Last updated on Feb 17, 2026

Get the free summary administration estates

Show details

Prepared by U.S. Legal Forms, Inc. Copyright 2016 U.S. Legal Forms, Inc. STATE OF MONTANASUMMARY ADMINISTRATION OF ESTATE Control Number MT ET20NOTES ON COMPLETING THESE FORMS The form(s) in this

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is summary administration estates

Summary administration estates is a streamlined legal process for handling the estate of a deceased individual with minimal assets or complexities.

pdfFiller scores top ratings on review platforms

My power went out while preparing the doc and I panicked all my work would be lost. When I rebooted and opened the website fillable form, there it was! I was able to breathe again.

Very easy to use and produces a good form.

This was my 1st document prepared and while I'm not yet done, it appears relatively simple to create.

The forms are so easy to find and use...

It is has been a very positive experience

sometimes it is not easy to move the markers where you need to & YOU CANT ADD A LINE

Who needs summary administration estates?

Explore how professionals across industries use pdfFiller.

The Comprehensive Guide to Summary Administration of Estates

How does summary administration work in estate management?

Summary administration is a streamlined process designed to simplify the handling of small estates. This process significantly reduces the time and costs typically associated with formal probate proceedings. In states like Montana, it is particularly applicable when the estate's value does not exceed certain thresholds, offering an effective solution for families navigating the complexities of estate management.

What are the differences between summary administration and formal probate?

Summary administration differs from formal probate primarily in its speed and requirements. While formal probate is a lengthy legal procedure involving extensive court oversight, summary administration simplifies this process, allowing quicker access to estate assets. This distinction is crucial for beneficiaries who need to resolve estate matters promptly.

When is summary administration applicable in Montana?

In Montana, summary administration can be utilized when the total value of the estate is less than $50,000, or when the decedent has been deceased for more than 30 days. Understanding these conditions helps individuals determine eligibility for this efficient estate process.

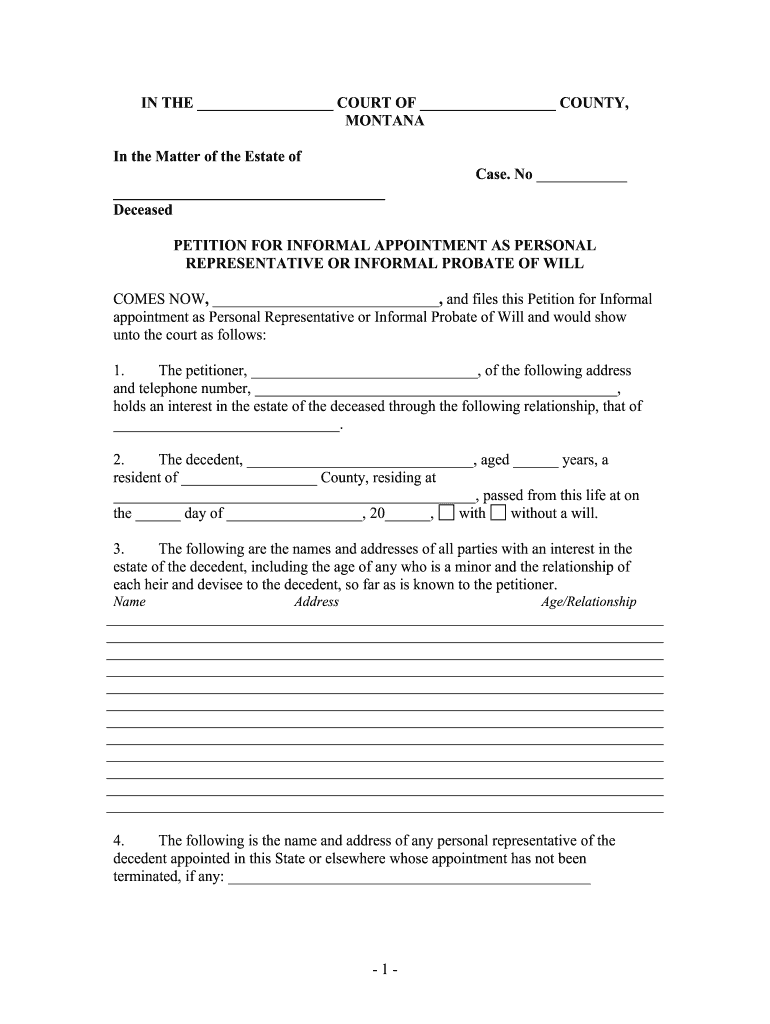

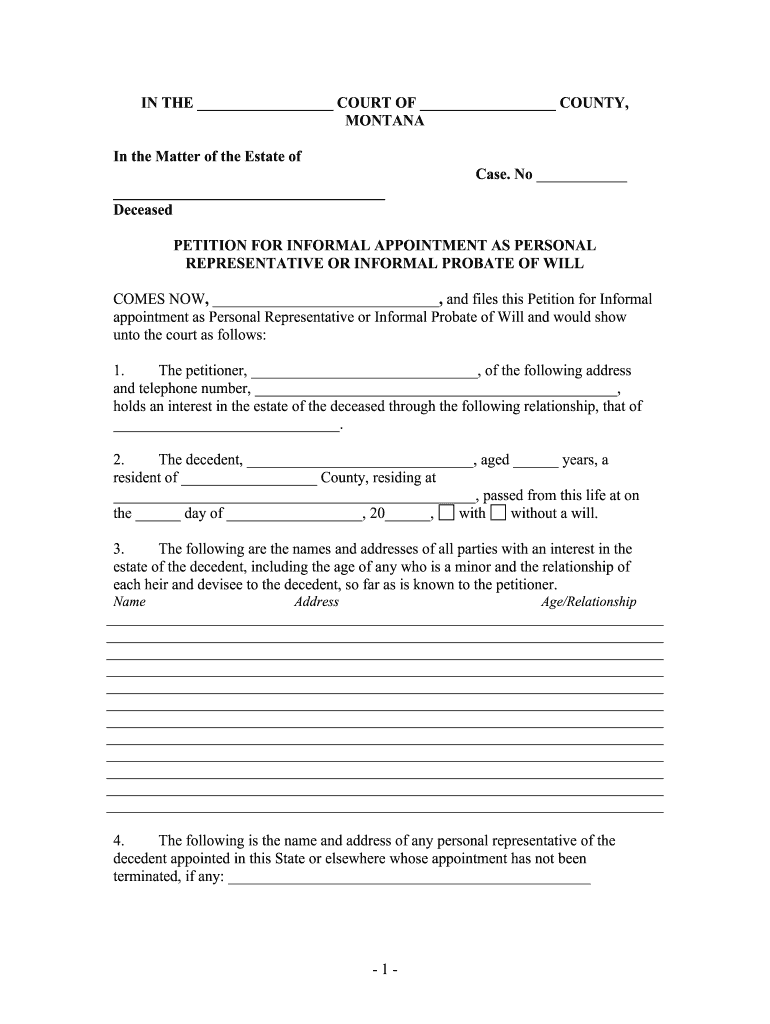

What steps are involved in navigating the summary administration process?

The process begins with filing a Petition for Summary Administration, followed by notifying interested parties. After the court grants approval, the personal representative can begin distributing the estate assets according to the law.

-

Complete and file the petition form with the appropriate court.

-

Inform all interested parties of the administration process.

-

Once the court approves, assets can be distributed to beneficiaries.

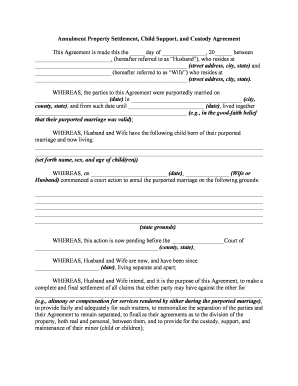

What documentation and forms are necessary for summary administration?

To successfully navigate the summary administration process, you'll need several key documents such as the Petition for Summary Administration form, death certificate, and a list of heirs. Each document plays a pivotal role in ensuring that the process complies with legal requirements.

How can ensure compliance with Montana laws?

-

Seek guidance from legal professionals familiar with Montana estate laws.

-

Utilize a checklist to ensure all forms are completed fully and accurately.

What does the summary administration of estate form entail?

The Summary Administration of Estate form is structured to capture vital information about the deceased, the estate, and the beneficiaries. Understanding the specific sections will aid in accurately filling out this essential document.

How can effectively complete and use the estate forms?

-

Each section of the summary administration form covers different aspects. Fill each with clear, concise information.

-

Leverage pdfFiller’s features, such as editing capabilities and eSigning, to enhance form accuracy and efficiency.

How can interactive tools assist in document management?

pdfFiller’s platform offers interactive tools that enhance document management. Users can efficiently edit, sign, and collaborate on estate documents without the hassle of traditional paperwork, thereby streamlining the process significantly.

What best practices should follow while completing estate forms?

-

Maintain a clear record of all documentation related to the estate.

-

Double-check all entries to prevent mistakes, which could delay the administration process.

-

Consult with an attorney if you have legal questions or uncertainties about the forms.

What are the key points to remember while managing estate documentation?

Documentation related to estate management should be handled with care. Key practices include regularly updating documents, ensuring digital backups, and securely storing sensitive information. Maintaining good organization will simplify the estate administration process for you and your beneficiaries.

How can store and manage my estate documents securely?

-

Consider using cloud storage services for easy and secure access to documents.

-

Regularly review and update documents to reflect any changes in your estate.

In conclusion, understanding the summary administration estates form is essential for navigating estate management effectively. The use of tools like pdfFiller can significantly enhance the method by allowing seamless interaction with documents, ensuring that you meet both legal obligations and personal needs.

How to fill out the summary administration estates

-

1.Begin by accessing the PDF document for summary administration estates.

-

2.Read through the entire document to understand the required sections.

-

3.Fill in the personal details of the deceased, including name, date of death, and last known address in the appropriate fields.

-

4.Enter the details of all beneficiaries, ensuring to include their names, addresses, and their relationship to the deceased.

-

5.List the assets of the estate, providing accurate descriptions and estimated values for each item.

-

6.If applicable, indicate any debts or liabilities that the estate owes.

-

7.After completing the sections, review all entries for accuracy and completeness.

-

8.Sign and date the document in the specified area, usually found at the end of the form.

-

9.Submit the filled document according to local jurisdiction requirements for summary administration estates.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.