SC DoR SC8822 2018 free printable template

Show details

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign SC DoR SC8822

Edit your SC DoR SC8822 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your SC DoR SC8822 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing SC DoR SC8822 online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit SC DoR SC8822. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

SC DoR SC8822 Form Versions

Version

Form Popularity

Fillable & printabley

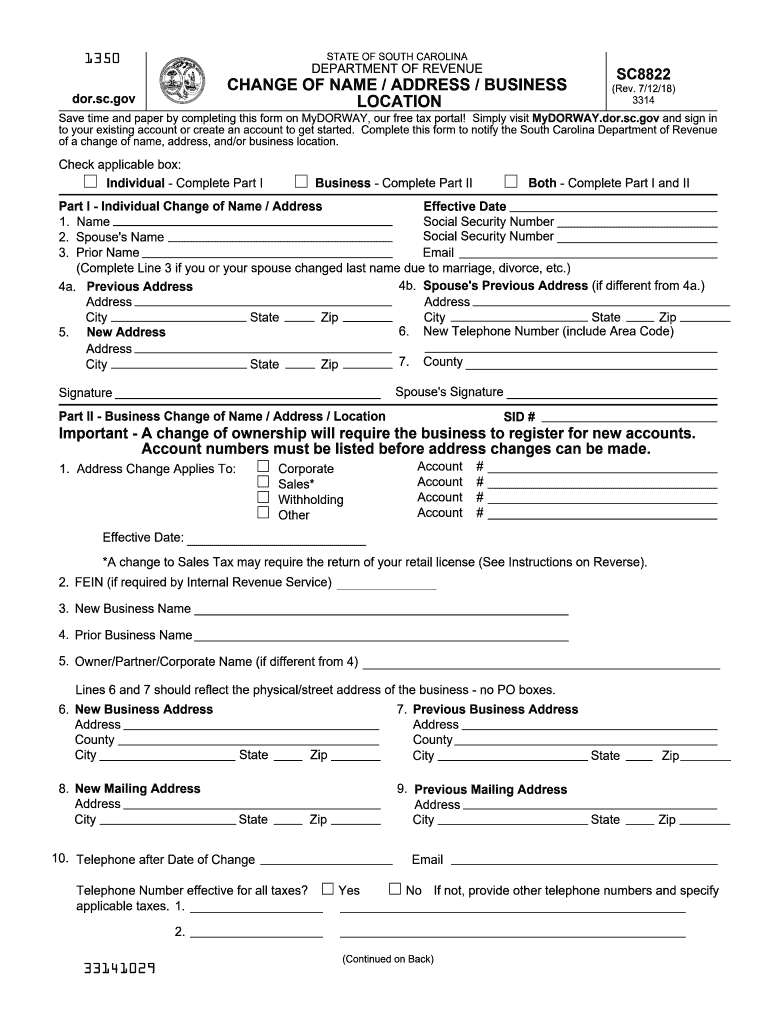

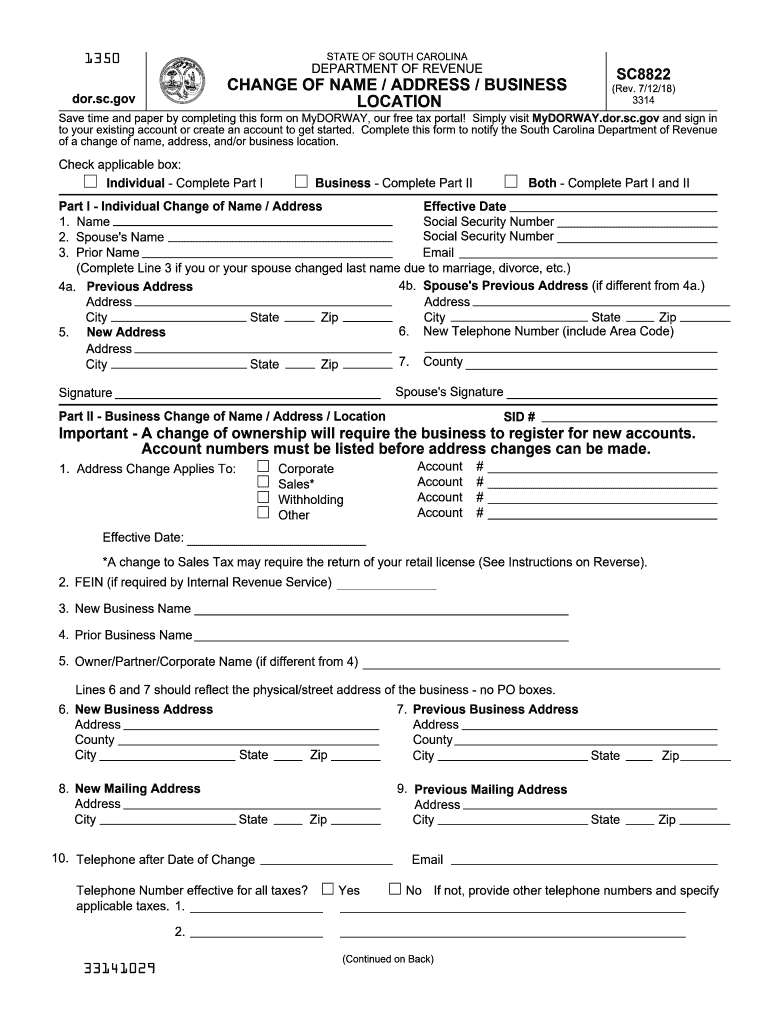

How to fill out SC DoR SC8822

How to fill out SC DoR SC8822

01

Gather necessary personal information such as your name, address, and social security number.

02

Obtain the SC DoR SC8822 form from the official website or designated offices.

03

Fill in your personal information in the appropriate sections of the form.

04

Provide details about your vehicle, including make, model, and vehicle identification number (VIN).

05

Indicate the reason for completing the SC DoR SC8822 form in the specified section.

06

Review the form for accuracy and completeness.

07

Sign and date the form where indicated.

08

Submit the completed form to the appropriate South Carolina Department of Revenue office, either in person or via mail.

Who needs SC DoR SC8822?

01

Individuals registering or making changes to their vehicle title in South Carolina.

02

Owners of vehicles needing to report a change of address or ownership.

03

Persons applying for a new title for a vehicle previously registered out of state.

Fill

form

: Try Risk Free

People Also Ask about

Are groceries tax free in SC?

Most groceries are not taxable, and this encompasses any food meant to be taken home and consumed. Items like beverages, snacks, and seasonings are included here, but hot, ready-to-eat foods are not. Other excluded items are: Foods meant to be heated in the store.

Where can I get hard copies of tax forms?

Picking up copies at an IRS Taxpayer Assistance Center. Going to the IRS Small Business and Self-Employed Tax Center page. Requesting copies by phone — 800-TAX-FORM (800-829-3676). Hours of operation are 7 a.m. to 10 p.m., Monday-Friday, your local time — except Alaska and Hawaii which are Pacific time.

What is the purpose of form 8453?

Form FTB 8453, California e-fle Return Authorization for Individuals, is the signature document for individual e-fle returns. By signing form FTB 8453 the taxpayer, electronic return originator (ERO), and paid preparer declare that the return is true, correct, and complete.

Who should file form 8453?

You'll need to file this federal tax signature form if you're attaching the following forms and documents: Form 1098-C, Contributions of Motor Vehicles, Boats, and Airplanes.

Where can I get my taxes done for free in South Carolina?

1040Now® offers free federal and free South Carolina Income Tax preparation and eFile of tax returns for taxpayers who meet the following requirements: Your AGI is $32,000 or less and. You live in South Carolina.

What is Form SC 8453?

About Form 8453, U.S. Individual Income Tax Transmittal for an IRS e-file Return.

What is subject to sales tax in SC?

Sales tax is imposed on the sale of goods and certain services in South Carolina. The statewide sales and use tax rate is six percent (6%). Counties may impose an additional one percent (1%) local sales tax if voters in that county approve the tax. Generally, all retail sales are subject to the sales tax.

What is exempt from sales tax in SC?

Some goods are exempt from sales tax under South Carolina law. Examples include most non-prepared food items, prescription drugs, and medical supplies.

Do I need to mail form 8453 to IRS?

If you are an ERO, you must mail Form 8453 to the IRS within 3 business days after receiving acknowledgement that the IRS has accepted the electronically filed tax return.

What items are tax-exempt in SC?

Other tax-exempt items in South Carolina CategoryExemption StatusFood and MealsRaw MaterialsEXEMPTUtilities & FuelEXEMPTMedical Goods and Services21 more rows

Will form 8453 hold up my refund?

Will It Hold Up My Return? Sign and mail your federal tax signature form and any supporting paperwork at the end of the e-filing process. Form 8453 won't hold up the processing of your return, but you should mail it within 48 hours of when the IRS accepted your return.

Is food exempt from sales tax in South Carolina?

Are groceries taxable in South Carolina? Grocery items are exempt from state sales tax but still subject to local sales tax.

Do I need to file 8843?

Form 8843 is not an income tax return. Form 8843 is merely an informational statement required by the U.S. government for certain nonresident aliens (including the spouses or dependents of nonresident aliens).

What is the purpose of form 8453 S?

Use this form to: Authenticate an electronic Form 1120S, U.S. Income Tax Return for an S Corporation, Authorize the ERO, if any, to transmit via a third-party transmitter, Authorize the intermediate service provider (ISP) to transmit via a third-party transmitter if you are filing online (not using an ERO), and.

Why do I need to file 8453?

Use Form 8453 to send any required paper forms or supporting documentation listed next to the checkboxes on Form 8453 (don't send Form(s) W-2, W-2G, or 1099-R). Don't attach any form or document that isn't shown on Form 8453 next to the checkboxes.

Do I have to file 8453 s?

If you're filing a 2021 Form 1120-S through an ISP and/or transmitter and you're not using an ERO, you must file Form 8453-S with your electronically filed return. An ERO can use either Form 8453-S or Form 8879-S to obtain authorization to file the corporation's Form 1120-S.

What items are usually tax exempt?

Some items are exempt from sales and use tax, including: Sales of certain food products for human consumption (many groceries) Sales to the U.S. Government. Sales of prescription medicine and certain medical devices. Sales of items paid for with food stamps.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get SC DoR SC8822?

The premium version of pdfFiller gives you access to a huge library of fillable forms (more than 25 million fillable templates). You can download, fill out, print, and sign them all. State-specific SC DoR SC8822 and other forms will be easy to find in the library. Find the template you need and use advanced editing tools to make it your own.

Can I create an electronic signature for the SC DoR SC8822 in Chrome?

Yes. By adding the solution to your Chrome browser, you may use pdfFiller to eSign documents while also enjoying all of the PDF editor's capabilities in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a photo of your handwritten signature using the extension. Whatever option you select, you'll be able to eSign your SC DoR SC8822 in seconds.

How do I complete SC DoR SC8822 on an Android device?

On an Android device, use the pdfFiller mobile app to finish your SC DoR SC8822. The program allows you to execute all necessary document management operations, such as adding, editing, and removing text, signing, annotating, and more. You only need a smartphone and an internet connection.

What is SC DoR SC8822?

SC DoR SC8822 is a form used for reporting certain financial and tax-related information to the South Carolina Department of Revenue.

Who is required to file SC DoR SC8822?

Individuals or businesses that meet specific criteria for tax obligations in South Carolina are required to file SC DoR SC8822.

How to fill out SC DoR SC8822?

To fill out SC DoR SC8822, provide the necessary identifying information, report financial data, and follow the instructions provided on the form.

What is the purpose of SC DoR SC8822?

The purpose of SC DoR SC8822 is to ensure compliance with state tax laws and to gather necessary information for tax assessment and collection.

What information must be reported on SC DoR SC8822?

Information that must be reported includes taxpayer identification details, income figures, deductions, and other relevant financial data as required by the form.

Fill out your SC DoR SC8822 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

SC DoR sc8822 is not the form you're looking for?Search for another form here.

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.