Get the free 497329611

Show details

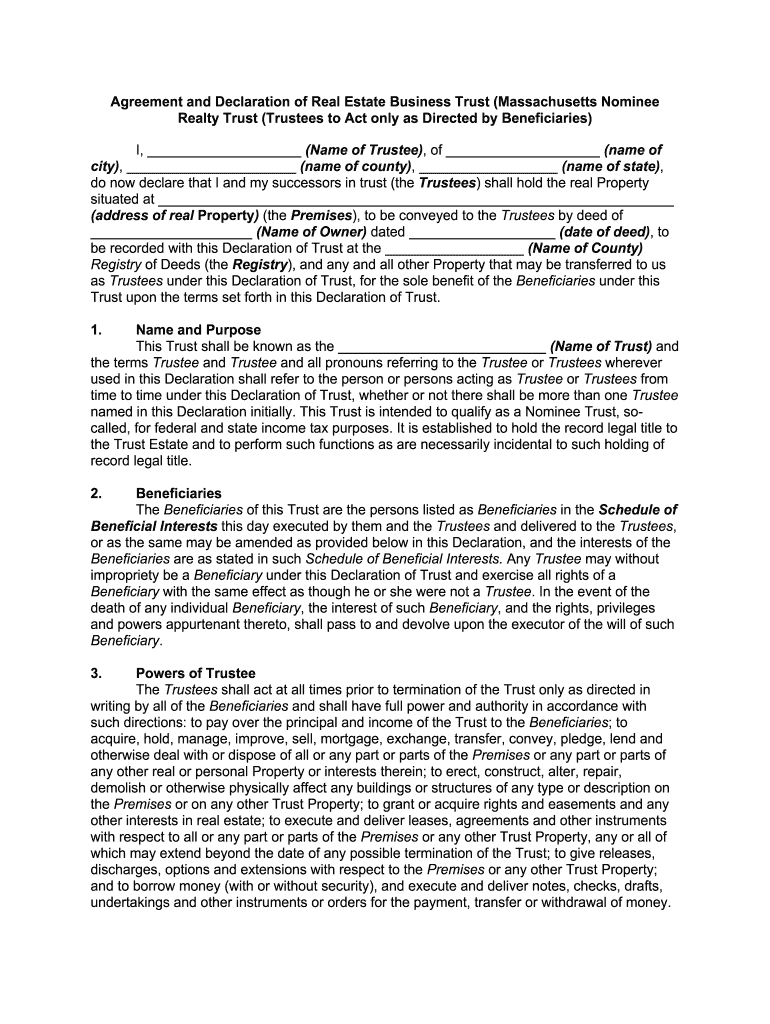

Agreement and Declaration of Real Estate Business Trust (Massachusetts Nominee Realty Trust (Trustees to Act only as Directed by Beneficiaries) I, (Name of Trustee), of (name of city), (name of county),

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is business trust

A business trust is a legal arrangement where assets are held by a trustee for the benefit of beneficiaries, often used for investment purposes or managing real estate.

pdfFiller scores top ratings on review platforms

I love that I can get support when I need it through chat.

Is good but would be nice to be able to move a text box once its created and has text

Nice applications, sometimes doesn't move real smoothe from one blank to the next if you do not need to fill in for that one it seems to get stuck and has a lag, but over all, nice program.

It is an easy to use program.. Unfortunately, I do not have an ongoing use for it.. I only needed a one time form...

Great so far. Confused a bit as to the # of documents that I can store versus folders.

Love being able to fill out forms on computer vs printing out and handwriting in info that is sloppy and messy.

Who needs 497329611 form?

Explore how professionals across industries use pdfFiller.

How to complete a business trust form

What is a business trust?

A business trust is a legal entity that allows individuals to hold and manage property or assets with limited liability. This structure ensures that the trustee manages the trust's assets for the benefit of the beneficiaries. Establishing a business trust can offer numerous benefits, including flexibility in management and potential tax advantages.

What are the key characteristics and components of business trusts?

The major characteristics of business trusts include the separation of legal ownership and beneficial ownership, where a trustee manages the trust's assets on behalf of the beneficiaries. Key components involve a declaration of trust that outlines the terms of the trust, the roles of the trustee, and the rights of the beneficiaries.

What are the benefits of establishing a business trust?

Establishing a business trust offers multiple advantages, such as limited liability protection and potential tax benefits. It can also allow for more straightforward transfer of assets, maintaining privacy, and offering flexibility in managing investments.

What terminology should know when dealing with business trusts?

Understanding key terminology is essential for effectively navigating business trusts. Key terms include 'trustee', who manages the trust, 'beneficiaries', who are entitled to the trust's benefits, and 'declaration of trust', which lays out the guidelines for the trust's operation.

What does the business trust form encompass?

-

The form must specify the name of the trust and its overarching purpose, ensuring clarity of intent.

-

Trustees must be identified clearly, as they will have responsibilities like managing assets and complying with legal requirements.

-

Providing a comprehensive description of the assets held in trust is critical for understanding the trust's scope and obligations.

-

This aspect outlines how the trust’s income or assets will be distributed among the beneficiaries, thereby defining their rights.

How do fill out the business trust form?

Filling out the business trust form involves following a step-by-step guide to ensure completeness and accuracy. Begin by ensuring you have all necessary information, such as the trust name and trustee identification. Common mistakes to avoid include neglecting to verify the accuracy of trustee details and failing to adequately define the trust’s purpose.

How can edit and manage my business trust form?

Editing your business trust form can be made easier by using tools such as pdfFiller, which allows for seamless PDF editing. Collaborative features let team members provide input, ensuring all aspects of the trust are covered. Additionally, consider utilizing cloud storage options to securely upload and store your finalized forms.

What legal considerations are involved in creating a business trust?

-

Each state has different requirements for establishing a business trust, making it important to consult local regulations.

-

Business trusts can affect tax situations differently; thus, understanding federal tax implications is crucial.

-

Engaging with a legal advisor is often critical to ensure compliance and address complexities related to business trusts.

What interactive tools can assist in creating my business trust?

Utilizing templates available on pdfFiller can help simplify the process of creating a business trust. Additionally, guided walkthroughs can provide instructions at each stage of form fulfillment, enhancing user understanding and efficiency. eSigning options expedite the approval process, allowing for rapid progression once the form is completed.

What are the next steps after submitting a business trust form?

-

Understanding the proper filing locations—state-specific or regional offices—is vital for successful compliance.

-

Be aware of any deadlines associated with trust submissions to maintain your trust’s legal standing.

-

Establish regular checks to ensure your trust remains in compliance with state laws and continues to serve its intended purpose.

How to fill out the 497329611 form

-

1.Access the pdfFiller website and log in or create an account.

-

2.Search for the 'business trust' template in the document library.

-

3.Select the template and open it in the editor.

-

4.Fill out the trust name and the type of business involved in the designated fields.

-

5.Input the names and details of the trustee(s) responsible for managing the trust.

-

6.List the beneficiaries who will benefit from the trust's assets or income.

-

7.Include specific provisions regarding trust management, asset distribution, and termination.

-

8.Review the filled document for accuracy and completeness.

-

9.Save your work and choose to print or download the completed business trust document.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.