Last updated on Feb 20, 2026

Get the free security agreement pdf

Show details

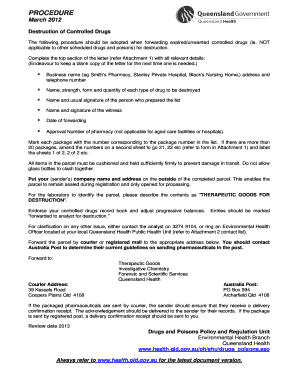

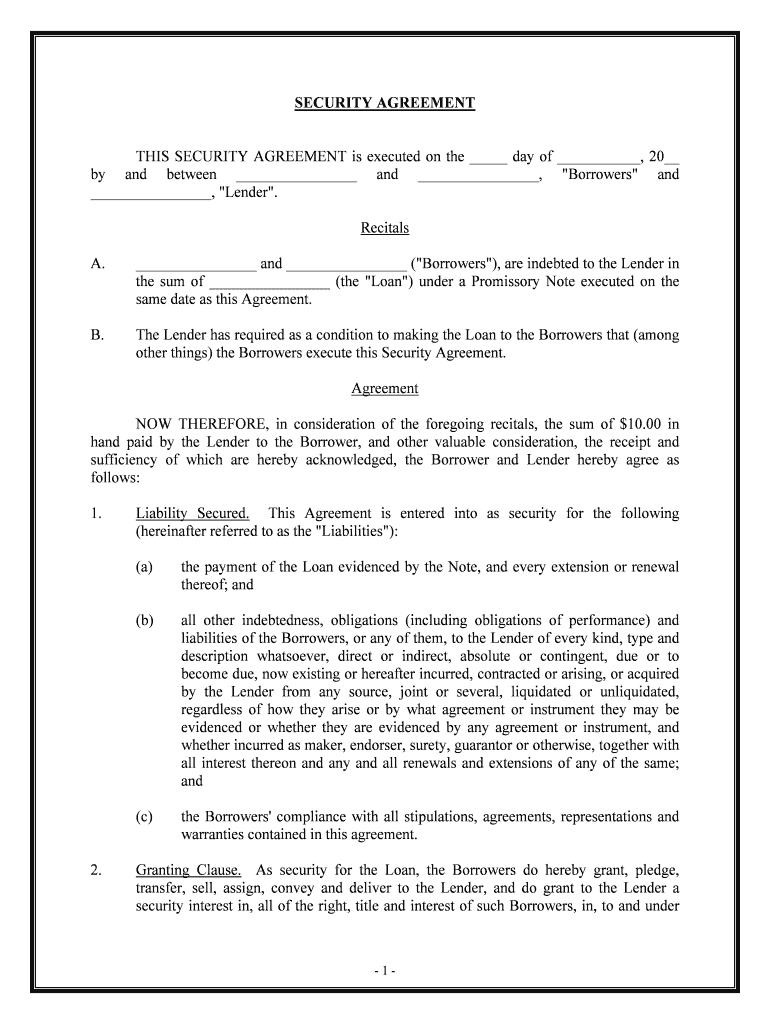

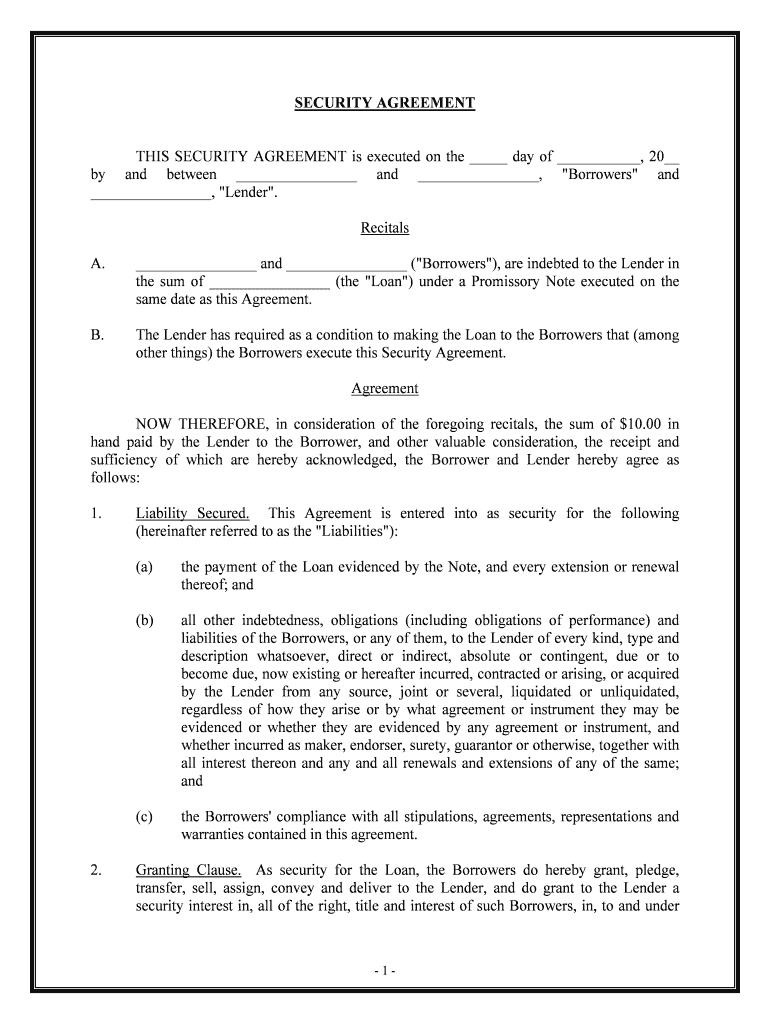

SECURITY AGREEMENTS SECURITY AGREEMENT is executed on the day of, 20 by and between and, “Borrowers and, “Lender “. Recitals A. and (“Borrowers “), are indebted to the Lender in the sum

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is security promissory

A security promissory is a written agreement where one party promises to pay a specific amount of money to another, often secured by collateral.

pdfFiller scores top ratings on review platforms

I was in a rush to get some documents preparred. This was a easy tool to use.

Sometimes there are too many steps to get to the document.

maybe need to improve on the circling the words

I am enjoying this program, but can't insert a picture.

This is my first time using PDFfiller and I am happy with the ease of sending estimates out to my customers.

It's Great, but cannot give five STARS until I'm better at it. Thank you.

Who needs security agreement pdf form?

Explore how professionals across industries use pdfFiller.

Comprehensive Guide to the Security Promissory Form

How can a security promissory form protect your financial interests?

A security promissory form is essential in financial transactions as it delineates the obligations of borrowers and lenders. This document includes detailed terms about the loan, the amount, and any collateral involved. By understanding how to fill out this form effectively, individuals and teams can safeguard their interests in any loan agreement.

-

A secured promissory note is a written promise to pay a specified sum of money to a lender at a future date, backed by collateral to secure the loan.

-

This note is crucial in ensuring that lenders have a legal claim on the collateral in case of default, thus minimizing risk.

-

Both borrowers seeking loans and lenders offering funds must clearly understand their roles, rights, and responsibilities outlined in the agreement.

What are the critical elements of a security agreement?

A well-drafted security agreement incorporates several vital elements that define the relationship between the borrower and the lender. Understanding these components can mitigate potential disputes in the future.

-

The agreement must specify complete details about both parties, including names and contact information, to ensure clarity.

-

Recitals explain the context of the agreement and outline the obligations, assisting in legal interpretation if needed.

-

This section details the liabilities secured by the collateral and outlines legal recourse for non-compliance or defaults.

How do you fill out the security agreement form?

Filling out the security agreement form requires attention to detail to ensure all necessary information is accurately recorded. Each step plays a critical role in forming a solid loan agreement that protects both the lender and borrower.

-

Indicate the date on which the agreement is being signed to establish a clear timeline for the transaction.

-

Fill in the full names, addresses, and any identifying information for both parties to avoid confusion.

-

Specify the total amount of money being loaned clearly, including any interest rate applicable.

-

Define the value of the collateral offered to secure the loan into clear language, avoiding ambiguity.

What are the differences between secured and unsecured promissory notes?

Secured promissory notes are backed by collateral, making them less risky for lenders compared to unsecured notes. Understanding these differences is essential when choosing the appropriate note for your financial needs.

-

A secured note is a loan guarantee by collateral, such as property, while unsecured notes are based solely on the borrower's creditworthiness.

-

These notes carry a higher risk for lenders due to the lack of collateral, potentially leading to higher interest rates.

-

Opt for a secured note when the borrower has valuable collateral to back the loan, making it more appealing to lenders.

How can you utilize a secured promissory note template?

A secured promissory note template can simplify the process of creating a loan agreement. By using a recognized format, you increase the likelihood of covering all necessary details.

-

A comprehensive template will typically include sections for lender and borrower information, loan amount, interest rates, and terms.

-

Incorporating standard language helps ensure enforceability and clarity in the agreement.

-

Personalizing the template to meet unique needs can expedite the process of securing loans while protecting interests.

What are the best practices for creating an effective security agreement?

Creating an effective security agreement requires careful consideration of the collateral and loan terms. Following specific steps can help ensure the agreement is legally enforceable and clear.

-

Assess the loan terms to select suitable collateral that aligns with the financial agreement.

-

Check legal requirements to ensure that the collateral is appropriately documented and secured.

-

Clearly define all terms to prevent potential disputes that may arise from misunderstandings.

-

Review relevant laws and regulations to comply with legal standards for security agreements in your region.

How can pdfFiller enhance your experience with the security promissory form?

pdfFiller empowers users by providing tools for editing, eSigning, and collaborating on security agreement forms. With its cloud-based platform, users can access forms anytime, streamlining the document management process.

-

Users can easily find and customize templates, streamlining the process of creating a security promissory form.

-

This feature allows for a legally binding agreement without the need for physical signatures, making transactions more efficient.

-

Teams can work together on forms, ensuring that all members are aligned and informed throughout the process.

How to fill out the security agreement pdf form

-

1.Open the PDF document for the security promissory on pdfFiller.

-

2.Begin by entering the date at the top of the document.

-

3.Fill in the names and addresses of both the borrower and lender in the designated fields.

-

4.Clearly state the amount of money being borrowed in the specified section.

-

5.Detail the interest rate and repayment terms, including dates and frequency of payments.

-

6.If applicable, describe the collateral securing the promissory note.

-

7.Include any additional terms or conditions that are relevant to the agreement.

-

8.Review the completed document for accuracy, ensuring all information is correct.

-

9.Sign the document in the signature field, adding your printed name and date below.

-

10.Save the completed form and share or print as needed for records.

Related Catalogs

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.