PH BIR 1702-EX 2018-2025 free printable template

Show details

Republic of the Philippines Department of Finance Bureau of Internal Revenuer BIR BCS/ Use Only: Item:Annual Income Tax Return BIR Form No.1702EX January 2018 (ENDS) Page 1Corporation, Partnership

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign philippines 1702 ex fillable form

Edit your bir 1702 form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your bir form 1702 return revenue download form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit ph bir form 1702 ex annual income online

Follow the steps down below to take advantage of the professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit bir form 1702 annual income print. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

PH BIR 1702-EX Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out form 1702

How to fill out PH BIR 1702-EX

01

Obtain a copy of the PH BIR 1702-EX form from the Bureau of Internal Revenue (BIR) website or your local BIR office.

02

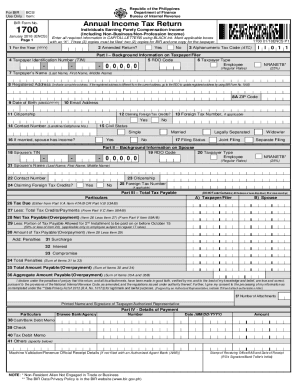

Fill in the Taxpayer Identification Number (TIN) at the top of the form.

03

Provide the necessary details in Part I, such as the name, address, and contact information of the taxpayer.

04

In Part II, declare the income earned for the taxable period, specifying the type of income.

05

Complete Part III by detailing the deductions and taxable income.

06

Calculate the tax due in Part IV and ensure to provide the correct amount.

07

Sign and date the form to certify that the information provided is true and accurate.

08

Submit the filled-out form to the BIR office, or file it online if available.

Who needs PH BIR 1702-EX?

01

Individuals, partnerships, and corporations earning income that are exempt from income tax under specific provisions.

02

Taxpayers who earned income exclusively from business activities not exceeding the prescribed threshold.

03

Entities required to file tax returns but eligible for a simplified form due to their income classification.

Fill

1702 form

: Try Risk Free

People Also Ask about bir 1702 ex

What is BIR 1702mx?

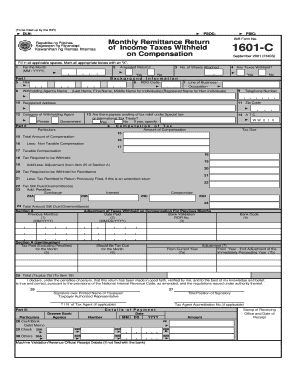

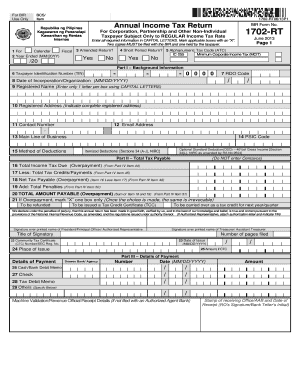

Annual Income Tax Return For Corporation, Partnership and Other Non-Individual.

What is Form 1702?

BIR form 1702-RT, or also known as Annual Income Tax Return for Corporation, Partnership and Other Non-Individual Taxpayer Subject Only to REGULAR Income Tax Rate is a tax form which is filed by non-individual taxpayers whose earnings are subject to income tax rate of 30%.

What is the purpose of BIR Form 1702-EX?

BIR Form 1702-EX is an Annual Income Tax Return for Corporations, Partnership, and Other Non-Individual Taxpayer EXEMPT.

What is the difference between 1702mx and 1702rt?

Form 1702-RT should be used by taxpayers who only have one source of income which is subject to regular tax rate of 30%. On the other hand, Form 1702-MX should be used by taxpayers who have multiple sources of income which are subjected to different tax rates or with income subject to special/preferential rates.

What is the difference between 1702 and 1702Q?

Form 1702Q – Quarterly Income Tax Return for Corporations, Partnerships, and other Non-Individual Taxpayers. Form 1702-EX – Annual Income Tax Return for Corporation, Partnership, and Other Non-Individual Taxpayer EXEMPT under the Tax Code, as Amended, [Sec. 30 and those exempted in Sec.

What is the form of income tax return?

ITR-7 ITR FormApplicable toExempt IncomeITR-3Individual or HUF, partner in a FirmYesITR-4Individual, HUF, FirmYes (Agricultural Income less than Rs 5,000)ITR-5Partnership Firm/ LLPYesITR-6CompanyYes3 more rows • 7 days ago

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for the 1702 ex form in Chrome?

You certainly can. You get not just a feature-rich PDF editor and fillable form builder with pdfFiller, but also a robust e-signature solution that you can add right to your Chrome browser. You may use our addon to produce a legally enforceable eSignature by typing, sketching, or photographing your signature with your webcam. Choose your preferred method and eSign your form 1702 ex in minutes.

How can I fill out bir tax return bureau internal revenue form on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. Create an account or log in if you already have one. After registering, upload your form 1702 form. You may now use pdfFiller's advanced features like adding fillable fields and eSigning documents from any device, anywhere.

How do I fill out 1702 ex on an Android device?

Use the pdfFiller mobile app to complete your ex 1702 on an Android device. The application makes it possible to perform all needed document management manipulations, like adding, editing, and removing text, signing, annotating, and more. All you need is your smartphone and an internet connection.

What is PH BIR 1702-EX?

PH BIR 1702-EX is a tax form used in the Philippines for the annual income tax return of corporations and other juridical entities that are exempt from income tax under specific laws.

Who is required to file PH BIR 1702-EX?

Corporations and other juridical entities that are exempt from paying income tax, such as non-profit organizations, must file PH BIR 1702-EX.

How to fill out PH BIR 1702-EX?

To fill out PH BIR 1702-EX, taxpayers must provide required information such as entity details, income, deductions, adjustments, and additional information relevant to the exemption qualifications.

What is the purpose of PH BIR 1702-EX?

The purpose of PH BIR 1702-EX is to report the income and financial activities of tax-exempt entities to the Bureau of Internal Revenue and to comply with government regulations.

What information must be reported on PH BIR 1702-EX?

The information that must be reported on PH BIR 1702-EX includes the name and address of the organization, the nature of operations, income received, and expenses incurred during the tax year.

Fill out your bir 1702 2018-2025 form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Bir Income Internal Revenue Form is not the form you're looking for?Search for another form here.

Keywords relevant to bir income tax internal revenue form

Related to bir form 1702 revenue online

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.