Get the free dr 15ez

Show details

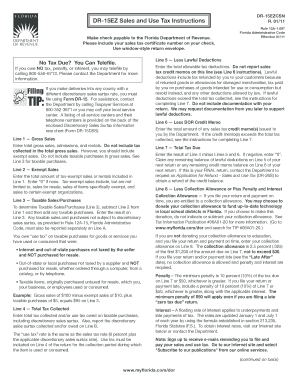

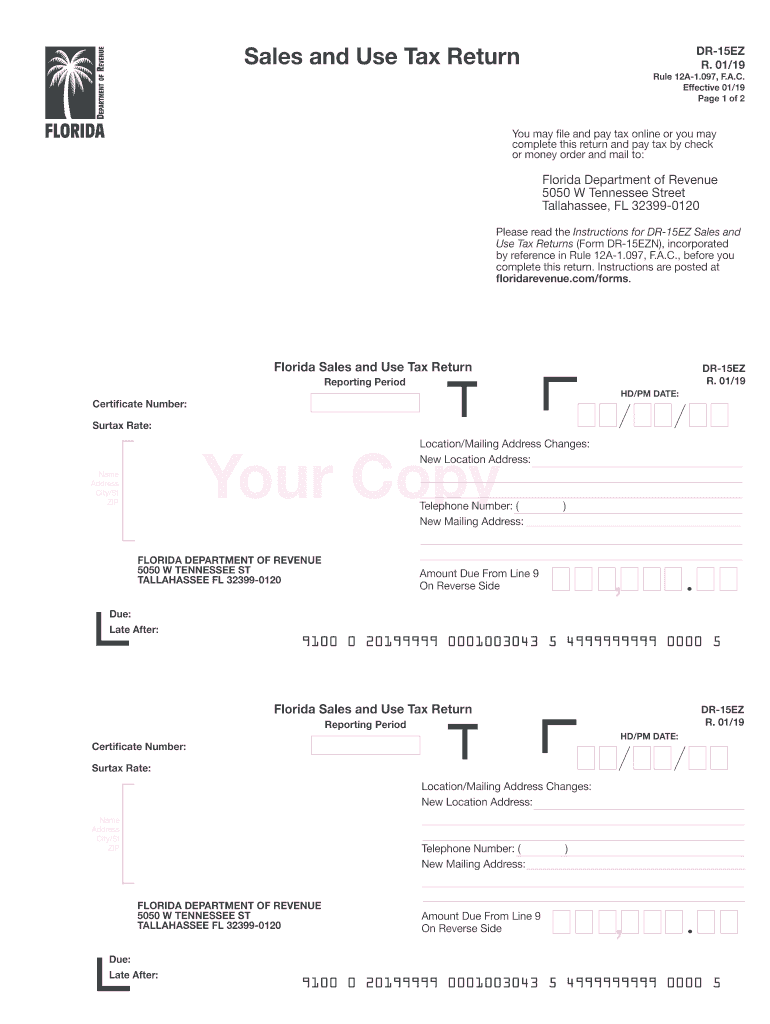

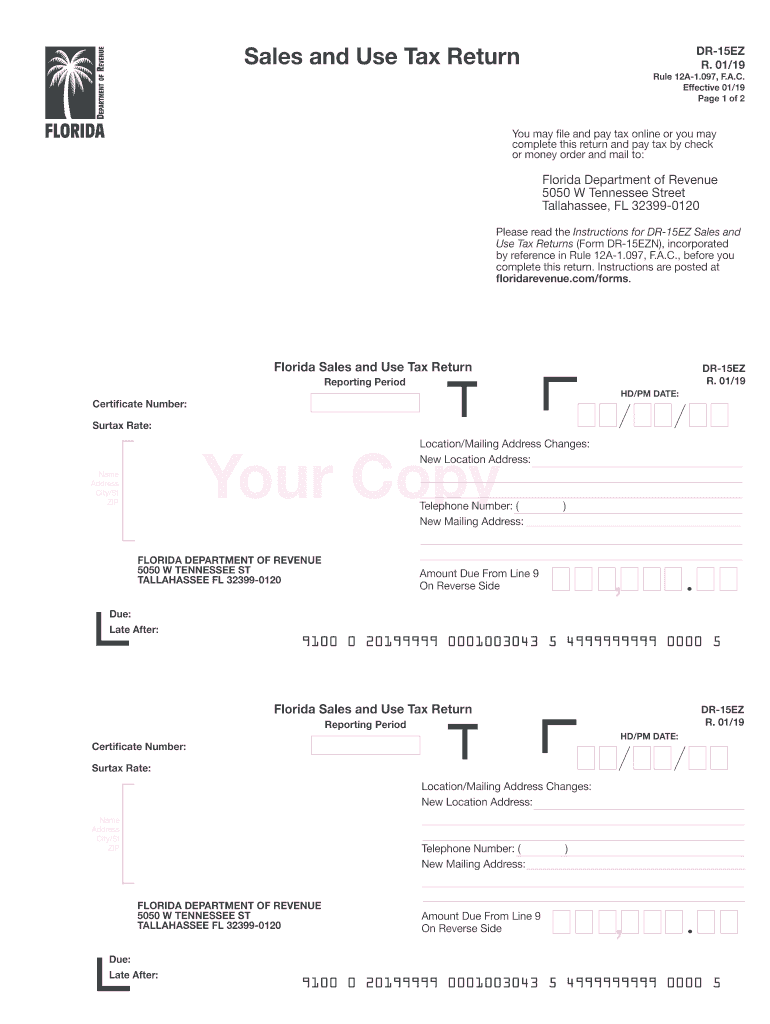

Sales and Use Tax Return DR-15EZ R. 01/19 Rule 12A-1. 097 F.A. C. Effective 01/19 Page 1 of 2 You may file and pay tax online or you may complete this return and pay tax by check or money order and mail to Florida Department of Revenue 5050 W Tennessee Street Tallahassee FL 32399-0120 Please read the Instructions for DR-15EZ Sales and Use Tax Returns Form DR-15EZN incorporated by reference in Rule 12A-1. More information on filing and paying electronically including a Florida e-Services...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign dr 15ez

Edit your dr 15ez form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your dr 15ez form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing dr 15ez online

Follow the steps below to take advantage of the professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit dr 15ez. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out dr 15ez

How to fill out FL DoR DR-15EZ

01

Download the FL DoR DR-15EZ form from the Florida Department of Revenue website.

02

Begin by filling out your personal information in the designated areas.

03

Provide your sales tax registration number or your federal employer identification number (FEIN).

04

Specify the reporting period for which you are filing the return.

05

Calculate the total sales for the period and enter the amount in the corresponding field.

06

Calculate the taxable sales and enter that amount.

07

Enter the sales tax collected or owed on taxable sales.

08

Include any adjustments or credits as necessary.

09

Calculate the total amount due and double-check all entries for accuracy.

10

Sign and date the form before submitting it to the appropriate address.

Who needs FL DoR DR-15EZ?

01

Any business or individual selling tangible personal property or taxable services in Florida.

02

Businesses that are required to report and remit sales tax.

03

Registered vendors in Florida who need to file periodic sales tax returns.

Fill

form

: Try Risk Free

People Also Ask about

What is the collection allowance for sales tax in Florida?

When you electronically file your sales and use tax return and electronically pay timely, you are allowed to deduct a collection allowance. The collection allowance is 2.5% (.025) of the first $1,200 of tax due, not to exceed $30.

What is exempt from sales tax in Florida?

Florida law grants governmental entities, including states, counties, municipalities, and political subdivisions (e.g., school districts or municipal libraries), an exemption from Florida sales and use tax.

Is Florida sales tax 7%?

Proper Collection of Tax Florida's general state sales tax rate is 6%. Additionally, most Florida counties also have a local option discretionary sales surtax.

Do you file Florida state tax return?

Because Florida doesn't tax personal income at the state level, you do not have to complete a Florida state income tax return as an individual.

What is the sales tax rate in Florida 2023?

Sales tax: 7.02 percent (average combined state and local) Counties are allowed to add a discretionary sales surtax, ranging from 0.5 percent to 1.5 percent.

What is the total sales tax rate in Florida?

How does Florida's tax code compare? Florida does not have a state individual income tax. Florida has a 5.50 percent corporate income tax. Florida has a 6.00 percent state sales tax rate, a max local sales tax rate of 2.00 percent, and an average combined state and local sales tax rate of 7.02 percent.

What is the difference between sales tax and use tax in Florida?

Use tax is due on the use or consumption of taxable goods or services when sales tax was not paid at the time of purchase. For example: If you buy a taxable item in Florida and did not pay sales tax, you owe use tax.

How do I file business taxes in Florida?

Electronically File and Pay with the Department File the Florida Corporate Short Form Income Tax Return (Form F-1120A) File Form F-7004. Pay the corporate income tax due on Forms F-1120 and F-1120A. Pay the tentative tax due on Form F-7004.

How do I file sales and use tax in Florida?

You have three options for filing and paying your Florida sales tax: File online: File online at the Florida Department of Revenue. You can remit your payment through their online system. File by mail: You can use Form DR-15 and file and pay through the mail. AutoFile – Let TaxJar file your sales tax for you.

How do I report sales and use tax in Florida?

You have three options for filing and paying your Florida sales tax: File online: File online at the Florida Department of Revenue. You can remit your payment through their online system. File by mail: You can use Form DR-15 and file and pay through the mail. AutoFile – Let TaxJar file your sales tax for you.

What is sales and use tax in Florida?

Florida's general state sales tax rate is 6% with the following exceptions: Retail sales of new mobile homes - 3% Amusement machine receipts - 4% Rental, lease, or license of commercial real property - 5.5%

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my dr 15ez directly from Gmail?

You can use pdfFiller’s add-on for Gmail in order to modify, fill out, and eSign your dr 15ez along with other documents right in your inbox. Find pdfFiller for Gmail in Google Workspace Marketplace. Use time you spend on handling your documents and eSignatures for more important things.

Where do I find dr 15ez?

It's simple with pdfFiller, a full online document management tool. Access our huge online form collection (over 25M fillable forms are accessible) and find the dr 15ez in seconds. Open it immediately and begin modifying it with powerful editing options.

How do I edit dr 15ez on an iOS device?

You can. Using the pdfFiller iOS app, you can edit, distribute, and sign dr 15ez. Install it in seconds at the Apple Store. The app is free, but you must register to buy a subscription or start a free trial.

What is FL DoR DR-15EZ?

FL DoR DR-15EZ is a simplified sales and use tax return form used by certain taxpayers in Florida to report their sales tax obligations.

Who is required to file FL DoR DR-15EZ?

Taxpayers in Florida with simple sales tax obligations, typically small businesses or individuals with limited sales, are required to file FL DoR DR-15EZ.

How to fill out FL DoR DR-15EZ?

To fill out FL DoR DR-15EZ, taxpayers must enter their business information, report total taxable sales, calculate the tax due, and provide payment if necessary.

What is the purpose of FL DoR DR-15EZ?

The purpose of FL DoR DR-15EZ is to provide a streamlined process for eligible taxpayers to report and pay their sales and use tax to the Florida Department of Revenue.

What information must be reported on FL DoR DR-15EZ?

The information that must be reported on FL DoR DR-15EZ includes the taxpayer's identification information, total sales made, taxable sales, and the tax amount due.

Fill out your dr 15ez online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Dr 15ez is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.