version as a reminder the presentation youre about to see isnt legal investment or accounting advice we encourage you to seek the counsel of a professional service provider to apply this content to your specific circumstances Im pleased to introduce todays presenters from Moss Adams Aaron Fenimore information reporting and withholding director in our San Francisco office and Jill Jim TRO information reporting and withholding director in our Southern California office with that Aaron Ill turn it over to you to get us started thanks Emily hi everyone my name...

People Also Ask about

What is a 1042s form?

What is the difference between Form 1042 and 1042-S?

What is 1042-s used for?

Is 1042-S tax return?

Why have I received a 1042-s?

What does a Canadian do with Form 1042-S?

What is 1042s used for?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send IRS Instruction 1042-S to be eSigned by others?

How can I get IRS Instruction 1042-S?

How do I edit IRS Instruction 1042-S online?

What is IRS Instruction 1042-S?

Who is required to file IRS Instruction 1042-S?

How to fill out IRS Instruction 1042-S?

What is the purpose of IRS Instruction 1042-S?

What information must be reported on IRS Instruction 1042-S?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.