Get the free Administration of Wills, Trusts, and Estates

Show details

District Court Denver Probate Court County, Colorado Court Address:In the Matter of the Estate of:Deceased Attorney or Party Without Attorney (Name and Address):COURT USE ONLY Case Number:Phone Number:

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is administration of wills trusts

The administration of wills and trusts refers to the legal process of managing and distributing a deceased person's estate according to their will or trust document.

pdfFiller scores top ratings on review platforms

Very good

Very good! Excelente!

Best PDF site

Easy to use site.

Appreciate their support and trustworthy

I used their services and subscribed annually by mistake but when I asked to cancel the order and refund amount, they immediately processed the refund. I really appreciate.

I used this for school for a month and…

I used this for school for a month and it was great. Only reason I unsubscribed was because I didn’t need it anymore. Customer service is also 10/10

I give you 5 stars

I give you 5 stars. I had no issues at all. It took me a second to grasp the system, but I figured it all out.

It is easily portable

It is easily portable, saves previous works for editing. It is the one stop app for all your document needs!!!

Who needs administration of wills trusts?

Explore how professionals across industries use pdfFiller.

How to fill out the administration of wills trusts form

Filling out the administration of wills trusts form is crucial for ensuring compliance with legal standards in estate planning. This form plays an essential role in managing assets and adhering to Colorado probate court requirements. In this guide, we will examine every aspect of the form, providing detailed instructions and tips for effective navigation.

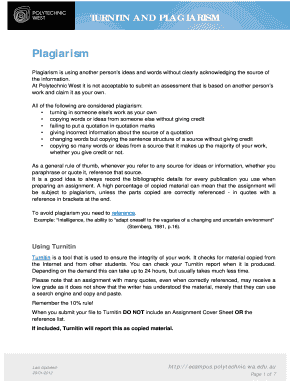

Understanding wills, trusts, and estates

Wills and trusts are fundamental legal instruments used for estate planning. A will is a legal document that outlines how a person's assets will be distributed upon their death, while a trust is a fiduciary relationship where one party holds title to property for the benefit of another.

-

Proper documentation ensures that the deceased's wishes are honored and minimizes legal disputes among heirs.

-

Wills typically go through probate, while trusts can provide for easier transitions and management of assets.

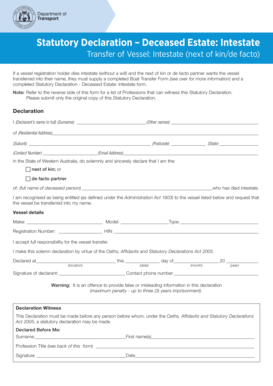

Key components of a domiciliary foreign personal representative’s sworn statement

A domiciliary foreign personal representative is someone appointed in another state to administer a decedent's estate. Understanding statutory references, such as § 15-10201(16.5) C.R.S., is crucial for grasping the legal implications involved.

-

These references guide the representation required in Colorado and clarify the authority granted to foreign representatives.

-

When filing in Colorado, a checklist includes the sworn statement and certified copies of relevant documents, such as court orders.

Filling out the domiciliary foreign personal representative’s sworn statement

The sworn statement must be completed with care to ensure accuracy. After gathering the necessary information, such as the deceased's identification and case number, follow these steps:

-

Make sure to provide the full name and date of death of the individual.

-

Ensure this number reflects the proceeding under which the estate is being administered.

-

This information is crucial for the court’s communication with the personal representative.

Document requirements for filing

Understanding the required documents is vital for a smooth filing process. The main documents required include:

-

These documents prove your authority to act as a personal representative in Colorado.

-

These letters confirm your appointment and powers as administrator.

-

Ensure you have any additional forms that the court may require for your specific case.

Navigating the Colorado probate process

The probate process in Colorado is essential for validating wills and managing estates. Generally, this involves several stages and timelines that can vary depending on the complexity of the estate.

-

The probate court oversees the administration process, ensuring that all statutory requirements are met.

-

Understand common delays that can occur, such as disputes over the validity of a will or issues with asset distribution.

-

Regular communication with the probate court can facilitate smoother administration.

Managing your forms with pdfFiller

pdfFiller provides a robust platform for managing your estate planning documents, including wills and trusts. Users can easily edit PDFs related to their sworn statements, ensuring precision in documentation.

-

Utilize pdfFiller to make necessary adjustments to your estate documents effortlessly.

-

Seamlessly sign your forms electronically and file them through the platform.

-

Take advantage of pdfFiller’s features for cooperative efforts in document management.

Ensuring compliance with Colorado laws

Compliance with state laws is crucial in the administration of wills and trusts. Non-compliance can lead to penalties and complications that may arise during the probate process.

-

Ensuring that all legal procedures are followed safeguards your authority as a personal representative.

-

Be aware of particular state laws that govern estate administration in Colorado.

-

Utilize legal resources or consult an attorney to confirm your understanding of the processes.

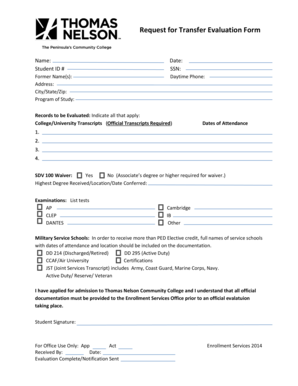

How to fill out the administration of wills trusts

-

1.Access pdfFiller and upload the administration of wills trusts document template.

-

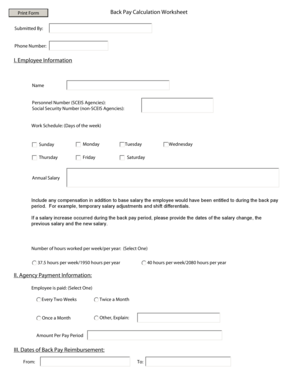

2.Begin by entering the decedent's full name and date of death in the designated fields at the top of the form.

-

3.Next, fill in the information about the executor or trustee, including their contact details, to establish their authority over the estate.

-

4.Then, outline the assets of the estate by providing descriptions and values for each asset, ensuring that documentation of ownership is included if necessary.

-

5.Complete the beneficiaries section by listing each beneficiary's full name and their respective inheritance shares or property.

-

6.If there are any debts or liabilities of the deceased, detail them in the appropriate section provided on the form.

-

7.Review all entered information for accuracy and completeness before submitting the document.

-

8.Once confirmed, electronically sign the form and submit it as instructed, often requiring filing with probate court if applicable.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.