Last updated on Feb 20, 2026

NJ-ET10 free printable template

Show details

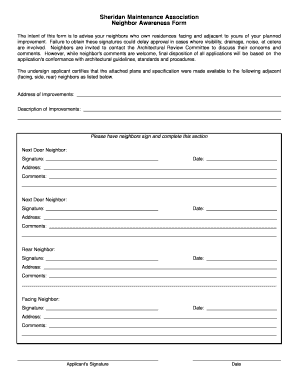

NEW JERSEY SMALL ESTATE TRANSFER OF ASSETS WITHOUT ADMINISTRATION Control Number NJET10InstructionsForms Included: Form One Affidavit of Surviving Spouse Form Two Authorization to Accept Service of

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is NJ-ET10

NJ-ET10 is a New Jersey tax form used for reporting and claiming exemption from New Jersey sales tax on specific purchases.

pdfFiller scores top ratings on review platforms

Helpful when needed. Some of the changes are not easy, but can usually make them work.

Had everything I needed for a short suspense date.

Just getting started but big help already

I simply love this app but little bit expensive.

Great, but limited in some options, unfortunately.

It makes the process of dealing with 'templates' less stressful.

Who needs NJ-ET10?

Explore how professionals across industries use pdfFiller.

Understanding the NJ-ET10 Form

What is the NJ-ET10 form?

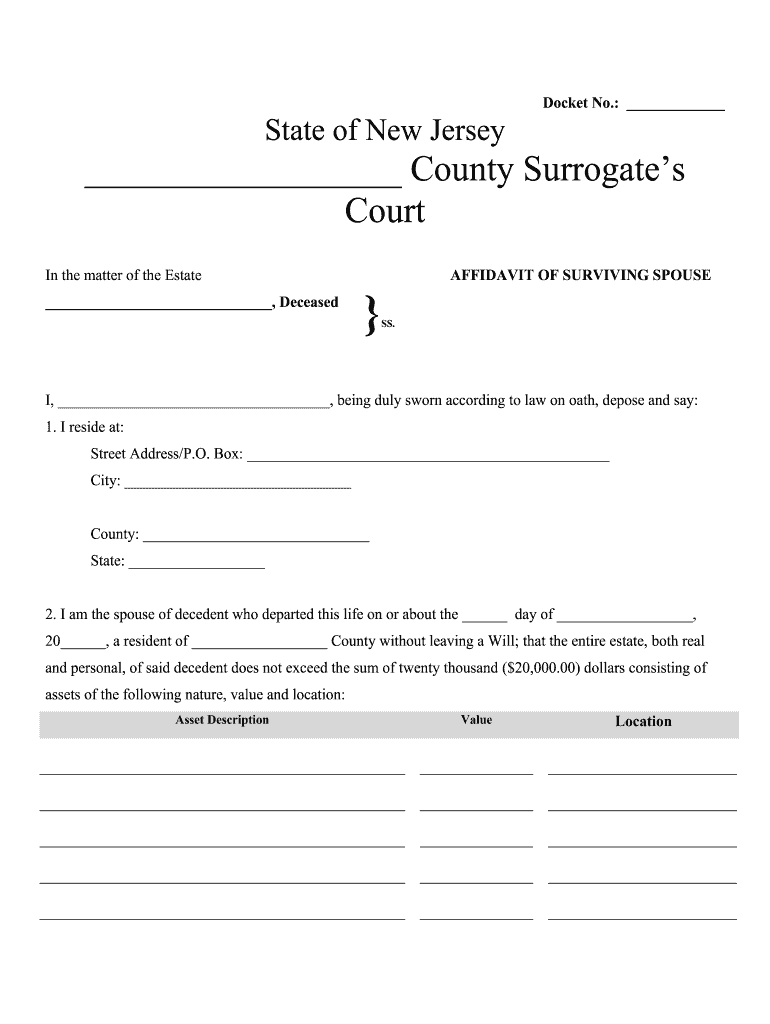

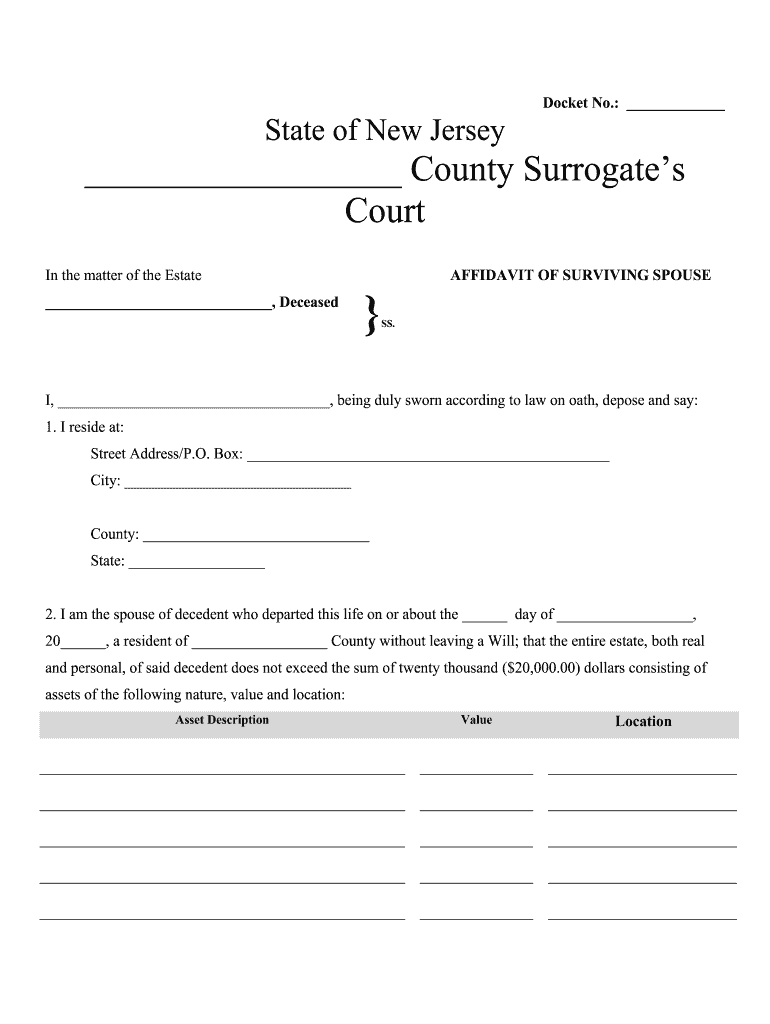

The NJ-ET10 form is crucial for facilitating small estate transfers in New Jersey. This form is primarily utilized by surviving spouses and heirs to claim assets of a deceased relative without needing to go through the lengthy probate process. Understanding this form is vital for any individual involved in estate management within New Jersey.

-

Designed to simplify the transfer of modest estates, the NJ-ET10 form ensures that deserving individuals can access inheritance without unnecessary legal hurdles.

-

The primary audience for the NJ-ET10 form includes surviving spouses and heirs, making it crucial for family members dealing with the loss of a loved one.

-

The NJ-ET10 form holds significant importance in New Jersey estate management, as it streamlines the asset transfer process and provides clarity in legal procedures.

What forms are included in the NJ-ET10?

The NJ-ET10 encompasses several specific forms, each serving a unique function in the estate transfer process. To ensure a smooth experience, understanding what each form entails is necessary.

-

This form allows a surviving spouse to affirm their rightful claim to the estate of the deceased.

-

This form designates someone to receive legal documents on behalf of the estate.

-

This form is for heirs who are next of kin and wish to claim their share of the estate.

-

Similar to Form Two, it offers another method for designating a representative for legal processes.

-

This form requires consent from all next of kin to proceed with the small estate claim.

Who is eligible to use the NJ-ET10 forms?

Eligibility for the NJ-ET10 forms primarily hinges on the relationship to the deceased and the value of the estate. Specific criteria must be met to ensure proper use of each form.

-

To use Forms One and Two, a surviving spouse must demonstrate their legal relationship to the deceased and meet specific estate value criteria.

-

Heirs with no surviving spouse can utilize Forms Three, Four, and Five, provided they can validate their kinship.

-

The estate's assets must fall within New Jersey's established valuation limits for small estate claims to qualify for the NJ-ET10 process.

How do complete the NJ-ET10 form process?

Completing the NJ-ET10 form process is methodical and involves a few critical steps to ensure everything is done correctly. Proper adherence to these steps can significantly ease the overall process.

-

Start by accurately filling out the Affidavit of Surviving Spouse, detailing necessary personal and estate information.

-

Submit the completed forms to your local County Surrogate's Office, where additional processing occurs.

-

Ensure that all required signatures are obtained and notarizations are completed as necessary to validate the forms.

-

After submission, anticipate a timeline for processing your NJ-ET10 forms, typically up to several weeks, depending on county workloads.

Where do submit the NJ-ET10 forms?

Submitting the NJ-ET10 forms requires you to know where to file them based on your New Jersey county as local requirements can vary. Adhering to local guidelines can expedite your case.

-

Forms should be submitted to the appropriate County Surrogate's Office according to your jurisdiction.

-

Familiarize yourself with any specific local guidelines or additional documents required for submission in your county.

-

Be aware of possible filing fees that could be charged upon submitting the NJ-ET10 forms, and ensure you have the necessary funds available.

How can pdfFiller help me manage NJ-ET10 forms?

pdfFiller offers a robust solution for managing NJ-ET10 forms, simplifying the filling out and submission process. With its cloud-based platform, users can access essential tools from any location.

-

Utilize pdfFiller to edit your NJ-ET10 form easily, ensuring all information is up-to-date and accurate.

-

The eSigning function allows you to expedite document signing, which is especially crucial in time-sensitive matters.

-

pdfFiller provides collaborative features, making it easier for teams to work together on form management.

What are the next steps for NJ-ET10 form users?

Wrapping up your NJ-ET10 form process requires a recap of essential actions needed for completion. It’s beneficial to leverage resources provided by pdfFiller to ensure everything runs smoothly.

-

Go through all essential actions necessary for completing the NJ-ET10 form process and ensure you’re well-informed.

-

Take advantage of pdfFiller’s resources for effective document management to navigate the NJ-ET10 form process easily.

How to fill out the NJ-ET10

-

1.Open the NJ-ET10 form on pdfFiller.

-

2.Begin by entering your organization's name in the specified field.

-

3.Provide your address, including city, state, and zip code in the corresponding sections.

-

4.Fill in the Federal Employer Identification Number (FEIN) or Social Security Number (SSN) as applicable.

-

5.Specify the type of exemption by selecting the appropriate box from the list provided.

-

6.In the next section, detail the purchases for which you are claiming exemption, including descriptions and values.

-

7.Review the form for completeness and accuracy before submission.

-

8.Finally, save the completed form, and you may choose to print or send it electronically depending on your preference.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.