Last updated on Feb 17, 2026

Get the free pdffiller

Show details

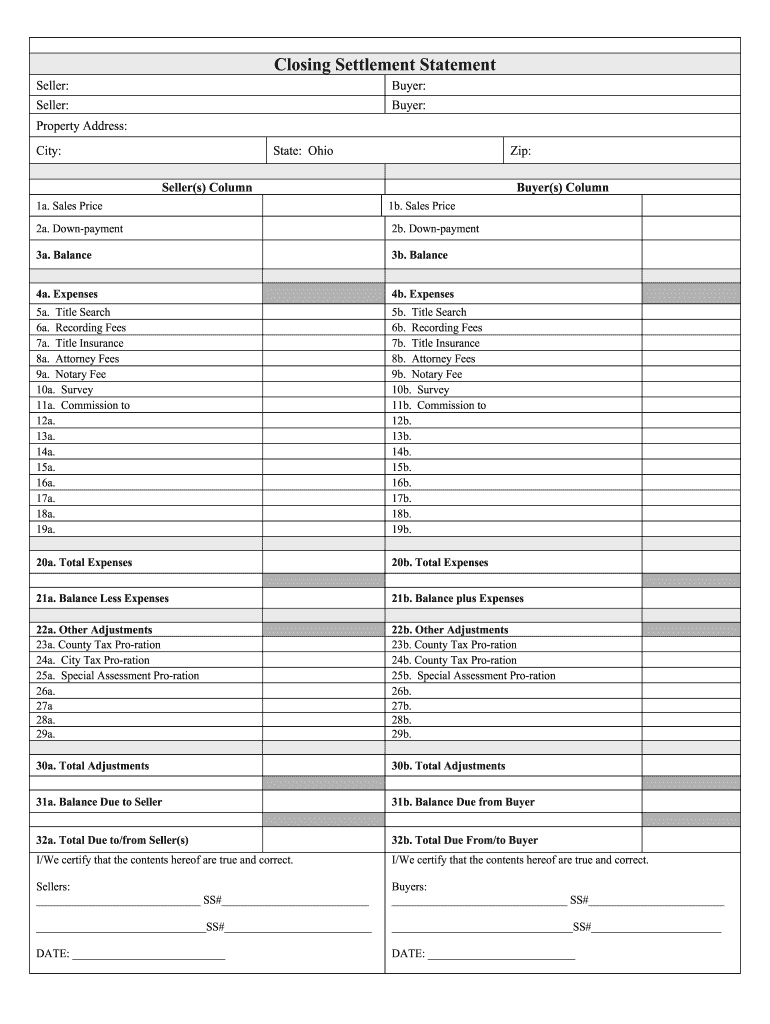

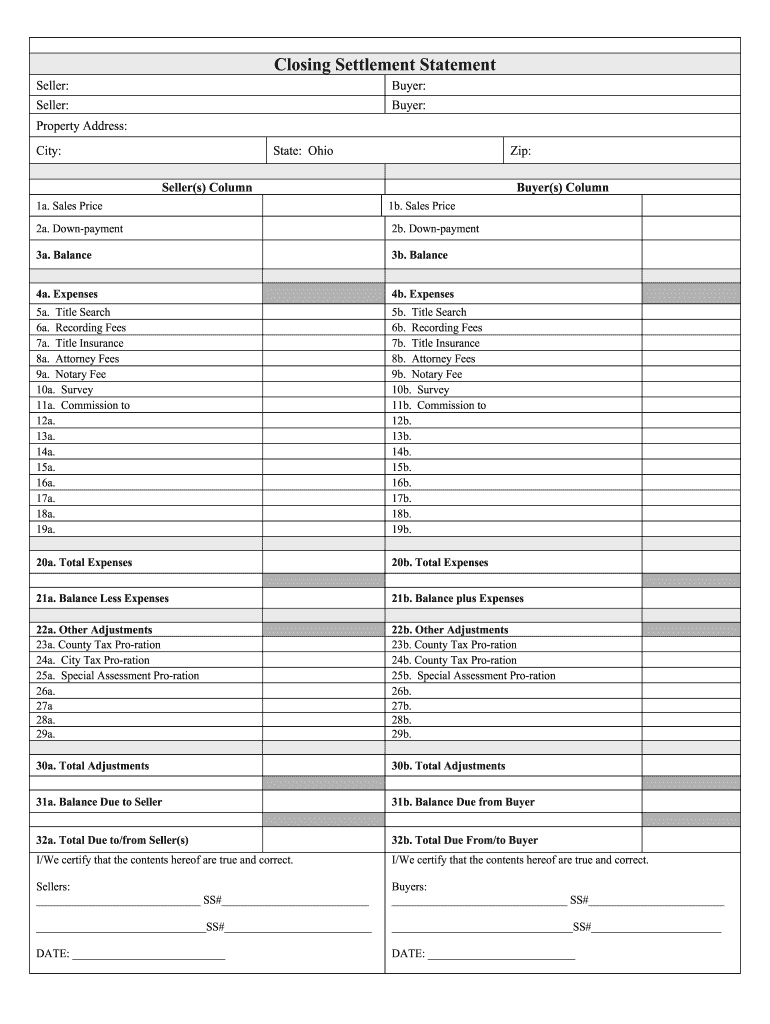

Closing Settlement Statement

Seller:Buyer:Seller:Buyer:Property Address:

City:State: Ohio:Seller(s) Column

1a. Sales PriceBuyer(s) Column

1b. Sales Price2a. Downpayment2b. Downpayment3a. Balance3b.

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is closing statement form

A closing statement form is a document that outlines the final details of a real estate transaction, including costs and credits for both the buyer and seller.

pdfFiller scores top ratings on review platforms

great

awesome program

I operate a small legal practice and…

I operate a small legal practice and this is a fabulous and easy to use addition to our systems.

It satisfied my requirment

It satisfied my requirment

I have not been able to see the…

I have not been able to see the completed report yet

awesome!

awesome! great app that allow great level of editing elements especially the "erase element" tool

it is wonderful

This is very easy to use. Very user friendly.

Who needs pdffiller form?

Explore how professionals across industries use pdfFiller.

Comprehensive Guide to Closing Statement Form on pdfFiller

To successfully fill out a closing statement form, you need to understand its components, fill it accurately, and ensure it's signed by both parties. This guide will walk you through each step, ensuring you can leverage pdfFiller for a seamless experience.

What is a closing settlement statement?

A Closing Settlement Statement, often referred to as a HUD-1, is a document that outlines the financial details of a real estate transaction. Its primary purpose is to itemize all charges and credits to the buyer and the seller, providing transparency and clarity regarding the costs involved in the transaction.

Accurately filling out the statement is crucial as it can significantly impact both parties' understanding of the financial aspects of the transaction. This document serves as a vital record for the closing process, ensuring all parties know their financial obligations.

-

The primary participants are the seller, who conveys the property, and the buyer, who acquires ownership.

-

Important to avoid disputes or misunderstandings regarding financial responsibilities.

What are the key components of the closing settlement statement?

The closing settlement statement typically consists of two main columns: one for the seller and one for the buyer. Each column lists essential line items that impact the overall transaction.

-

The total amount for which the property is sold, which can affect tax implications.

-

The initial amount paid upfront, which reduces the loan amount needed.

-

Refers to the remaining amount due after the down payment.

-

Various fees that may include inspection costs, loan origination fees, and closing costs.

How do you fill out the closing settlement statement?

Completing a closing settlement statement can seem daunting, but following a systematic approach simplifies the task. Start by gathering essential documents and using a clear template from pdfFiller.

-

Collect all relevant financial documents and agreements related to the sale.

-

pdfFiller offers interactive tools for easy editing, making it efficient to input data.

-

Utilize pre-filled templates provided by pdfFiller to reduce errors and save time.

-

Double-check information to minimize errors, such as miscalculating totals.

What are the common expense items in a closing statement?

Expenses can vary widely, but understanding common fees involved in the closing process can assist buyers and sellers in financial planning. It is crucial to be aware of these costs to avoid surprise expenses during the closing.

-

Confirms property ownership and reveals any liens or encumbrances.

-

Charged by the county to record the new deed; essential for legal ownership.

-

Protects against future claims on the property; an essential cost at closing.

-

Covers legal services; advisable to consult an attorney during closing.

-

Fees for notarizing documents, which adds validity to the settlement.

How are adjustments and prorations handled?

Adjustments and prorations are vital components that ensure fairness in cost sharing between the buyer and seller post-sale. Understanding how to accurately input these adjustments into the closing statement can prevent future disputes.

-

Correct the overall amount owed or collected on partial payments.

-

Based on who owns the property at specific times; crucial in areas with local regulations.

-

Ongoing charges like city improvements; necessary to consider when calculating totals.

What are the steps for certifying and signing the document?

Certifying the closing statement is a final but essential step in the transaction process. Both parties must sign the document, which formalizes the agreement and indicates that all information is correct.

-

Both seller and buyer ensure that all entries are accurately represented.

-

Follow specific signing guidelines to maintain legal integrity and enforcement.

-

pdfFiller’s eSign feature allows secure digital signing, enhancing convenience and security.

What are the next steps after completing the settlement statement?

Once the closing settlement statement is completed and signed, the next steps ensure that all parties are clear about what comes next in the transaction process. This phase includes document storage and collaboration, which are critical for effective communication.

-

Discuss what occurs next in terms of transferring ownership and any follow-up actions.

-

Utilize pdfFiller’s cloud capabilities to store documents securely.

-

Ensure that involved teams can access and work on documents efficiently.

What additional context is there for Ohio buyers and sellers?

In Ohio, specific regulations may govern aspects of the closing statement that buyers and sellers should be aware of. It's beneficial for residents to be informed of these regulations to navigate the closing process smoothly.

-

Review local laws regarding required disclosures and document handling.

-

Useful insights for Ohio residents to help minimize confusion during the closing period.

-

Understanding common fees unique to Ohio transactions is essential for proper financial planning.

How can pdfFiller assist with your document needs?

pdfFiller provides a comprehensive suite of features that go beyond closing statements, enhancing your document management experience. Utilizing a cloud-based platform allows for collaboration, accessibility, and improved efficiency.

-

Streamline document workflows by accessing all files in one place.

-

Encourage teamwork and collaboration regardless of team location.

-

Take advantage of various editing tools and integration options for all your documentation needs.

How to fill out the pdffiller form

-

1.Open the closing statement form in pdfFiller.

-

2.Review the transaction details, ensuring all information is accurate.

-

3.Start with the buyer's information section, entering the buyer's name, address, and contact details.

-

4.Move on to the seller's section, filling in the seller's name, address, and contact information.

-

5.Input the property details, including the address, legal description, and sale price.

-

6.List all closing costs, separating costs incurred by the buyer and seller, such as commissions and fees.

-

7.Enter applicable credits for the buyer or seller based on previous agreements.

-

8.Calculate the total amount due or owed by each party, ensuring all calculations are accurate.

-

9.Review the entire form for completeness, checking for any missing information or errors before submission.

-

10.Save and download the completed form, or share it directly with relevant parties as required.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.