PH BIR Form 0619-E 2018-2026 free printable template

Show details

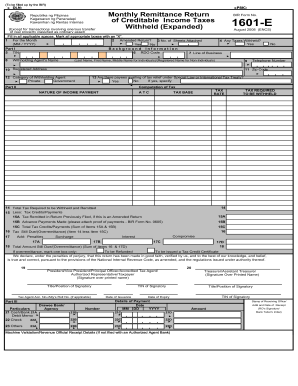

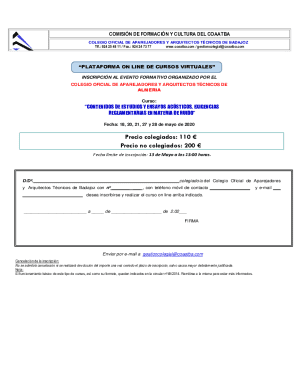

Monthly Remittance Form BIR Form No.0619E

January 2018

Page 1Annex Republic of the Philippines

Department of Finance

Bureau of Internal Revenuer BIR BCS/

Use Only Item:of Creditable Income Taxes Withheld

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign bir form 0619e

Edit your 0619e bir form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your bir form 0619 e editable form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit bir form 0619 e online

To use the services of a skilled PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit bir 0619 e form download pdf. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

Dealing with documents is simple using pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out 0619 e form

How to fill out PH BIR Form 0619-E

01

Download PH BIR Form 0619-E from the BIR website or obtain a physical copy from a BIR office.

02

Fill out your Taxpayer Identification Number (TIN) in the designated field.

03

Enter your name or the name of the business entity.

04

Provide the complete address including street, city, and postal code.

05

Specify the return period for which you are filing the form.

06

Calculate the total income earned during the specified period and input it in the appropriate section.

07

Fill out any deductions applicable to your income.

08

Calculate the total tax due based on the income and deductions.

09

Review the form to ensure all information is accurate and complete.

10

Sign and date the form before submission.

Who needs PH BIR Form 0619-E?

01

PH BIR Form 0619-E is required for individuals earning income from business and/or practice of profession who are required to file quarterly income tax returns.

Fill

bir form 0619 e download

: Try Risk Free

People Also Ask about 0619 e bir form download

What is the deadline for 1601EQ?

1601-EQ forms shall be filed not later than the last day of the month, following the end of the taxable quarter during which the withholding tax was made.

What is the meaning of form 1601e?

What is this form? BIR Form 1601-E, or also known as Monthly Remittance Return of Creditable Income Taxes Withheld (Expanded) is a tax return filed by a designated Withholding agent who is required of withholding taxes on income payments subject to Expanded / Creditable Withholding Taxes.

What is the difference between 1601e and 0619-e?

Form 1601EQ – Quarterly Remittance of Creditable Income Tax Withheld. This is what you file every January, April, July, and October. Each form covers the quarter immediately preceding it. It's basically similar to Form 0619E but with more details as to what you withheld.

What is 0619-E form?

What is this form? BIR Form 0619-E or Monthly Remittance Form for Creditable Income Taxes Withheld (Expanded) is a remittance form that is used for remittance of expanded withholding taxes, as mentioned within the provisions of Revenue Regulations No.

What is the timing of withholding tax?

This section provides that the obligation of the payor to deduct and withhold tax arises “at the time an income payment is paid or payable, or the income payment is accrued or recorded as an expense or asset, whichever is applicable, in the payor's books, whichever comes first.”

How do I file 1604 E?

How to File BIR Form 1604E Date of Remittance. Reference Number of Filing or Payment (N/A if not applicable) Bank of Tax Payments Made (N/A if not applicable) The overall amount of withholding tax to be remitted. Penalties, if any were made.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete bir form 0619e online online?

Completing and signing 0619 e form download online is easy with pdfFiller. It enables you to edit original PDF content, highlight, blackout, erase and type text anywhere on a page, legally eSign your form, and much more. Create your free account and manage professional documents on the web.

How do I make changes in 0619 e bir form?

pdfFiller not only allows you to edit the content of your files but fully rearrange them by changing the number and sequence of pages. Upload your bir form 0619 e excel to the editor and make any required adjustments in a couple of clicks. The editor enables you to blackout, type, and erase text in PDFs, add images, sticky notes and text boxes, and much more.

How do I make edits in bir form 0619 e download excel without leaving Chrome?

Install the pdfFiller Google Chrome Extension to edit 0619 e form excel and other documents straight from Google search results. When reading documents in Chrome, you may edit them. Create fillable PDFs and update existing PDFs using pdfFiller.

What is PH BIR Form 0619-E?

PH BIR Form 0619-E is a tax form used in the Philippines for the filing of the quarterly income tax for individuals earning income from business or profession, as well as certain withholding taxes.

Who is required to file PH BIR Form 0619-E?

Individuals who are self-employed, professionals, and other taxpayers who earn income that is subject to the graduated income tax rates or are required to remit withholding taxes must file PH BIR Form 0619-E.

How to fill out PH BIR Form 0619-E?

To fill out PH BIR Form 0619-E, taxpayers need to provide accurate information, including personal details, income earned from various sources, tax calculations, and any applicable deductions or credits, following the guidelines set by the Bureau of Internal Revenue.

What is the purpose of PH BIR Form 0619-E?

The purpose of PH BIR Form 0619-E is to report and remit income tax liabilities on a quarterly basis to the Bureau of Internal Revenue, ensuring compliance with tax regulations in the Philippines.

What information must be reported on PH BIR Form 0619-E?

PH BIR Form 0619-E must report information including the taxpayer’s name, Tax Identification Number (TIN), income details, applicable tax rates, total tax due, and signatures of the taxpayer or authorized representative.

Fill out your PH BIR Form 0619-E online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Bir Form 0619 E Pdf is not the form you're looking for?Search for another form here.

Keywords relevant to bir form 0619e pdf

Related to bir 0619e form

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.