MI MI-1040CR-7 2018 free printable template

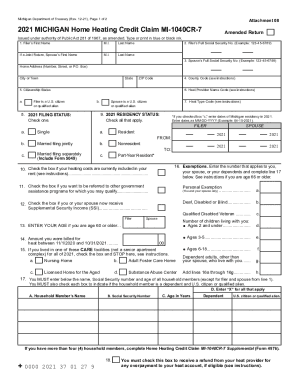

Get, Create, Make and Sign mi 1040cr 7 2021

How to edit mi 1040cr 7 2021 online

Uncompromising security for your PDF editing and eSignature needs

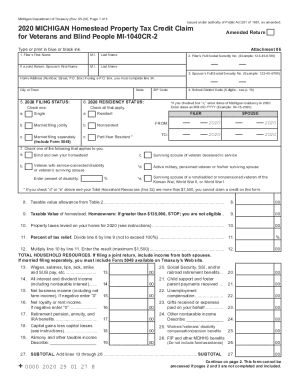

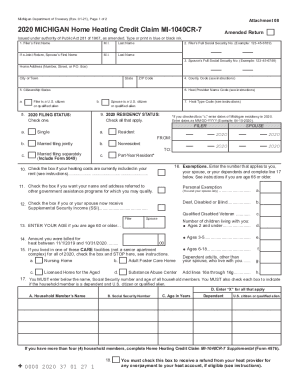

MI MI-1040CR-7 Form Versions

How to fill out mi 1040cr 7 2021

How to fill out MI MI-1040CR-7

Who needs MI MI-1040CR-7?

Instructions and Help about mi 1040cr 7 2021

Hi I'm mark for each COM in Michigan working families with low incomes may qualify for a state version of the Earned Income Tax Credit ETC like the federal version Michigan's credit is offered to those with certain incomes to help encourage families to continue to work despite low wages and to keep those who do above the poverty line Michigan state ETC is modeled after the federal credit as far as eligibility requirements so if a taxpayer in the state was able to claim the federal credit they can also claim the state at Michigan offers the at six percent of the federal credit and allows taxpayers to receive any amount that is greater than their tax liability back as a refund making the credit fully refundable helps to work families regain some of their hard-earned money which they can use to offset other state or local taxes that may be significant a family without state income tax liability can receive the entire amount of the at back as a refund which can be extremely beneficial to a family stretching every dollar the ETC is an important credit to pay attention to a tax time because it lets families keep more of what they earn and is shown to be effective at reducing poverty levels for more information visit each hacks com

People Also Ask about

Where can I get my MI tax form?

Can you file MI 1040CR online?

What is form MI-1040CR-7?

Where do you get tax forms from?

What is the Michigan Home heating tax credit for 2021?

Our user reviews speak for themselves

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit mi 1040cr 7 2021 from Google Drive?

How do I execute mi 1040cr 7 2021 online?

How do I fill out mi 1040cr 7 2021 using my mobile device?

What is MI MI-1040CR-7?

Who is required to file MI MI-1040CR-7?

How to fill out MI MI-1040CR-7?

What is the purpose of MI MI-1040CR-7?

What information must be reported on MI MI-1040CR-7?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.