SG DBS Self Certification on Usa Citizenship/Tax Residency Status 2014 free printable template

Show details

SELF CERTIFICATION ON US CITIZENSHIP/TAX RESIDENCY STATUS Individuals Only Customer s Particulars Name (as in ERIC/Passport) : ERIC/Passport No : Country of Issue : Address : Postcode : State : Country

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign go dbs com sg

Edit your go dbs com sg form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your go dbs com sg form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit go dbs com sg online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Log in to your account. Start Free Trial and sign up a profile if you don't have one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit go dbs com sg. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, it's always easy to deal with documents. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

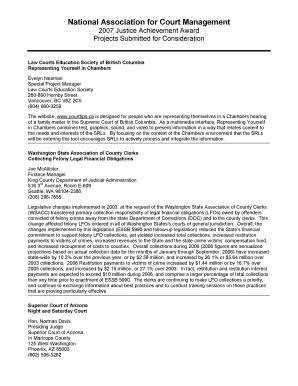

SG DBS Self Certification on Usa Citizenship/Tax Residency Status Form Versions

Version

Form Popularity

Fillable & printabley

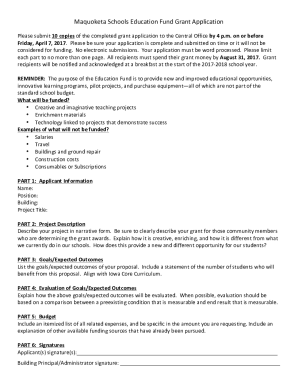

How to fill out go dbs com sg

How to fill out SG DBS Self Certification on Usa Citizenship/Tax Residency

01

Obtain the SG DBS Self Certification form from the relevant authority or website.

02

Start filling out your personal information, including your name, address, and date of birth.

03

Indicate your citizenship status by checking the appropriate box for USA citizenship or tax residency.

04

Provide any additional information required concerning your tax residency status, if applicable.

05

Review your completed form for accuracy and completeness.

06

Sign and date the form to certify that all the information provided is true.

07

Submit the completed form to the appropriate entity as instructed.

Who needs SG DBS Self Certification on Usa Citizenship/Tax Residency?

01

Any individual or entity that is a USA citizen or taxpayer and needs to certify their residency status for regulatory or compliance purposes.

Fill

form

: Try Risk Free

People Also Ask about

How do I speak to customer service at DBS?

Contact Us DBS BusinessCare. 1800 222 2200 (in Singapore) / +65 6222 2200 (Overseas) 8:30am to 8:30pm.

How do I contact DBS from overseas?

Alternatively, you may call our Customer Service Centre at 1800 339 6963 or (65) 6339 6963 from overseas.

What is tax residence status?

To qualify for the tax residency status, you should either have: Physically stayed and worked in Singapore for a minimum of 183 days in the preceding calendar year.

Is US My country of tax residence?

As a general matter, under the U.S. Internal Revenue Code (Code), all U.S. citizens and U.S. residents are treated as U.S. tax residents. In order for a non-U.S. citizen (alien individual) to be treated as a resident alien, he or she must satisfy either the “green card test” or the substantial presence test.

Why is my bank sending me a tax residency?

Why are you receiving this letter? The letter is intended to fulfill the bank's due diligence obligations under both the OECD Common Reporting Standard (all countries of “tax residence” except the United States) and FATCA (whether you are a “tax resident” of the United States).

Can I use DBS App overseas?

Enable your Card for overseas usage to transact and withdraw foreign currency overseas. Avoid foreign exchange and debit card fees by using a DBS Visa Debit Card linked to any of our multi-currency accounts (e.g. My Account or Multiplier). Enable Card For Overseas Use.

How do I change my DBS tax residency status?

You can also update your tax residence status via: Upon completion of form, you can: DBS Public Web: Visit our DBS website > "Digital Services" > "Banking at your convenience" > “Self Certification on Tax Residency Status”. Present the completed form and your NRIC/Passport for verification.

What determines tax residency of Singapore?

Individuals who are physically present or who exercise an employment (other than as a director of a company) in Singapore for 183 days or more during the year preceding the year of assessment are treated as residents for that year of assessment.

How do I change my fiscal residency?

In order to change your tax residency status, there are a few things you must do. The first is to move out of your previous home. Next, establish a home in a foreign country. And finally, cut all financial and legal ties to your previous state of residence.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit go dbs com sg from Google Drive?

By integrating pdfFiller with Google Docs, you can streamline your document workflows and produce fillable forms that can be stored directly in Google Drive. Using the connection, you will be able to create, change, and eSign documents, including go dbs com sg, all without having to leave Google Drive. Add pdfFiller's features to Google Drive and you'll be able to handle your documents more effectively from any device with an internet connection.

How do I fill out the go dbs com sg form on my smartphone?

The pdfFiller mobile app makes it simple to design and fill out legal paperwork. Complete and sign go dbs com sg and other papers using the app. Visit pdfFiller's website to learn more about the PDF editor's features.

How can I fill out go dbs com sg on an iOS device?

Get and install the pdfFiller application for iOS. Next, open the app and log in or create an account to get access to all of the solution’s editing features. To open your go dbs com sg, upload it from your device or cloud storage, or enter the document URL. After you complete all of the required fields within the document and eSign it (if that is needed), you can save it or share it with others.

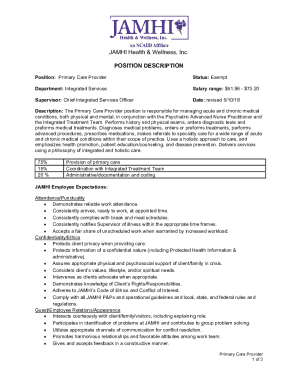

What is SG DBS Self Certification on USA Citizenship/Tax Residency?

SG DBS Self Certification on USA Citizenship/Tax Residency is a document required by Singapore's DBS Bank to collect information from customers regarding their citizenship and tax residency status in the United States. It ensures compliance with international tax regulations.

Who is required to file SG DBS Self Certification on USA Citizenship/Tax Residency?

Individuals who are US citizens or US tax residents, as well as entities with US control or ties, are required to file the SG DBS Self Certification on USA Citizenship/Tax Residency.

How to fill out SG DBS Self Certification on USA Citizenship/Tax Residency?

To fill out the SG DBS Self Certification, individuals need to provide their personal information, including name, address, date of birth, and details about their US citizenship or tax residency. Specific guidelines and sections must be completed as per the form's instructions.

What is the purpose of SG DBS Self Certification on USA Citizenship/Tax Residency?

The purpose of the SG DBS Self Certification is to help DBS Bank comply with US tax laws and regulations, particularly the Foreign Account Tax Compliance Act (FATCA), by identifying US persons and reporting their financial accounts.

What information must be reported on SG DBS Self Certification on USA Citizenship/Tax Residency?

The information that must be reported includes the individual's name, tax identification number (TIN), date of birth, address, and details regarding their US citizenship or residency status.

Fill out your go dbs com sg online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Go Dbs Com Sg is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.