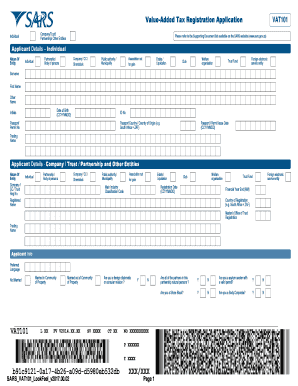

ZA SARS VAT101 2014 free printable template

Show details

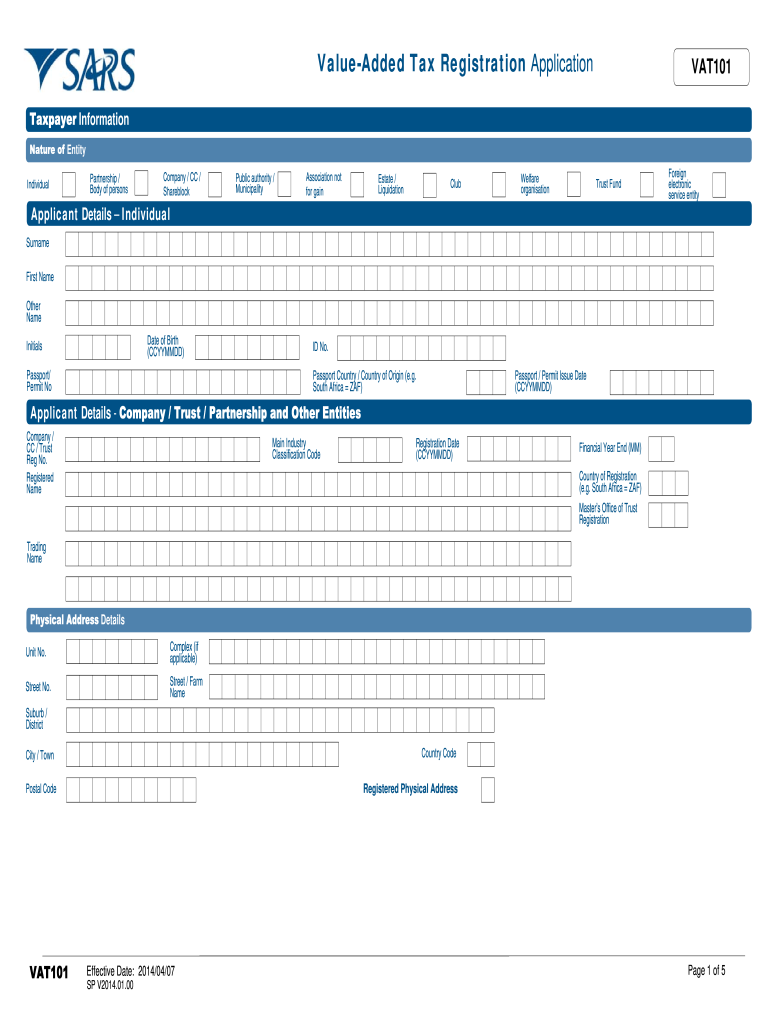

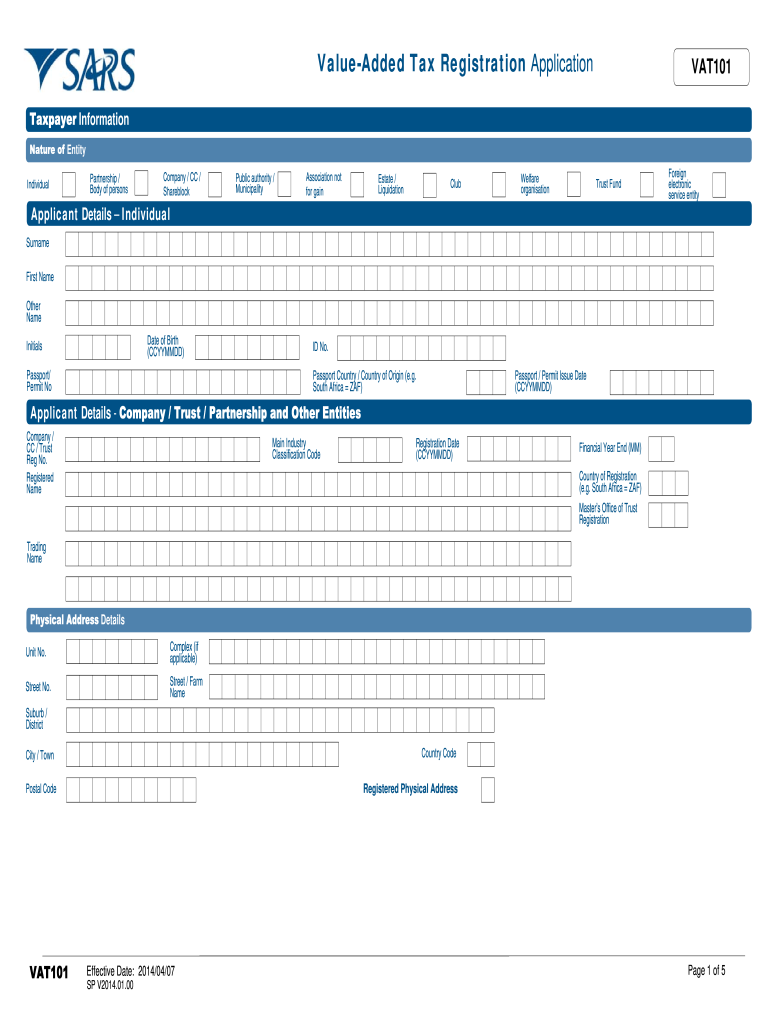

Value-Added Tax Registration Application VAT101 Information Entity Individual Partnership / Body of persons Company / CC / Shareblock Public authority / Municipality Association not for gain Estate / Liquidation Club Welfare organisation Trust Fund Applicant Details Individual Foreign electronic service entity Surname First Name Other Name Date of Birth CCYYMMDD Initials Passport/ Permit No ID No. Passport Country / Country of Origin e.g. South Africa ZAF Passport / Permit Issue Date CC /...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign ZA SARS VAT101

Edit your ZA SARS VAT101 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your ZA SARS VAT101 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit ZA SARS VAT101 online

Follow the steps below to take advantage of the professional PDF editor:

1

Log in to your account. Start Free Trial and register a profile if you don't have one yet.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit ZA SARS VAT101. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

ZA SARS VAT101 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out ZA SARS VAT101

How to fill out ZA SARS VAT101

01

Obtain the ZA SARS VAT101 form from the SARS website or your nearest SARS office.

02

Fill in your personal details, including your name, address, and VAT registration number.

03

Specify the tax period for which you are submitting the VAT101.

04

Indicate the total amount of VAT output and input (tax charged and claimed) for the period.

05

Calculate the difference between the VAT output and input to determine if you owe money or will receive a refund.

06

Provide detailed information about your sales, purchases, and any adjustments in the respective sections.

07

Review all the information for accuracy before submitting the form.

08

Submit the completed VAT101 form electronically via the SARS e-filing system or in person at a SARS branch.

Who needs ZA SARS VAT101?

01

All individuals and businesses that are registered for VAT in South Africa need to complete the ZA SARS VAT101 form.

02

This includes vendors who must declare their VAT liabilities or refunds for a specific tax period.

Fill

form

: Try Risk Free

People Also Ask about

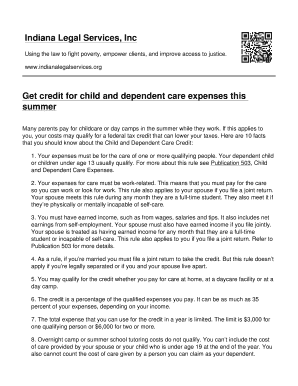

Is a VAT number the same as a tax ID?

When you register for VAT in a single country, you receive this identifier for their system. We'll cover what exactly it's used for in a section below. Important note: This is not the same as a local tax number or tax ID. A VAT number is exclusively for the Value-Added Tax scheme.

What is a VAT form?

A VAT form is a document that you can use on the economy to receive tax relief on purchases. The amount of tax relief varies from store to store and can be from 7%-19%.

What happens if you don't have a VAT number?

VAT numbers are only given to businesses that have actually registered for VAT, so if your business isn't VAT registered, it's perfectly fine to send invoices that don't include a VAT number.

Do US citizens have a VAT number?

The U.S. does not have a VAT system, but when required companies may register and report VAT in the EU, UK, Australia and parts of Asia. VAT numbers are approved by tax authorities when your company has business activities in their country that legally require VAT reporting. Do you need a VAT number?

How do I get a VAT registration number?

The VAT Registration application must be made through one of the following channels: eFiling; or. Make a virtual appointment via our eBooking system by selecting the following options: Appointment channel: Telephonic engagement or Video. Reason category: Other. Reason for appointment: VAT registration.

What happens if I don't have a VAT number?

VAT numbers are only given to businesses that have actually registered for VAT, so if your business isn't VAT registered, it's perfectly fine to send invoices that don't include a VAT number.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute ZA SARS VAT101 online?

Easy online ZA SARS VAT101 completion using pdfFiller. Also, it allows you to legally eSign your form and change original PDF material. Create a free account and manage documents online.

How do I edit ZA SARS VAT101 in Chrome?

Get and add pdfFiller Google Chrome Extension to your browser to edit, fill out and eSign your ZA SARS VAT101, which you can open in the editor directly from a Google search page in just one click. Execute your fillable documents from any internet-connected device without leaving Chrome.

How can I fill out ZA SARS VAT101 on an iOS device?

Install the pdfFiller iOS app. Log in or create an account to access the solution's editing features. Open your ZA SARS VAT101 by uploading it from your device or online storage. After filling in all relevant fields and eSigning if required, you may save or distribute the document.

What is ZA SARS VAT101?

ZA SARS VAT101 is a value-added tax (VAT) return form used in South Africa for businesses to report their VAT obligations to the South African Revenue Service (SARS).

Who is required to file ZA SARS VAT101?

All registered VAT vendors in South Africa are required to file ZA SARS VAT101, regardless of the size of their business or the amount of VAT they collect.

How to fill out ZA SARS VAT101?

To fill out ZA SARS VAT101, vendors need to provide details such as their VAT registration number, the period of the return, total sales, total purchases, and the amount of VAT collected and paid.

What is the purpose of ZA SARS VAT101?

The purpose of ZA SARS VAT101 is to enable registered businesses to report their VAT transactions accurately and to calculate the VAT they owe or are owed. This helps ensure compliance with tax laws.

What information must be reported on ZA SARS VAT101?

ZA SARS VAT101 requires vendors to report information including their sales and purchases, VAT charged on sales, VAT incurred on purchases, and the total VAT payable or refundable.

Fill out your ZA SARS VAT101 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

ZA SARS vat101 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.