Get the free 481367068 special needs irrevocable trust agreement

Show details

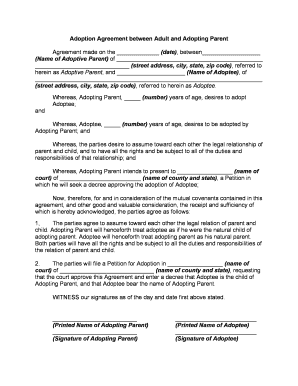

Special Needs Irrevocable Trust Agreement for Benefit of Disabled Child of Trust or This Agreement is made (date), between (Name of Settler), of (street address, city, county, state, zip code), (the

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is special needs trust

A special needs trust is a financial tool designed to manage assets for individuals with disabilities without jeopardizing their eligibility for government benefits.

pdfFiller scores top ratings on review platforms

I have needed something like this to fill out legal forms instead of using a typewriter. I searched online and found this, then our attorney said this is what their office uses so we bought it. It is exactly what I needed. So thankful for it.

The best solution I have found for editing and working with .pdf documents. Great Product!!

thanks for the easy way to got it(all the forms) without to go to take, very affordable... Thanks

Very responsive and good accountability of downloaded and filled-in forms. A fine "user friendly" program so far! Thanks

Faster than Adobe for these governmental box forms

great! i thought it was going to be free though

Who needs 481367068 special needs irrevocable?

Explore how professionals across industries use pdfFiller.

How to fill out the 481367068 special needs irrevocable

-

1.Start by obtaining the special needs trust template from pdfFiller.

-

2.Open the template in the pdfFiller editor and familiarize yourself with the sections.

-

3.Fill in the personal details of the beneficiary, ensuring that you provide their full name and current address accurately.

-

4.Specify the purpose of the trust in the designated section, clarifying that it is meant to benefit the individual with special needs.

-

5.Designate a trustee who will manage the funds, including their full name and contact information.

-

6.Outline the funding sources for the trust, detailing any specific assets or amounts that will be included.

-

7.Include a section on the distribution plan, explaining how and when the funds can be accessed by the beneficiary.

-

8.Review all sections for accuracy and completeness before saving the document in your desired format.

-

9.Finalize and download the completed trust document directly from pdfFiller, ensuring you have copies for all relevant parties.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.