NY DTF IT-201-X 2018 free printable template

Show details

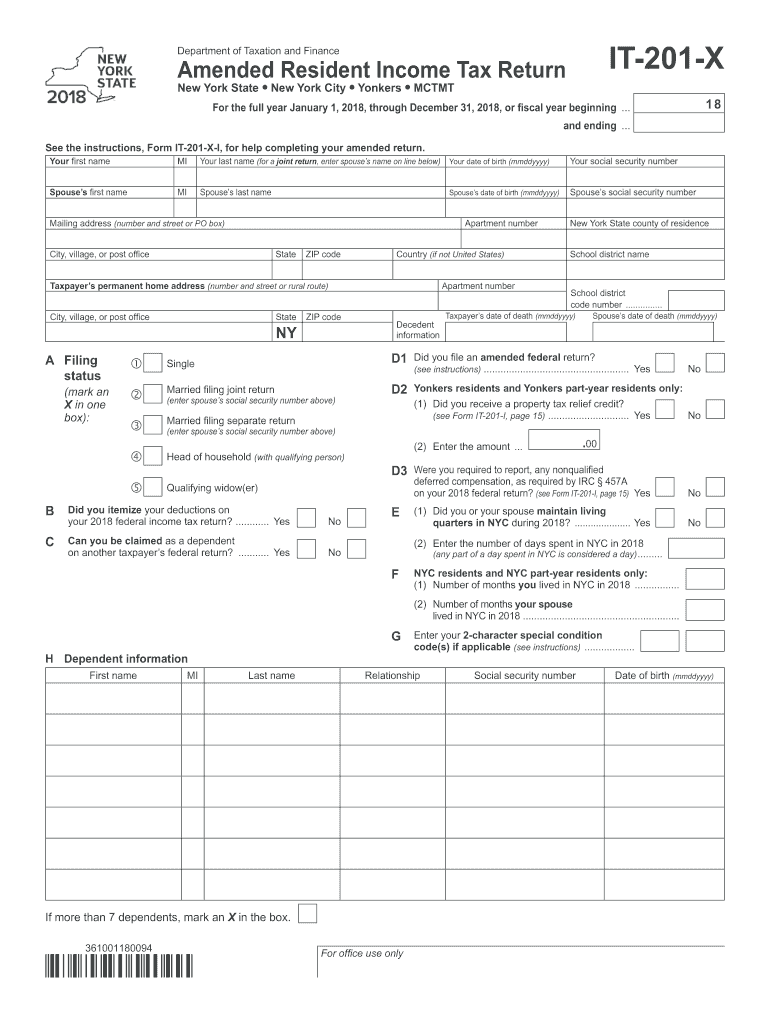

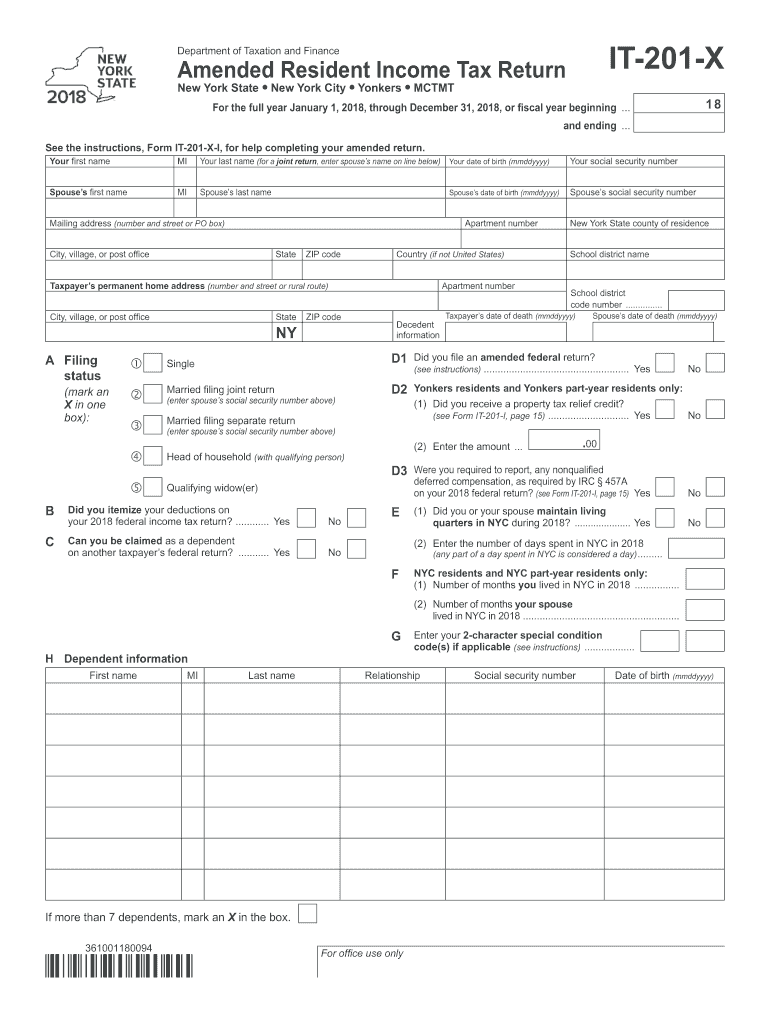

81 To pay by electronic funds withdrawal mark an X in the box and fill in lines 82 through 82d. If you pay by check or money order you must complete Form IT-201-V and mail it with your return. Account information If the funds for your payment or refund would come from or go to an account outside the U.S. mark an X in this box see instructions. 24 Add lines 19 through 23. New York subtractions Name s as shown on page 1 IT-201-X 2018 Page 3 of 6 Standard deduction or itemized deduction 34...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign NY DTF IT-201-X

Edit your NY DTF IT-201-X form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your NY DTF IT-201-X form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit NY DTF IT-201-X online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit NY DTF IT-201-X. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

It's easier to work with documents with pdfFiller than you can have believed. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

NY DTF IT-201-X Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out NY DTF IT-201-X

How to fill out NY DTF IT-201-X

01

Gather all relevant tax documents including previous tax returns and any notices from the NY Department of Taxation and Finance.

02

Obtain the NY DTF IT-201-X form from the New York State Department of Taxation and Finance website.

03

Fill out your personal information, including your name, address, and Social Security number at the top of the form.

04

Indicate the tax year you are amending on the form.

05

Complete the sections on income, adjustments, and deductions as applicable, using the previous return as a reference.

06

Enter the corrected amounts for tax credits and payments based on your updated calculations.

07

Provide an explanation for changes made in the designated section of the form.

08

Review the form for accuracy and completeness before submitting.

09

Sign and date the form as required.

10

Submit the completed form by mail to the address specified in the instructions.

Who needs NY DTF IT-201-X?

01

Any taxpayer who has filed a New York State personal income tax return (Form IT-201) and needs to amend their return due to errors or changes in income, deductions, or credits.

02

Individuals who received a notice from the NY Department of Taxation and Finance indicating that adjustments are needed for their previously filed tax return.

Fill

form

: Try Risk Free

People Also Ask about

What is a X201 form?

The X201 Form is a form that allows you to fill out information about the product. It has all of the details you need.

How do I get a business name in NY?

You must file the certificate in the office of the County Clerk in the county where your business is located. Get the Certificate of Assumed Name form. You can also get the form at the County Clerk's office in your borough. For sole proprietors and general partnerships, the filing fee varies by county.

Do I need a business license as a sole proprietor in NY?

You don't have to register your Sole Proprietorship with the New York Department of State. It simply exists once you decide to start a business and engage in business activities.

What is a NYS business certificate?

If you plan on conducting a for-profit business through a sole proprietorship or general partnership under any name other than your own, you are required by law to file a Business Certificate (also called a Certificate of Assumed Name).

How do I register my business name in NY?

Form an Entity Visit the NYS Business Wizard to determine the requirements for your business and apply for the right license or permit. Sole proprietorships and general partnerships file in the county where they're located. Business Corporations file a Certificate of Incorporation with the Department of State.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify NY DTF IT-201-X without leaving Google Drive?

Simplify your document workflows and create fillable forms right in Google Drive by integrating pdfFiller with Google Docs. The integration will allow you to create, modify, and eSign documents, including NY DTF IT-201-X, without leaving Google Drive. Add pdfFiller’s functionalities to Google Drive and manage your paperwork more efficiently on any internet-connected device.

How can I get NY DTF IT-201-X?

The premium subscription for pdfFiller provides you with access to an extensive library of fillable forms (over 25M fillable templates) that you can download, fill out, print, and sign. You won’t have any trouble finding state-specific NY DTF IT-201-X and other forms in the library. Find the template you need and customize it using advanced editing functionalities.

Can I create an electronic signature for signing my NY DTF IT-201-X in Gmail?

It's easy to make your eSignature with pdfFiller, and then you can sign your NY DTF IT-201-X right from your Gmail inbox with the help of pdfFiller's add-on for Gmail. This is a very important point: You must sign up for an account so that you can save your signatures and signed documents.

What is NY DTF IT-201-X?

NY DTF IT-201-X is the New York State amended personal income tax return form that taxpayers use to correct errors on their original IT-201 form.

Who is required to file NY DTF IT-201-X?

Taxpayers who need to correct mistakes or make changes to their originally filed New York State income tax return are required to file NY DTF IT-201-X.

How to fill out NY DTF IT-201-X?

To fill out NY DTF IT-201-X, taxpayers need to provide their personal information, indicate the year of the original return being amended, disclose the changes being made, and report the correct amounts for any affected lines.

What is the purpose of NY DTF IT-201-X?

The purpose of NY DTF IT-201-X is to allow individuals to amend their previously filed New York State income tax returns to correct inaccuracies or update information for compliance.

What information must be reported on NY DTF IT-201-X?

Information that must be reported on NY DTF IT-201-X includes personal identification details, the original tax return's figures, the adjustments being made, and the revised total amounts for the period being amended.

Fill out your NY DTF IT-201-X online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

NY DTF IT-201-X is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.