TSP-1 2019-2025 free printable template

Get, Create, Make and Sign tsp 1 form

Editing tsp form 1 online

Uncompromising security for your PDF editing and eSignature needs

TSP-1 Form Versions

How to fill out tsp start form

How to fill out TSP-1

Who needs TSP-1?

Video instructions and help with filling out and completing tsp 1 form fillable

Instructions and Help about 1 tsp

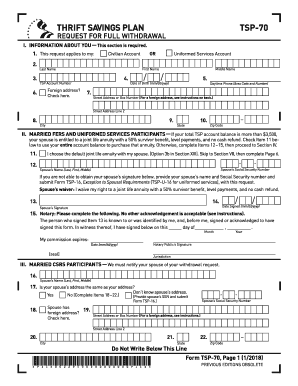

Learning how to use the TSP withdrawal forms, so I'm not going to bore you and go through every column of these forms because it's quite voluminous but let's start here with the TSP 75 this one is titled the age-based in service withdrawal requests so let's break down those words real quick what is age based age base means you are 59 and a half or older 59 and a half or older, and you're still in service, so we're gonna look at some other forms after you retire but right now we're just talking about still employed in service means still employed, so you're 59 and a half you're still employed, and you want to make this withdrawal request this is the form that you would use, and it's it's got some complications so let's walk through it, I'm going to take you to the biggest concern that you have you'll look on the screen here I'm going to put up box two which is a withdrawal request form this is the amount you are requesting so if you'll notice with this then while you're still employed you can request any amount from the TSP simply because you've reached that magic age of 59 and a half now why half I don't know I guess half the politicians wanted 59 the other half one at sixty, so they compromise to 59 and a half I don't have that's what it is what it is but when you reach that age you can put whatever amount you want on this line, and you can withdraw it now if you'll notice the very next box down it says transfer election here you can elect to transfer that withdrawal directly to an IRA or if you have a Roth TSP you can also do it to a Roth IRA if you would like and so you can check that box, and then you'll take note that a couple of pages later there is on box nine the where you can put in line twenty-twenty nine you can tell them how much or what percentage of the amount you were requesting that you want to transfer to your IRA so let me help you out you're 60 years old, and you are ready to buy that boat before you're ready to retire let's just play that game for a minute, and you need twenty thousand dollars to buy that boat you can move your TSP out decide what percentage of your TSP withdrawal needs to be put in your pocket again now they're going to withhold 20 mandatory federal withholding so gross it up by 20 or get 20 less of a boat one of the other, but there'll be tax if you've got tax deferred money that you're pulling they will send you whatever percentage you want and allow you to roll the rest of it to an IRA if you want so you can have that dual function by going through these two parts of the form okay so make sure your percentage is match they said in dollars now this is percentages when you get down to section nine you have to think through the math on that make sure it makes sense for you and you're calculating the 20 mandatory federal withholding they're going to have as well, so that's the way you can make a partial withdrawal once you've done this one time once you've used this TSP seventy-five it is no longer any good...

People Also Ask about thrift tsp1 online

What is the TSP 70 transfer form?

Are there TSP tax forms?

What form do I use for TSP transfer of assets?

What is the TSP full withdrawal form?

What is a TSP 41 form?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get fillable tsp 1 form?

Can I sign the tsp election form electronically in Chrome?

How do I fill out tsp form on an Android device?

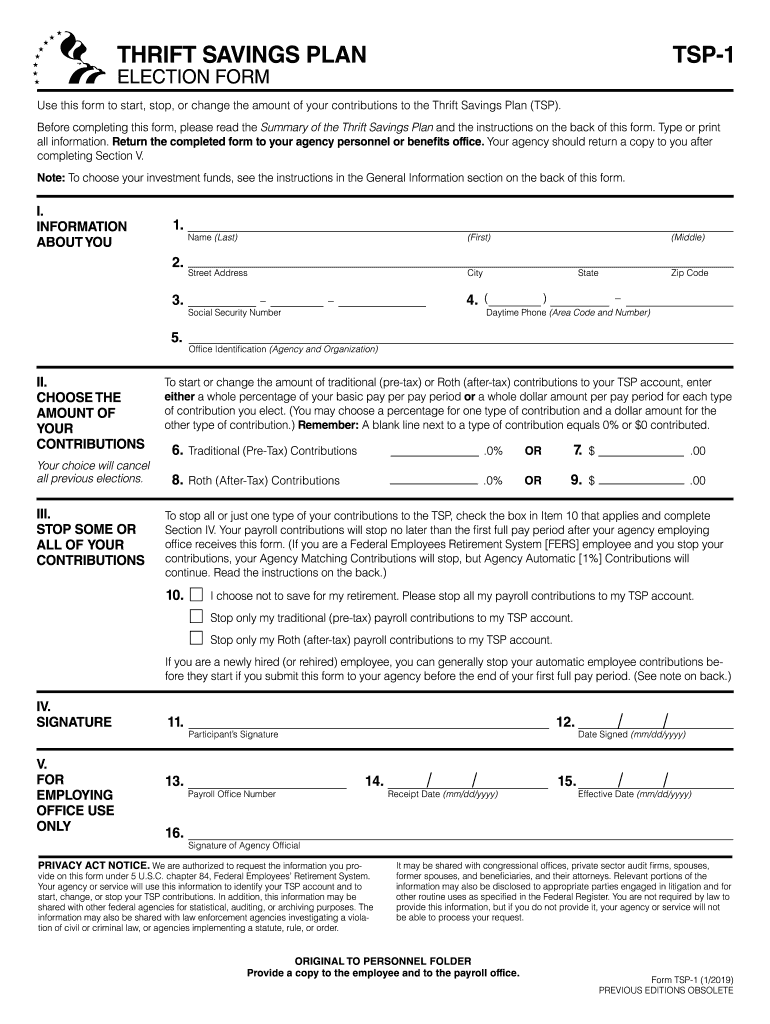

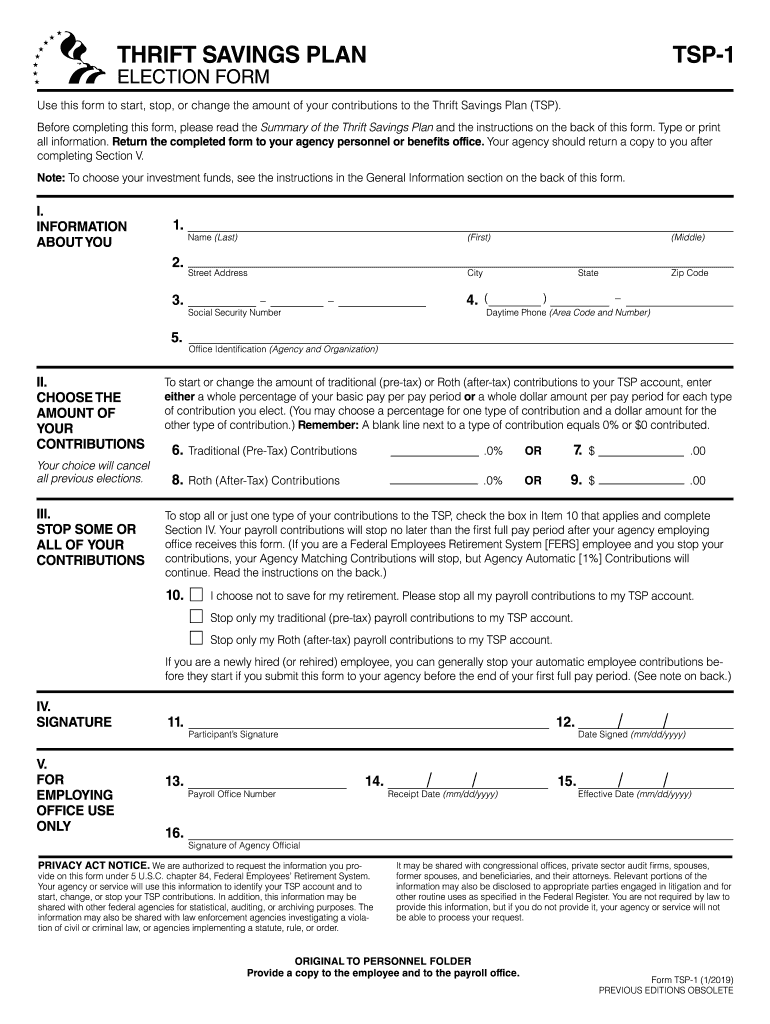

What is TSP-1?

Who is required to file TSP-1?

How to fill out TSP-1?

What is the purpose of TSP-1?

What information must be reported on TSP-1?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.