Last updated on Feb 20, 2026

Get the free home equity reverse

Show details

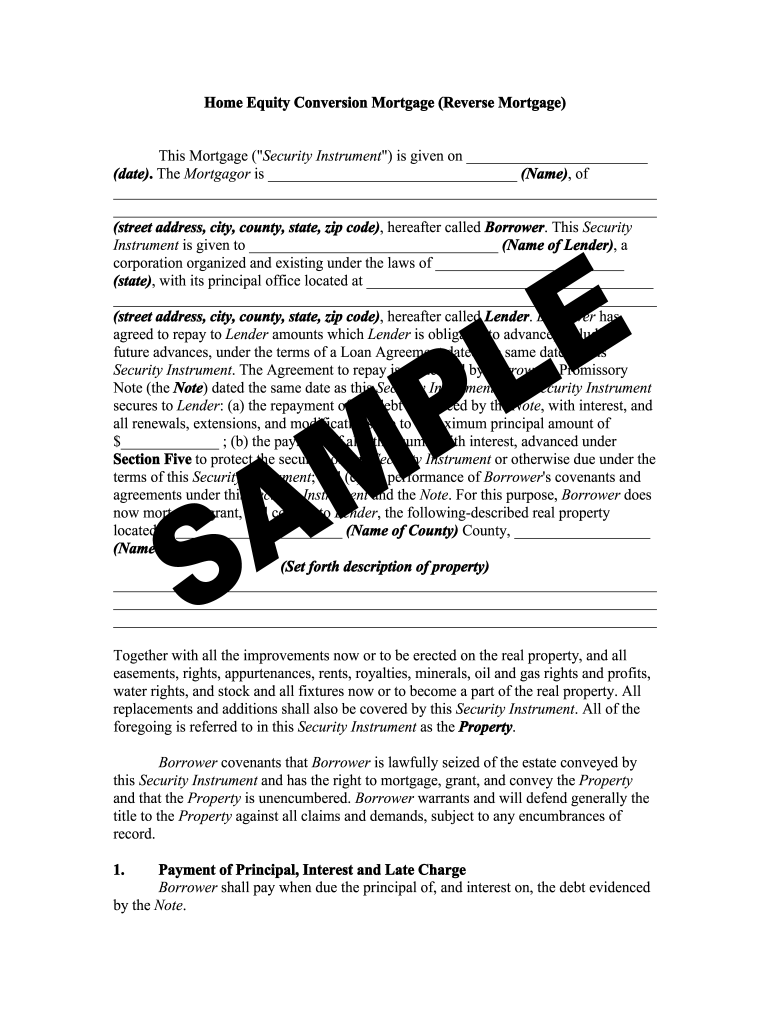

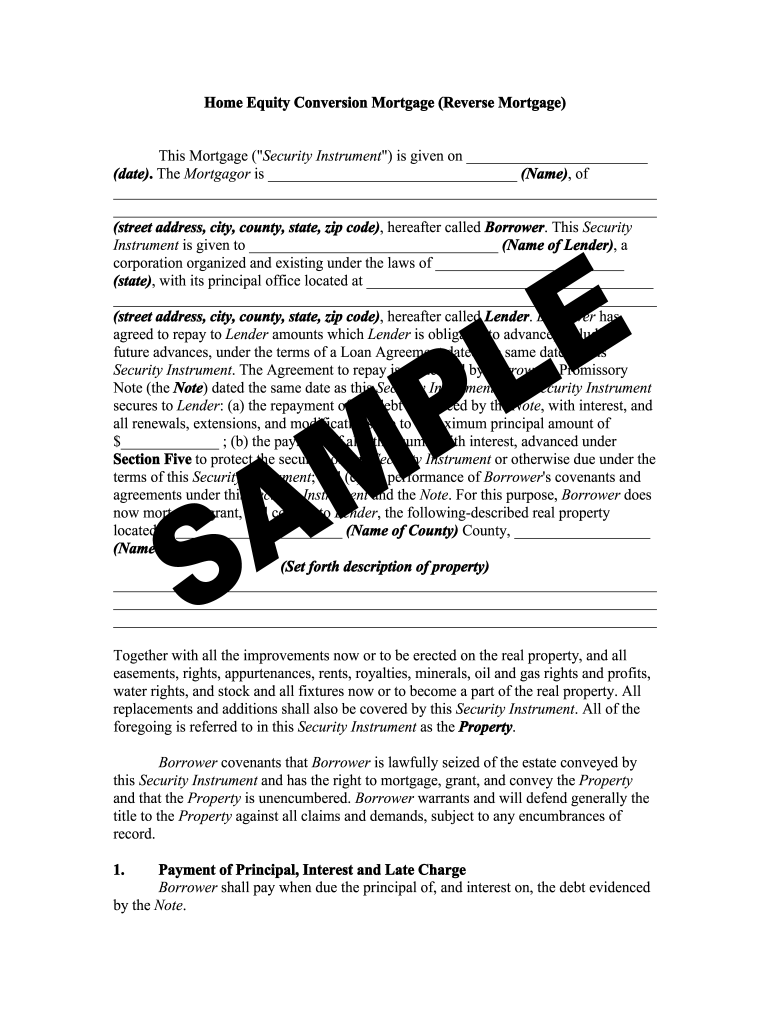

Home Equity Conversion Mortgage (Reverse Mortgage) This Mortgage (“Security Instrument “) is given on (date). The Mortgagor is (Name), of (street address, city, county, state, zip code), hereafter

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is home equity reverse

Home equity reverse refers to a financial product allowing homeowners to convert a portion of their home equity into cash, typically without requiring monthly mortgage payments.

pdfFiller scores top ratings on review platforms

Get trial period and easy to use pdf writter <3

I appreciate a free trial and I was able to get the one form that I needed. I simply cancelled so I don't forget to cancel the 30-day trial and get charged! Thank you very much for the easy to fill form.

it is easy to use with nice platform. Just 1 issue, i was unable to find how to merge my PDF doc.

Great

I'm just getting started with it, but, seems to be very user friendly and I'm excited to use it

Worked great and did what I needed. One option that could make it better would be the ability to initial as well as sign.

Who needs home equity reverse?

Explore how professionals across industries use pdfFiller.

Comprehensive Guide to the Home Equity Conversion Mortgage Reverse Mortgage Form

How do home equity reverse mortgages work?

Home equity reverse mortgages, specifically the Home Equity Conversion Mortgage (HECM), allow homeowners aged 62 or older to convert a portion of their home equity into loan proceeds without having to make monthly mortgage payments. This financial product is designed to provide seniors with additional cash flow during retirement. Importantly, the loan must be repaid when the homeowner sells the home, moves out, or passes away.

-

HECM is a federally insured reverse mortgage product that enables seniors to tap into their home equity.

-

Unlike conventional mortgages, reverse mortgages do not require monthly payments; instead, the loan balance increases over time.

-

To qualify, one must be at least 62 years old, own the home outright or have a low mortgage balance, and live in the home as their primary residence.

What do you need to know about the Home Equity Reverse Mortgage Form?

The Home Equity Conversion Mortgage reverse mortgage form is a vital document that stakeholders use to apply for a HECM. Understanding this form can streamline the application process. The mortgage form has crucial sections that must be completed accurately to ensure the effective processing of the loan application.

-

The form includes vital information about the mortgagor, lender, and details of the property being mortgaged.

-

Key sections include mortgagor details, lender information, and a comprehensive description of the property.

-

Accurate completion of the form is essential to prevent processing delays and ensure compliance with regulatory standards.

What are the key components of the Mortgage Security Instrument?

The Mortgage Security Instrument is a foundational aspect of a reverse mortgage. Understanding its components helps borrowers grasp their rights and responsibilities under the loan agreement.

-

The form requires specific information about the mortgagor and lender, including names, addresses, and contact information.

-

Understanding repayment agreements outlined in the Promissory Note is critical, as they specify when and how the loan must be repaid.

-

Borrowers should be aware of how interest rates are applied and the conditions under which the loan can be modified or renewed.

How can you fill out the Home Equity Reverse Mortgage Form?

Filling out the Home Equity Reverse Mortgage Form requires meticulous attention to detail. By following step-by-step instructions, users can ensure that the form is completed correctly and avoid common pitfalls.

-

Begin by gathering all necessary documents, then proceed to fill out each section as guided by the form layout.

-

Watch for errors such as incorrect property descriptions or missing signatures, as these can lead to application denial.

-

pdfFiller offers various tools that allow users to edit, sign, and manage documents efficiently, making the form-filling process smoother.

What are the alternatives to reverse mortgages?

While reverse mortgages provide a valuable option for cash flow, they are not the only route. Prospective borrowers should consider alternatives such as home equity loans and other financial strategies.

-

These loans allow homeowners to borrow against their home's equity, typically requiring monthly payments.

-

Refinancing can reduce monthly payments but may not be accessible to all borrowers.

-

Selling a larger home and moving to a smaller property can free up cash and reduce ongoing expenses.

-

Strategies like budgeting or reducing discretionary spending can help manage expenses without relying on reverse mortgages.

What compliance and legal considerations should you keep in mind?

Compliance with state regulations is crucial when it comes to reverse mortgages. Understanding your rights and responsibilities is essential for a successful borrowing experience.

-

Different states have their own rules regarding reverse mortgages; borrowers should familiarize themselves with these laws.

-

It's important to know your legal rights as a borrower to avoid potential pitfalls.

-

pdfFiller provides document management solutions that ensure compliance, giving users peace of mind during the process.

How to fill out the home equity reverse

-

1.Start by downloading the home equity reverse form from pdfFiller.

-

2.Open the PDF file using pdfFiller's editor.

-

3.Fill in your personal information, including name, address, and contact details.

-

4.Provide details about your home, such as its current value and mortgage balance.

-

5.Indicate your income sources and current financial situation honestly.

-

6.Make selections regarding the type of reverse mortgage you're interested in.

-

7.Review all entered information for accuracy and completeness.

-

8.Sign the form electronically using pdfFiller's signature tools.

-

9.Download or print the completed form and make copies for your records.

-

10.Submit the form to your chosen lender according to their application procedures.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.