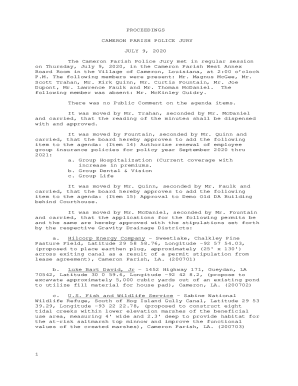

HowToGYST Dave Ramseys Baby Steps 2018-2026 free printable template

Show details

This document outlines Dave Ramsey's baby steps for achieving financial stability, including saving for emergencies, paying off debt, and investing for retirement.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign dave ramsey baby steps pdf download form

Edit your dave ramsey baby steps pdf form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your dave ramsey baby steps worksheet form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit pdffiller online

Use the instructions below to start using our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit dave ramsey baby steps printable form. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out ramsey baby steps pdf form

How to fill out HowToGYST Dave Ramseys Baby Steps

01

Step 1: Save $1,000 for a starter emergency fund.

02

Step 2: List all debts from smallest to largest.

03

Step 3: Focus on paying off the smallest debt first while making minimum payments on others.

04

Step 4: Once the smallest debt is paid off, move to the next smallest and repeat the process.

05

Step 5: After all debts are cleared, save 3 to 6 months of expenses in a fully funded emergency fund.

06

Step 6: Invest 15% of your household income into retirement accounts.

07

Step 7: Save for your children's college education.

08

Step 8: Pay off your mortgage early.

09

Step 9: Build wealth and give generously.

Who needs HowToGYST Dave Ramseys Baby Steps?

01

Individuals looking to create a structured plan for financial stability.

02

Families wanting to get out of debt methodically.

03

Anyone interested in saving for emergencies and retirement.

04

People who want a clear roadmap for financial success.

Fill

what are dave ramsey's baby steps

: Try Risk Free

People Also Ask about

What is baby Step 3 on Dave Ramsey's plan?

Baby Step 3: Save 3–6 Months of Expenses in a Fully Funded Emergency Fund. You've paid off your debt! Don't slow down now. Take that money you were throwing at your debt and build a fully funded emergency fund that covers 3–6 months of your expenses.

How long does it take to complete Dave Ramsey baby steps?

It typically takes about six months to save up a fully-funded emergency fund once you've completed Baby Steps 1 and 2—as long as you don't fall into the same spending habits that got you into debt in the first place.

What are the 7 baby steps of Dave Ramsey?

You can too! Save $1,000 for Your Starter Emergency Fund. Pay Off All Debt (Except the House) Using the Debt Snowball. Save 3–6 Months of Expenses in a Fully Funded Emergency Fund. Invest 15% of Your Household Income in Retirement. Save for Your Children's College Fund. Pay Off Your Home Early. Build Wealth and Give.

What to do after 7 baby steps?

What Comes After the 7 Baby Steps? Save $1,000 for your starter emergency fund. Pay off all debt (except the house) using the debt snowball. Save 3–6 months of expenses in a fully funded emergency fund. Invest 15% of your household income in retirement. Save for your children's college fund. Pay off your home early.

What is baby step 1 Ramsey?

BABY STEP 1 – Save $1,000 to start an emergency fund. BABY STEP 2 – Pay off all debt using the debt snowball method. BABY STEP 3 – Save 3 to 6 months of expenses for emergencies. BABY STEP 4 – Invest 15% of your household income into Roth IRAs and pre-tax retirement funds.

When following the 7 baby steps what is step 1?

Baby Step 1: Save $1,000 for Your Starter Emergency Fund In this first step, your goal is to save $1,000 as fast as you can. Your emergency fund will cover those unexpected life events you can't plan for. And there are plenty of them. You don't want to dig a deeper hole while you're trying to work your way out of debt!

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my HowToGYST Dave Ramseys Baby Steps in Gmail?

It's easy to use pdfFiller's Gmail add-on to make and edit your HowToGYST Dave Ramseys Baby Steps and any other documents you get right in your email. You can also eSign them. Take a look at the Google Workspace Marketplace and get pdfFiller for Gmail. Get rid of the time-consuming steps and easily manage your documents and eSignatures with the help of an app.

How do I edit HowToGYST Dave Ramseys Baby Steps straight from my smartphone?

You may do so effortlessly with pdfFiller's iOS and Android apps, which are available in the Apple Store and Google Play Store, respectively. You may also obtain the program from our website: https://edit-pdf-ios-android.pdffiller.com/. Open the application, sign in, and begin editing HowToGYST Dave Ramseys Baby Steps right away.

How do I edit HowToGYST Dave Ramseys Baby Steps on an iOS device?

You can. Using the pdfFiller iOS app, you can edit, distribute, and sign HowToGYST Dave Ramseys Baby Steps. Install it in seconds at the Apple Store. The app is free, but you must register to buy a subscription or start a free trial.

What is HowToGYST Dave Ramseys Baby Steps?

Dave Ramsey's Baby Steps are a series of seven financial steps designed to help individuals achieve financial stability and independence. The steps include building an emergency fund, paying off debt, and investing for retirement.

Who is required to file HowToGYST Dave Ramseys Baby Steps?

Anyone seeking to improve their financial situation and gain control over their money can follow Dave Ramsey's Baby Steps, regardless of their income level or financial background.

How to fill out HowToGYST Dave Ramseys Baby Steps?

To fill out the Baby Steps, individuals should first evaluate their current financial situation, set achievable goals for each step, and systematically work through each step while tracking their progress.

What is the purpose of HowToGYST Dave Ramseys Baby Steps?

The purpose of Dave Ramsey's Baby Steps is to provide a clear, easy-to-follow plan for managing money, eliminating debt, and building wealth over time.

What information must be reported on HowToGYST Dave Ramseys Baby Steps?

Individuals following the Baby Steps should report their income, expenses, debt amounts, and savings to evaluate their progress through the steps and make necessary adjustments to their plans.

Fill out your HowToGYST Dave Ramseys Baby Steps online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

HowToGYST Dave Ramseys Baby Steps is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.