Get the free quiet tax

Show details

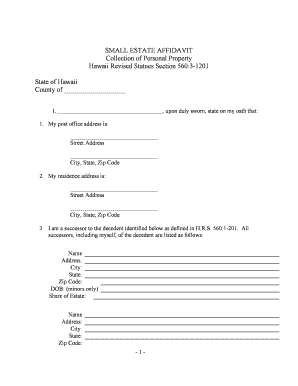

CIVIL ACTION NO. JUDICIAL DISTRICT COURT IN AND FOR THE PARISH OF STATE OF LOUISIANA VS PETITION TO QUIET TAX TITLE NOW INTO COURT, comes, of lawful age and a resident of Parish, State of Louisiana,

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is quiet tax

A quiet tax refers to the unnoticed or implicit costs that individuals incur, often related to time or convenience, that do not appear as direct charges.

pdfFiller scores top ratings on review platforms

Had I been in business as I was prior to my retirement the product would have been useful.

Great , very good

it was useful

easy to navigate

good

Very convenient

Who needs quiet tax?

Explore how professionals across industries use pdfFiller.

Guide to Filing an IRS Quiet Tax Form on pdfFiller

How does a quiet tax form work?

A Quiet Tax Form is designed to help property owners clarify the ownership of certain properties and prevent disputes over titles. Filing this form is crucial as it helps streamline the process of affirming ownership rights, especially for individuals dealing with inherited properties or liens.

-

A legal instrument used to clear the titles of properties by confirming ownership and addressing any outstanding claims.

-

To provide a public record that can help protect property rights and reduce disputes.

-

Property transfers, probates, or resentments regarding property ownership.

What are the prerequisites for filing a quiet tax form?

Before you begin the process of filing a Quiet Tax Form, it's essential to understand the eligibility requirements and gather necessary documentation. This preparation prevents delays in your filing.

-

Typically requires proof of property ownership, such as a deed or title.

-

Includes tax deeds, identification documents, and any existing court judgments related to the property.

-

Tax deeds represent legal ownership of property after a tax deed sale, making them vital for quiet tax filings.

How do you complete a quiet tax form?

Completing a Quiet Tax Form can be straightforward with the right tools and information. Utilizing a platform like pdfFiller not only simplifies this process but enhances your ability to manage your documents efficiently.

-

Collect all necessary property details and legal documents before starting your filing.

-

Use the user-friendly interface of pdfFiller to input your information accurately.

-

Take advantage of pdfFiller's editing and e-signature capabilities to ensure your form is signed and submitted correctly.

What are the post-filing procedures for a quiet tax form?

After submitting your Quiet Tax Form, knowing the correct procedures is vital to ensure the process continues smoothly. Understanding how to check the status of your filing can help mitigate anxiety.

-

Ensure your form is filed with the appropriate local or state tax office.

-

Processing times can vary; typically, expect a few weeks to a couple of months.

-

Follow up with the tax office to confirm they have received your filing.

What are the potential risks and pitfalls of filing a quiet tax form?

Filing a Quiet Tax Form may seem straightforward, but it comes with potential legal implications that users should be aware of. Ensuring accuracy during the filling process is essential to avoid complications.

-

Filing inaccurately can lead to disputes or contesting of property ownership.

-

Simple mistakes, like incorrect names or property descriptions, can cause significant delays.

-

Ensuring that all information is accurate and complies with state laws is critical for successful filing.

How does pdfFiller enhance quiet tax form filing?

pdfFiller serves as a powerful tool for users seeking to streamline their tax management processes. Its capabilities not only cater to individual needs but also serve teams working on multiple filings.

-

With a centralized platform, users can manage their documents with ease, making the filing efficient.

-

Designed for team efforts, pdfFiller's features allow multiple users to collaborate on a single document.

-

Access your forms from anywhere, ensuring flexibility in the management of your tax documents.

What should you know about local compliance for filing in Louisiana?

In Louisiana, specific state laws govern property and tax filings, making it essential to be aware of local regulations. Ensuring compliance can prevent future disputes.

-

Louisiana has unique laws concerning property ownership and tax filings; being informed can save time.

-

Utilize local county offices or online resources to find guidance specific to your situation.

-

Maintaining records well beyond the filing year is vital in case of future disputes.

How to fill out the quiet tax

-

1.Open pdfFiller and upload the quiet tax document you need to fill out.

-

2.Begin by entering your personal information in the designated fields, such as name, address, and contact details.

-

3.Review the sections that require financial information and input the necessary data accurately, ensuring to double-check for any errors.

-

4.For any signatures required, utilize the e-signature feature to sign the document electronically.

-

5.After completing all sections, review the document for completeness and accuracy before finalizing.

-

6.Once satisfied, click on the 'Save' button to store your filled document, and choose a preferred format for download if needed.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.