Get the free pdffiller

Show details

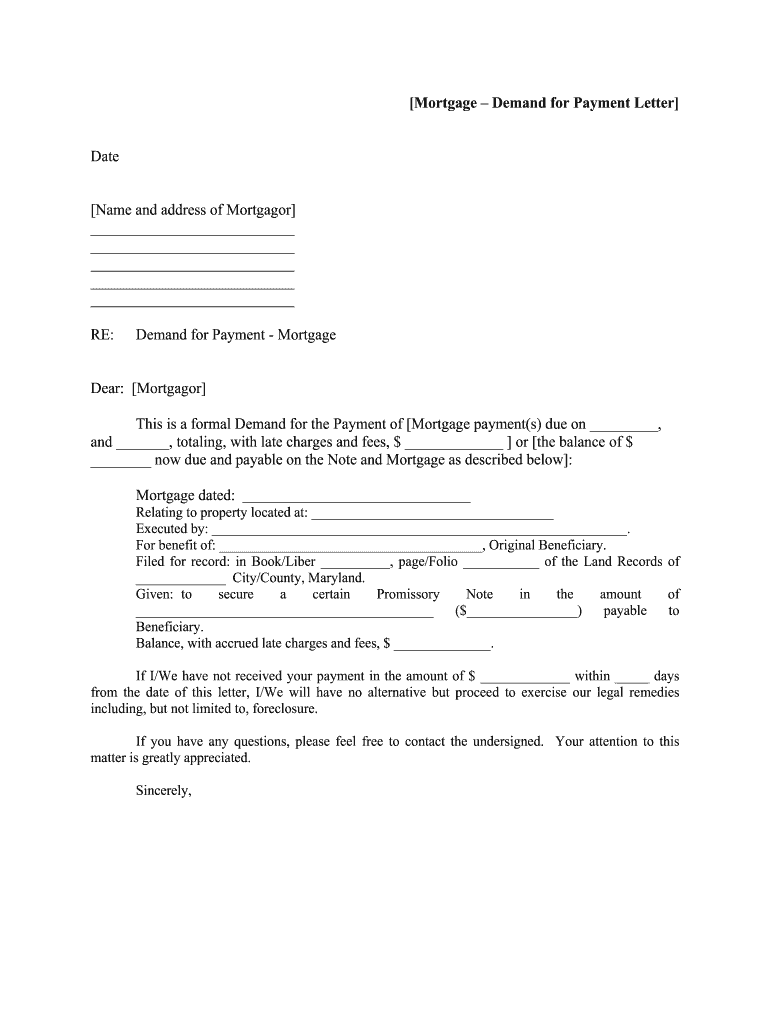

Mortgage Demand for Payment Letter Date Name and address of Mortgagor RE:Demand for Payment Mortgage Dear: Mortgagor This is a formal Demand for the Payment of Mortgage payment(s) due on, and, totaling,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign pdffiller form

Edit your pdffiller form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your pdffiller form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing pdffiller form online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Log into your account. It's time to start your free trial.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit pdffiller form. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

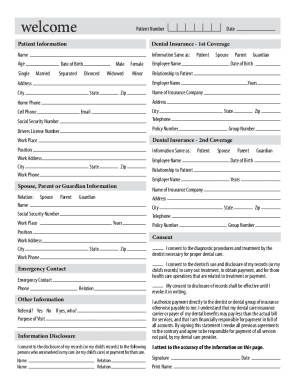

How to fill out pdffiller form

How to fill out mortgage demand letter

01

To fill out a mortgage demand letter, follow these steps:

1. Start by addressing the letter to the appropriate recipient, such as the lender or mortgage company.

02

Clearly state your intention in the opening paragraph, mentioning that you are writing to request a payoff statement for your mortgage loan.

03

Provide your personal information, including your full name, contact details, and loan account number.

04

Explain the purpose of your request in detail, including any specific reasons for the demand letter (e.g., refinancing, selling the property, or clearing any outstanding balance).

05

Mention the deadline by which you expect to receive the payoff statement or response from the lender.

06

Attach any necessary supporting documents, such as previous loan statements, proof of payments, or legal notices.

07

Include a closing paragraph expressing your appreciation for their prompt attention to your request.

08

Sign the letter with your full name and date it.

09

Make copies of the letter for your records.

10

Send the original letter via certified mail with a return receipt requested or through a secure method to ensure it reaches the intended recipient.

Who needs mortgage demand letter?

01

Various individuals or entities might need a mortgage demand letter, including:

02

- Homeowners who want to request a payoff statement from their lender to determine the remaining balance on their mortgage loan.

03

- Homeowners who plan to refinance their mortgage and need an official document stating the amount required to pay off the current mortgage.

04

- Homeowners who intend to sell their property and need a payoff statement to accurately determine the outstanding mortgage amount to be paid off from the selling price.

05

- Legal professionals representing clients involved in mortgage-related disputes or litigation who require a formal request for payoff statements.

06

- Anyone facing issues with their mortgage company, such as inaccurate billing, incorrect loan terms, or failure to credit payments, and requires documentation of their demands.

Fill

form

: Try Risk Free

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I fill out pdffiller form using my mobile device?

Use the pdfFiller mobile app to fill out and sign pdffiller form. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, their features, and how to get started.

Can I edit pdffiller form on an iOS device?

Use the pdfFiller app for iOS to make, edit, and share pdffiller form from your phone. Apple's store will have it up and running in no time. It's possible to get a free trial and choose a subscription plan that fits your needs.

How do I edit pdffiller form on an Android device?

You can make any changes to PDF files, like pdffiller form, with the help of the pdfFiller Android app. Edit, sign, and send documents right from your phone or tablet. You can use the app to make document management easier wherever you are.

What is mortgage demand letter?

A mortgage demand letter is a communication sent by a lender to a borrower requesting payment of the outstanding balance on a mortgage loan.

Who is required to file mortgage demand letter?

Lenders or mortgage holders are required to file a mortgage demand letter when a borrower fails to make timely mortgage payments.

How to fill out mortgage demand letter?

To fill out a mortgage demand letter, include the borrower's name, loan details, outstanding balance, payment history, and a request for payment.

What is the purpose of mortgage demand letter?

The purpose of a mortgage demand letter is to notify the borrower of the outstanding balance on the loan and request payment to avoid further action.

What information must be reported on mortgage demand letter?

The mortgage demand letter must include the borrower's name, loan details, outstanding balance, payment history, and a request for payment.

Fill out your pdffiller form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Pdffiller Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.