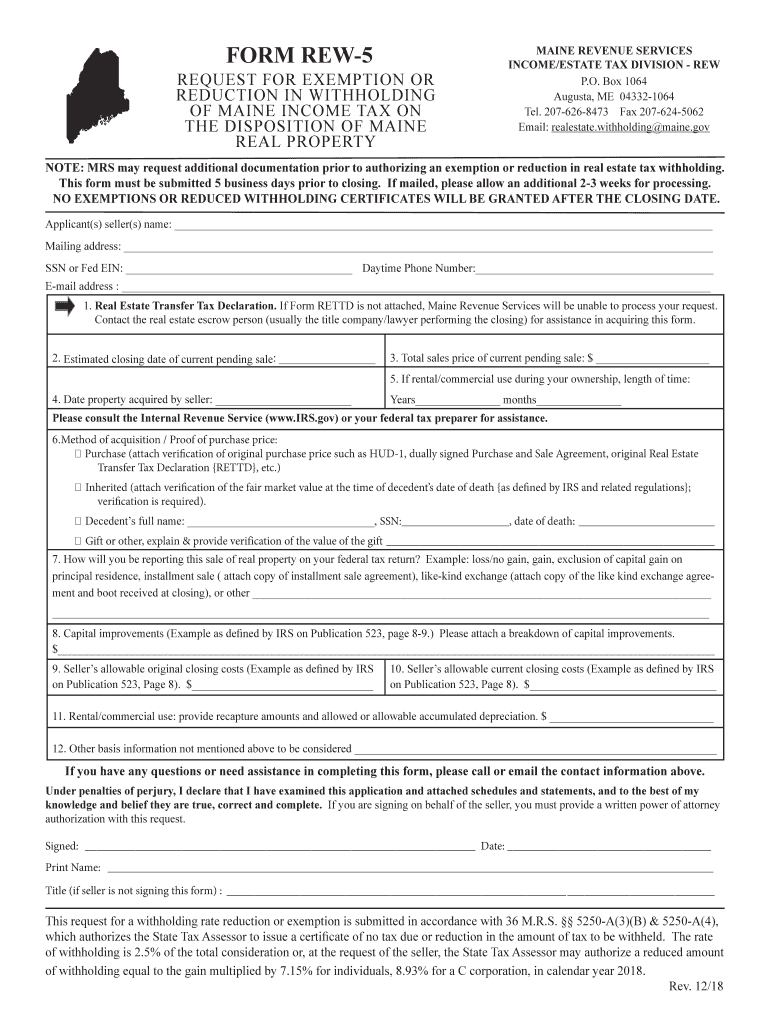

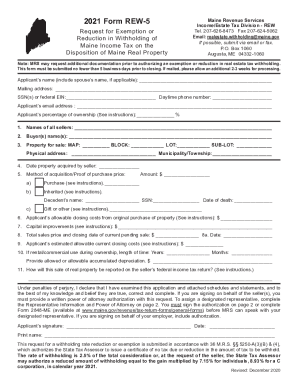

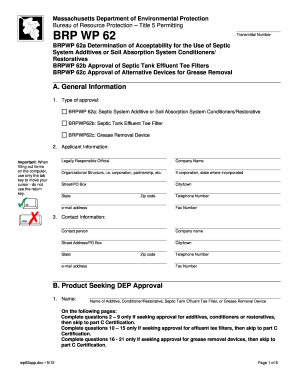

ME MRS REW-5 2018 free printable template

Get, Create, Make and Sign ME MRS REW-5

Editing ME MRS REW-5 online

Uncompromising security for your PDF editing and eSignature needs

ME MRS REW-5 Form Versions

How to fill out ME MRS REW-5

How to fill out ME MRS REW-5

Who needs ME MRS REW-5?

Instructions and Help about ME MRS REW-5

Hi welcome to seven facts you are watching episode 19 of the US series in this series we cover seven little-known facts about all the states and territories of the United States so feel free to check out the entire playlist if you're interested also don't forget to subscribe to this channel there are hundreds of videos up already with more to come, so it'll be worth it today we'll talk about a state that's not as popular as the others, but it's just as interesting Maine lets being settled by Europeans in the 17th century Maine was officially declared a state in 1820 after it voted to secede from Massachusetts thus becoming America's 23rd state this small land was much fought over by the French English and allied natives during the 17th and early 18th century during this period the two sides conducted raids against each other and even took captives for ransom this situation was a little hard as Maine has a very chilly climate and the environment is not exactly settler friendly, so we would imagine that under such conditions European colonists would try to cooperate with each other to increase their chances of survival, but obviously this didn't really happen as our more violent and possessive instincts were a lot more prominent as I said Maine is a cold state blanketed by thick forests, so naturally this is the last place you would expect to find a desert but a desert in Maine you will certainly find the 160000 square meets a desert of Maine lies outside the town of Freeport and is now a popular tourist attraction however what you really get your attention is that this is a man-made desert it originally developed as a result of over farming one single family managed to turn their land into sandy dunes because they pretty much did everything wrong they failed to rotate their crops than started to heavily clear the land of trees and then their sheep wreaked havoc by over grazing Maine is one of America's least densely populated States especially on the East Coast instead of lots of people you will most likely encounter lots and lots of trees approximately 89 of the state is covered by forests and Timberland, so they don't call it the Pine Tree State for no reason in fact no other state comes close to this figure in the forested areas of the Interior lies much uninhabited land some of which doesn't even have formal political organization into local units the Northwest Ariosto unorganized territory in the north for example has an area of 6910 square kilometers and a population of ten or one person for every 690 square kilometers Maine has a number of quirky museums some of them being quite odd one of them is the telephone Museum in Ellsworth ok this isn't really an art place but rather a fascinating one if you're into all technology the museum exhibits working equipment functioning as it did years ago switches manuals switchboards telephones tools schematics and photographs a slightly more quirky place is the Maine coast Dean History Museum in Jones...

People Also Ask about

What is the capital gains tax rate for 2022 on real estate?

How long do you have to keep a property to avoid capital gains tax?

How do I not pay capital gains on a home sale?

Do I have to buy another house to avoid capital gains?

What age do you stop paying property taxes in Maine?

How can I avoid paying tax on the sale of my house?

Where can I get hard copies of tax forms?

Do I have to pay taxes when I sell my house in Maine?

What is the capital gains tax on real estate in Maine?

Do you have to pay capital gains when you sell your house in Maine?

How much is capital gains tax on real estate in Maine?

How to order Maine income tax forms?

How do I calculate capital gains on sale of property?

Can you avoid the Maine state tax when you sell your home?

Am I liable for capital gains tax when I sell my house?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get ME MRS REW-5?

How do I execute ME MRS REW-5 online?

How do I fill out ME MRS REW-5 using my mobile device?

What is ME MRS REW-5?

Who is required to file ME MRS REW-5?

How to fill out ME MRS REW-5?

What is the purpose of ME MRS REW-5?

What information must be reported on ME MRS REW-5?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.