COPFCU Outgoing Wire Transfer Form 2014 free printable template

Show details

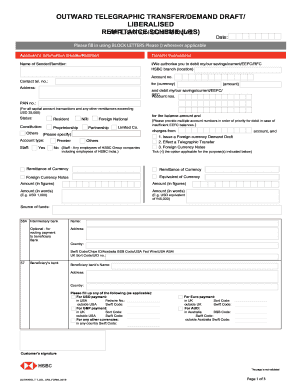

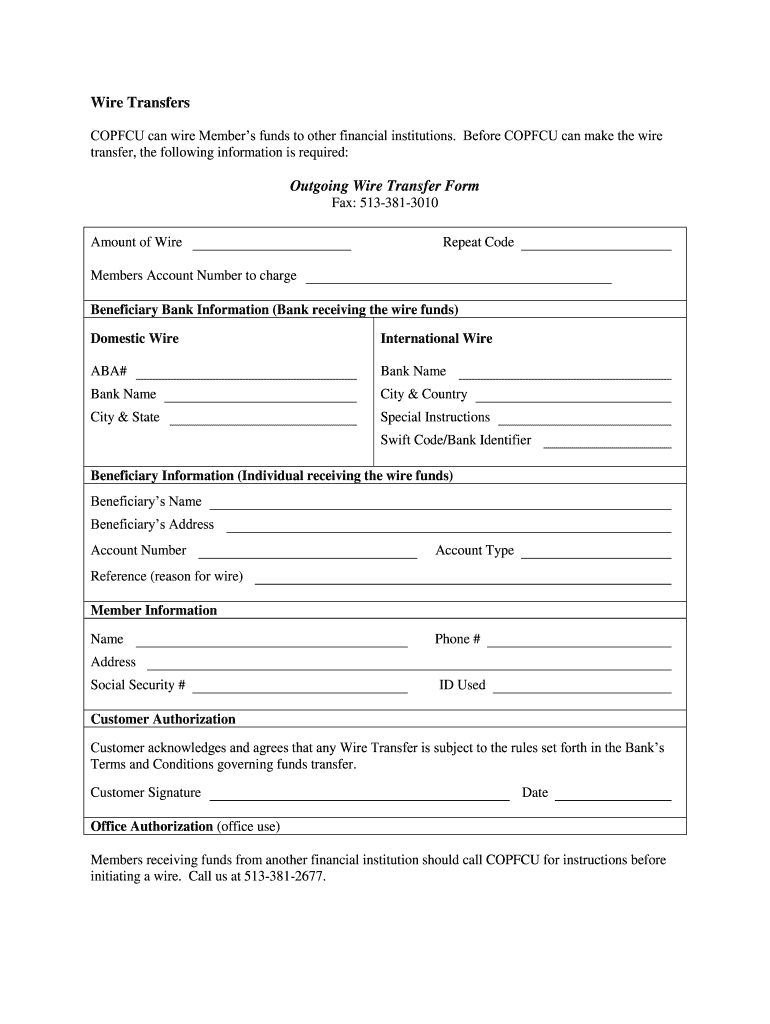

Wire Transfers CORFU can wire Member s funds to other financial institutions. Before CORFU can make the wire transfer, the following information is required: Outgoing Wire Transfer Form Fax: 513-381-3010

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign COPFCU Outgoing Wire Transfer Form

Edit your COPFCU Outgoing Wire Transfer Form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your COPFCU Outgoing Wire Transfer Form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit COPFCU Outgoing Wire Transfer Form online

To use our professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit COPFCU Outgoing Wire Transfer Form. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

It's easier to work with documents with pdfFiller than you could have believed. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

COPFCU Outgoing Wire Transfer Form Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out COPFCU Outgoing Wire Transfer Form

How to fill out COPFCU Outgoing Wire Transfer Form

01

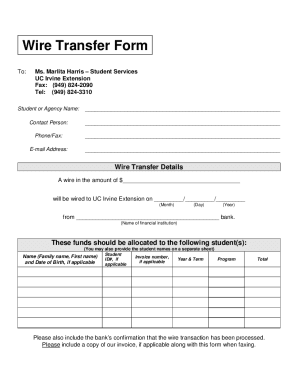

Obtain the COPFCU Outgoing Wire Transfer Form from the financial institution's website or branch.

02

Fill in your personal information, including your name, address, and account number.

03

Provide the recipient's details, including their name, address, and bank account number.

04

Input the receiving bank's information, including the bank's name, address, and routing number.

05

Specify the amount to be transferred and the currency type.

06

Review all the information for accuracy to avoid any delays or issues.

07

Sign and date the form where required.

08

Submit the completed form to the financial institution via the designated method (in-person, mail, or electronically).

Who needs COPFCU Outgoing Wire Transfer Form?

01

Individuals who wish to send money to someone else through the bank.

02

Businesses that need to make payments to suppliers or contractors via wire transfer.

03

Anyone who requires a quick and secure way to transfer funds to accounts in different banks.

Fill

form

: Try Risk Free

People Also Ask about

How do I find my bank wire instructions?

You can contact your bank to track your wire transfer, and they'll use your Federal Reference number to trace it. They'll be able to see the transactional details between your bank, the corresponding bank into which funds are being deposited, as well as identify the wire transfer's current location.

How do you write wiring instructions?

How To Set Up a Wire Transfer Recipient bank name (the bank that the money is going to) Recipient bank's American Bankers Association (ABA) routing number or other code3. Payee's account number at the bank. Any additional information you need to provide (such as further delivery instructions)

Is sending wire instructions safe?

Wire transfers are generally safe and secure, provided you know the person who's receiving them. If you use a legitimate wire transfer service, each person involved in a wire transfer transaction should be required to prove their identity so that anonymous transfers are impossible.

Is it safe to share wire instructions?

Wire transfers are quite secure, but they do carry some risks. Since wire transfers require the recipient's bank account number and a network code or SWIFT code, any errors in these numbers (such as incorrect digits) can sidetrack your transfer, or result in it being deposited into the wrong account.

How do you write wire instructions?

What Information Is Needed for International Wire Transfer? The receiver's full name. The recipient's physical address. Bank name and address. The bank account number and type (e.g., checking, savings, etc.) The bank routing number. The amount of money being transferred. The reason you're transferring the funds.

How do you verbally confirm wire instructions?

You should verify wiring instructions directly with the payee, preferably by phone, using contact information that is known and reliable. Staff should also verify the bank routing number is correct, and that the bank's location is consistent with where you intend to send the wire.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for the COPFCU Outgoing Wire Transfer Form in Chrome?

Yes, you can. With pdfFiller, you not only get a feature-rich PDF editor and fillable form builder but a powerful e-signature solution that you can add directly to your Chrome browser. Using our extension, you can create your legally-binding eSignature by typing, drawing, or capturing a photo of your signature using your webcam. Choose whichever method you prefer and eSign your COPFCU Outgoing Wire Transfer Form in minutes.

How can I edit COPFCU Outgoing Wire Transfer Form on a smartphone?

You may do so effortlessly with pdfFiller's iOS and Android apps, which are available in the Apple Store and Google Play Store, respectively. You may also obtain the program from our website: https://edit-pdf-ios-android.pdffiller.com/. Open the application, sign in, and begin editing COPFCU Outgoing Wire Transfer Form right away.

How do I fill out COPFCU Outgoing Wire Transfer Form using my mobile device?

The pdfFiller mobile app makes it simple to design and fill out legal paperwork. Complete and sign COPFCU Outgoing Wire Transfer Form and other papers using the app. Visit pdfFiller's website to learn more about the PDF editor's features.

What is COPFCU Outgoing Wire Transfer Form?

The COPFCU Outgoing Wire Transfer Form is a document used by members of the Credit Union to authorize the transfer of funds from their account to another financial institution.

Who is required to file COPFCU Outgoing Wire Transfer Form?

Any member of COPFCU who wishes to initiate an outgoing wire transfer is required to file the COPFCU Outgoing Wire Transfer Form.

How to fill out COPFCU Outgoing Wire Transfer Form?

To fill out the COPFCU Outgoing Wire Transfer Form, provide your account details, the recipient's name and account information, the amount to be transferred, and any relevant instructions as required by the form.

What is the purpose of COPFCU Outgoing Wire Transfer Form?

The purpose of the COPFCU Outgoing Wire Transfer Form is to ensure that fund transfers are authorized and accurately processed according to the member's instructions.

What information must be reported on COPFCU Outgoing Wire Transfer Form?

The information that must be reported on the COPFCU Outgoing Wire Transfer Form includes the member's account number, recipient's name, recipient's account number, recipient's bank details, the amount to be transferred, and any necessary routing numbers.

Fill out your COPFCU Outgoing Wire Transfer Form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

COPFCU Outgoing Wire Transfer Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.