Canada MCAP Gift Letter 2001-2025 free printable template

Get, Create, Make and Sign gift letter template canada

How to edit gift letter template canada online

Uncompromising security for your PDF editing and eSignature needs

How to fill out gift letter template canada

How to fill out Canada MCAP Gift Letter

Who needs Canada MCAP Gift Letter?

Instructions and Help about gift letter template canada

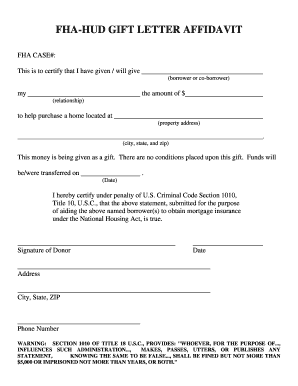

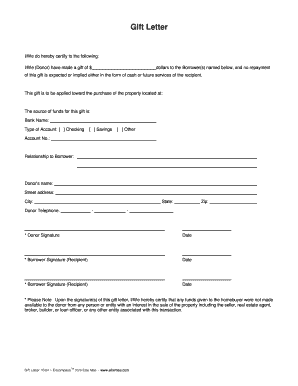

Gift funds What are they How much can you get Gift funds when looking to purchase a homeland you're getting a loan That's the topic of our video today I'm here with Sean Lennon Sean why don't you introduce yourself a din 30 seconds or less tell the people a little about who you are My name is Sean Lennon I'm a Partner home Savings & Trust Mortgage We're an in-house mortgage bank local Fairfax VA We've been working with Matt and the Evangeline Condo team for a while, and I'm happy to be here today to help you all out with some more information on the ugly part the buying process the financing part of things Yeah so let's get right into it and let'dive into it because a lot of times relatives parents whoever want to help out and arable and lucky enough to be able to provide gift funds when a relative is looking to buy house First of all what are gift funds and how much can you gift That's an answer that can go down a lot of roads Gift funds are if you are lucky enough Mohave a family member able to provide you money to go toward the down payment and closing costs of your real estate transaction we can use those to help supplement the financing needs There are rules there are limits there pretax implications that we will need to consider But gift funds a lot of times the person buying the home doesn't have all the liquid money needed to purchase it and gift fund scan come in very handy if you have the opportunity to get them So let's say I'm buying a house and one of my parents wants to give me call it 50000 That'd be awesome right it would never happen It's not going to So let's say I'm buying a house and a family member wants to give me money Very overall 1000 feet bird's eye view how would they go about doing that and what sort of paper trail do you all need Paper trail is key All of this has to be verified and sourced You'll probably hear your lender refer a lotto sourcing money Deposits transfers gift funds We need to be able to see a paper trail of where that came from What that means to you is that when you receive that money from your Dad we need it to be in the form of check or wire transfer Ugly word is cash We can't accept cash We can't prove where cash came from Your parent or relative will also have cosigned a gift letter form notifying that this is a gift and not a loan Now there are tax implications that could be involved with that, so it's important to understand tax laws and how it could impact you There are ways creative ways to get around that What would be an example of a tax law or would that be diving too deep into it, I'll have to give the disclaimer that I am not an accountant so make sure you consult with one if you are worried about this Right now the limit that can't be taxed is14000 And if they go over that I'm getting 14001Uncle Sam knows about that taking their cut what happens at that point Well it's supposed to be self-reported So yeah consult your tax accountant about that and things of that nature Whoever you are...

People Also Ask about

How do you write a proof of gift letter?

How do you write a gift declaration?

What is a gift letter for mortgage Canada?

Is a gift letter a legal document?

What is a gift letter Canada?

Our user reviews speak for themselves

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my gift letter template canada directly from Gmail?

How do I complete gift letter template canada online?

Can I create an eSignature for the gift letter template canada in Gmail?

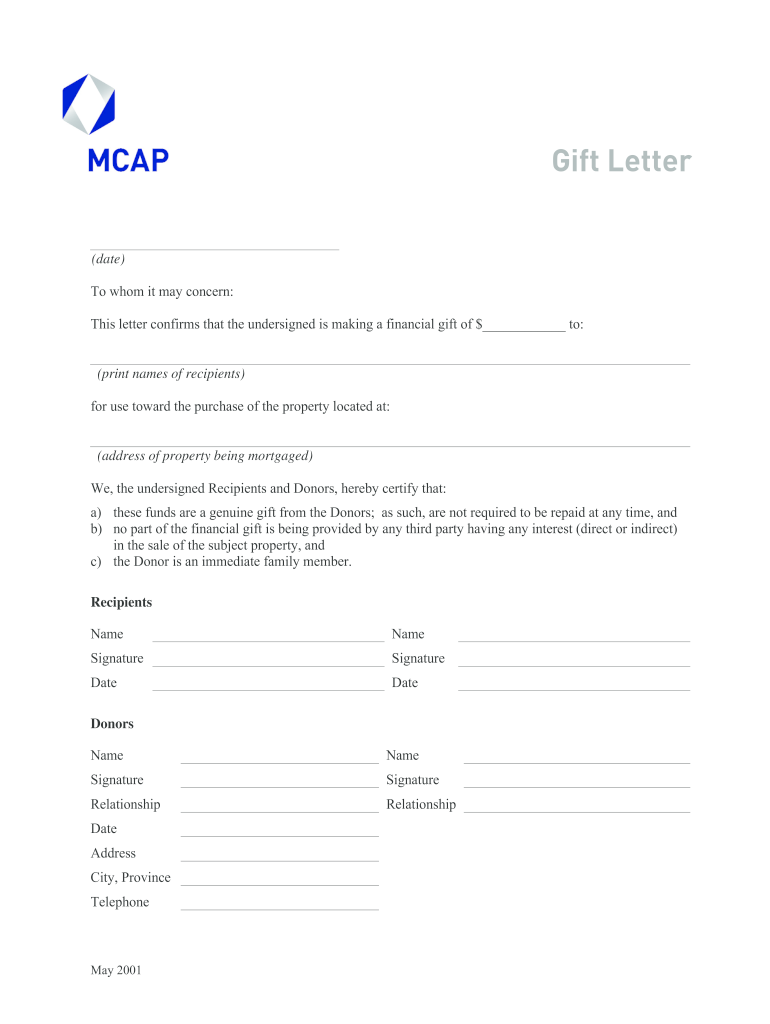

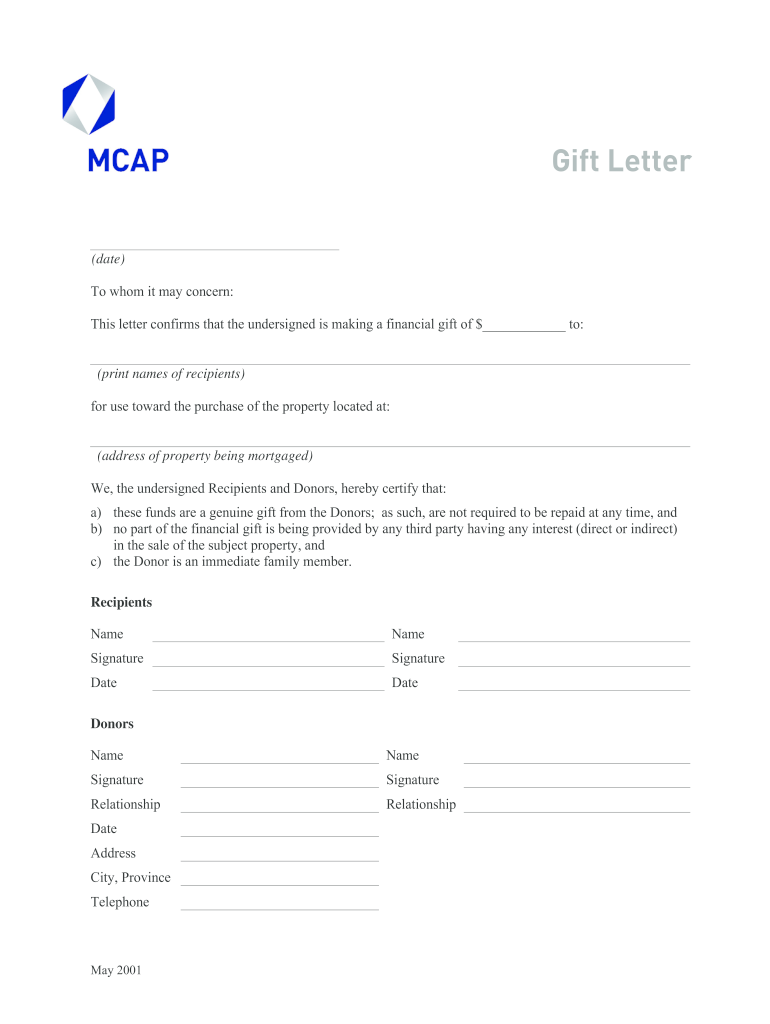

What is Canada MCAP Gift Letter?

Who is required to file Canada MCAP Gift Letter?

How to fill out Canada MCAP Gift Letter?

What is the purpose of Canada MCAP Gift Letter?

What information must be reported on Canada MCAP Gift Letter?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.