Last updated on Feb 20, 2026

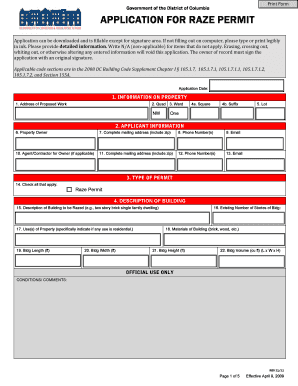

OR-37014 free printable template

Show details

SELLER\'S PROPERTY DISCLOSURE STATEMENT, OR STATEMENT OF EXCLUSION

(NOT A WARRANTY)

(Oregon Revised Statutes: 105.464)INSTRUCTIONS TO THE SELLER

Please complete the following form. Do not leave any

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is OR-37014

The OR-37014 is a form used for reporting specific financial transactions related to state taxes in Oregon.

pdfFiller scores top ratings on review platforms

Satisfactory

Customer Service

I had an issue with my account and worked with customer service to get it resolved. They responded quickly and were very helpful! This is important to me. I appreciate them very much!

Simple, easy, and smooth.

BEST

I need to learn everthing about it

I found it pretty easy to use since I am not very techie. I haven't tried anything except doing some corrections to some documents. Looking forward to the other features.

Who needs OR-37014?

Explore how professionals across industries use pdfFiller.

Complete guide to the OR-37014 form on pdfFiller

How do understand the OR-37014 form?

The OR-37014 form is essential for sellers in Oregon to disclose critical information about their properties to potential buyers. It ensures transparency in real estate transactions and is rooted in the Oregon Revised Statutes (ORS). Understanding the legal context and implications of this form is imperative for both sellers and buyers.

-

The OR-37014 form is a seller disclosure statement that outlines material facts about the property, aimed at informing buyers.

-

Familiarity with relevant ORS provisions helps in understanding sellers' obligations regarding disclosures.

-

Incomplete forms may lead to legal consequences, including potential lawsuits for misrepresentation.

What do need to know about navigating the OR-37014 form fields?

Navigating the OR-37014 form requires attention to detail and a clear understanding of the required information. Certain fields must be filled out precisely to adhere to legal standards and minimize liabilities.

-

Sellers must complete sections regarding property condition, repairs, and disclosures. Each part holds significance in the selling process.

-

Break down the form into manageable parts for completion, ensuring clarity and accuracy in responses.

-

Avoid errors such as omitting critical disclosures or providing ambiguous answers, as these can lead to complications later.

How can claim an exclusion effectively?

Claiming an exclusion can benefit sellers under specific circumstances. However, knowing the criteria for this process and the limitations is essential to avoid future disputes.

-

Understand what qualifies you for exclusion which may include the property type or duration of ownership.

-

Use this section correctly to communicate your eligibility for a disclosure exemption if applicable.

-

Claiming an exclusion can lead to legal repercussions if not handled correctly, including disputes over property disclosures.

What legal considerations and responsibilities should be aware of?

Sellers in Oregon have specific legal obligations to fulfill when completing the OR-37014 form. Failure to comply can lead to significant legal and financial consequences.

-

Sellers must provide accurate information about their property to avoid misrepresentation claims.

-

It’s advisable to seek legal counsel when unsure about particular disclosures to ensure compliance.

-

Refusing to present the completed form to potential buyers can lead to loss of trust and legal troubles.

How does pdfFiller simplify OR-37014 form management?

pdfFiller offers tools for managing the OR-37014 form, making it easier for sellers to complete, edit, and sign documents within a user-friendly platform.

-

Easily upload the OR-37014 form, make necessary edits, and fill in required data online.

-

Work alongside team members for efficient form management, especially when handling multiple transactions.

-

Utilize eSignature options and secure cloud storage to access your OR-37014 form anytime and anywhere.

What are some sample scenarios for completing the OR-37014 form?

Real-world scenarios highlight the importance of accurately disclosing property details. These examples can assist sellers in understanding how to navigate their unique situations.

-

Sellers may have different disclosure needs, such as handling repairs or environmental hazards.

-

Understanding what conditions must be disclosed is crucial for compliance and maintaining buyer trust.

-

The OR-37014 form is fundamental in facilitating transparent real estate transactions and protecting seller interests.

What are the best practices for submitting the OR-37014 form?

Submitting the OR-37014 form correctly requires adherence to Oregon state regulations and maintaining communication with potential buyers.

-

Double-check the form for accuracy and ensure you comply with all state regulations before submission.

-

Inform buyers about how to handle offers, particularly when disclosures are incomplete.

-

Track your submission and follow up to ensure all parties are informed and compliant.

How to fill out the OR-37014

-

1.Download the OR-37014 form in PDF format from the official Oregon Department of Revenue website.

-

2.Open the downloaded PDF using pdfFiller or upload the form to your pdfFiller account.

-

3.Begin by filling in your personal details such as name, address, and contact information in the designated fields.

-

4.Next, move on to section one of the form, where you will provide information about the financial transaction, including dates and amounts.

-

5.Be sure to accurately report all necessary financial figures and double-check your entries for accuracy.

-

6.Continue filling out any additional sections as applicable to your individual situation.

-

7.After completing the form, use the preview option to review your inputs and ensure all information is correct.

-

8.Once satisfied with the information, proceed to save your form or use the submit option if required.

-

9.If you need a physical copy, choose the print option, otherwise download the filled form for your records.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.