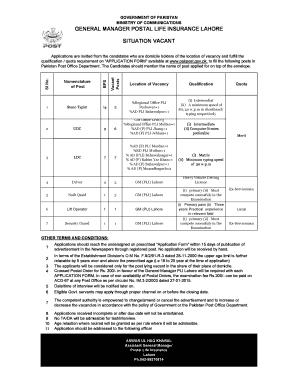

Get the free postal life insurance pakistan deposit slip

Fill out, sign, and share forms from a single PDF platform

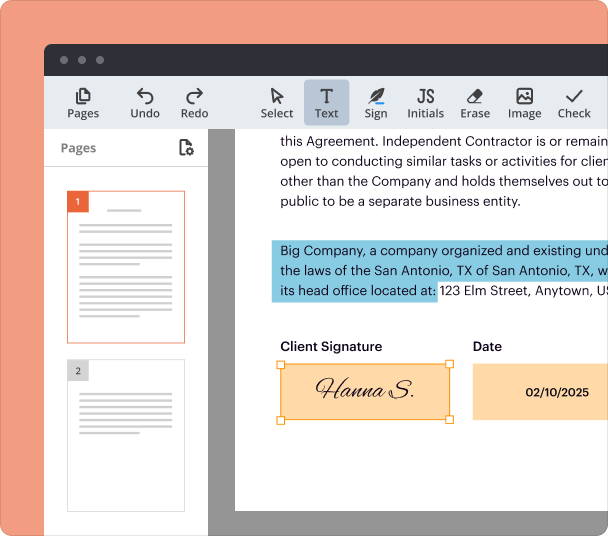

Edit and sign in one place

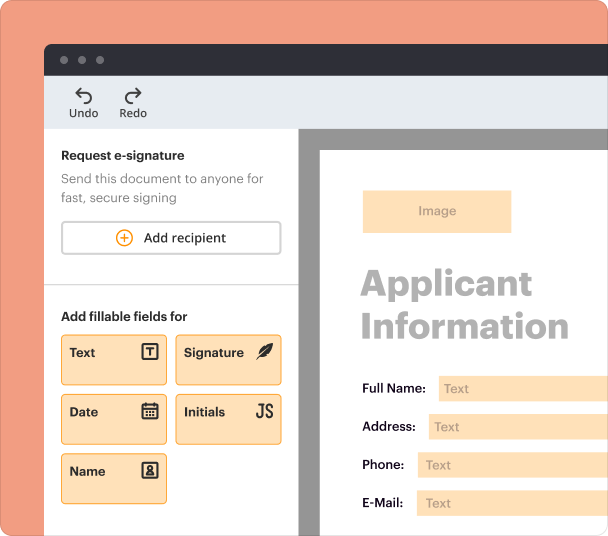

Create professional forms

Simplify data collection

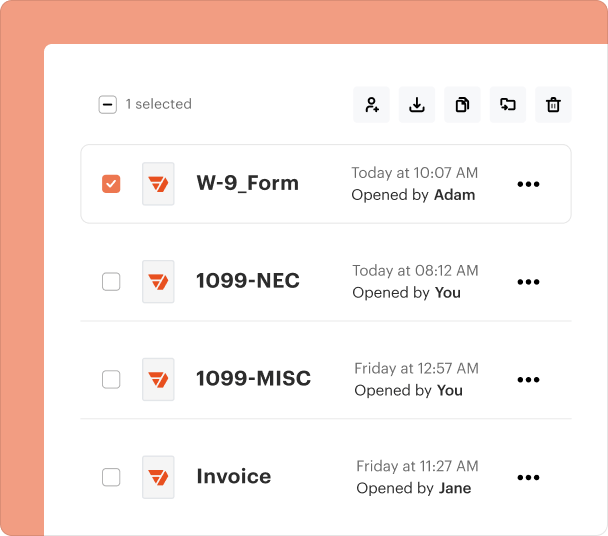

Manage forms centrally

Why pdfFiller is the best tool for your documents and forms

End-to-end document management

Accessible from anywhere

Secure and compliant

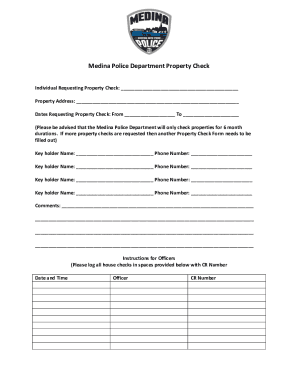

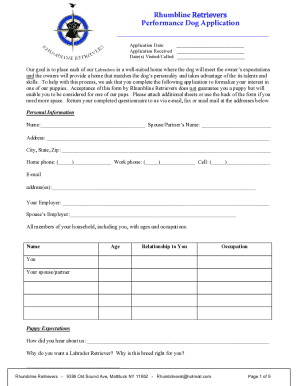

How to fill out the postal life insurance deposit form

What is postal life insurance?

Postal Life Insurance (PLI) refers to life insurance products offered by postal services, aimed at providing financial security to policyholders. Understanding the basics of PLI is essential for anyone considering a loan against their policy. It is particularly important as loans can be a vital source of immediate funds during emergencies.

Why consider loans against PLI policies?

Loans against Postal Life Insurance policies allow policyholders to access funds without having to surrender their life insurance coverage. These loans can be used for various purposes, such as education, medical expenses, or home renovations, providing flexibility while maintaining financial protection.

Who is eligible to apply for a loan?

Eligibility criteria typically include a valid postal life insurance policy, meeting age requirements, and being current on premium payments. It's crucial to review your specific policy terms to ensure you meet these conditions before applying for a loan.

How does the postal life insurance loan application form work?

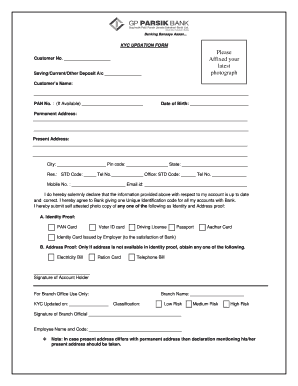

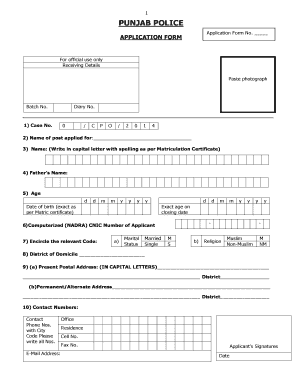

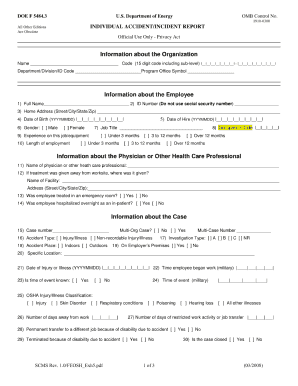

The loan application form is a crucial document that needs to be filled out accurately to ensure your request is processed smoothly. Understanding the key fields and how to navigate the form will mitigate the chances of delays or rejections.

What are the key fields in the application form?

-

This identifies your specific insurance policy.

-

Including your name, address, and contact details.

-

Clearly state how much you wish to borrow.

-

Detail your reasons for requesting the loan.

How to fill out the loan application step-by-step

Filling out the loan application successfully involves several key steps. From specifying your policy number to clearly articulating the purpose of the loan, each entry holds significance in the approval process.

-

This is crucial; it ensures your application is connected to the correct insurance policy.

-

Fill in your current details accurately to avoid potential mismatches.

-

Request a sensible loan amount which you can repay comfortably.

-

Choose a branch that is most convenient for you to submit the form.

What common mistakes should you avoid?

Many applicants make mistakes, such as incorrect personal details or failing to attach requisite documents. These errors can lead to unnecessary delays and may even result in rejection of your application.

How to submit your loan application form

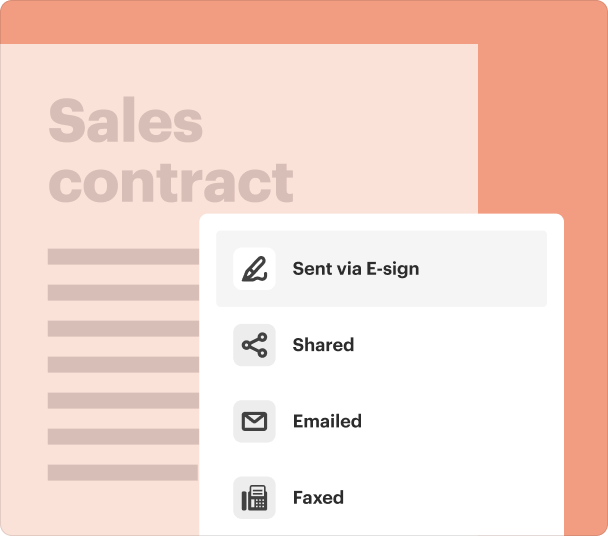

Once you have completed the form, submission is key. You can submit your application at designated post offices or via online channels, depending on your region’s services.

What happens after you submit your application?

Upon submission, your application will undergo a review process, which generally takes a few weeks. Various factors influence approval time, including completeness of documentation and loan amount requested.

How to manage your loan after approval

After your loan is approved, it is essential to follow a set repayment schedule. Keeping track of your payments can help you avoid penalties and maintain a good credit standing.

How can pdfFiller assist you in this process?

pdfFiller provides tools to streamline your experience, enabling easy editing and electronic signing of your application. Its collaborative features allow teams to manage multiple applications effectively, aligning perfectly with our positioning statement that pdfFiller empowers users to seamlessly edit PDFs, eSign, collaborate, and manage documents from a single, cloud-based platform.

-

Easily modify your application form as necessary.

-

No more hassle with physical signatures.

-

Keep track of your submissions and manage documents on a cloud platform.

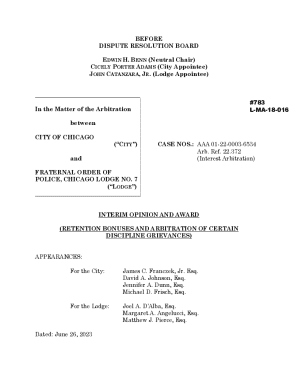

Know your rights and resources

It’s crucial to understand the regulations governing postal life insurance in Pakistan. Policyholders have specific rights when applying for loans, which includes the right to access consumer protection resources.

-

Be aware of the laws regulating insurance in your region.

-

Understand your rights throughout the application and loan management process.

-

Know who to contact should you face issues during your loan application.

Frequently Asked Questions about postal life insurance deposit slip download pdf download form

What documents do I need to apply for a loan?

You typically need to provide your postal life insurance policy document, proof of identity, and any other required supporting documents as specified by the post office.

Can I apply for a loan online?

Yes, many postal services offer online applications for loans against life insurance policies, which can streamline the process.

How long does it take to get loan approval?

The approval process can vary, but it generally takes a few weeks depending on the completeness of your application and supporting documents.

What should I do if my application is rejected?

If your loan application is rejected, review the reason given, correct any mistakes, and consider reapplying with the necessary adjustments.

Can I request a larger loan amount later?

Once a loan is approved, you can apply for a larger amount later but will have to undergo a new application process.

pdfFiller scores top ratings on review platforms