Last updated on Feb 20, 2026

Get the free california note

Show details

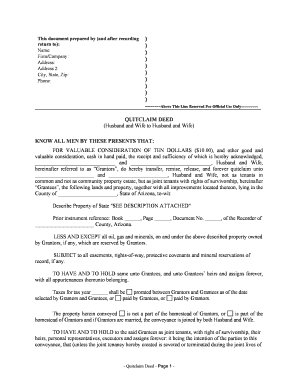

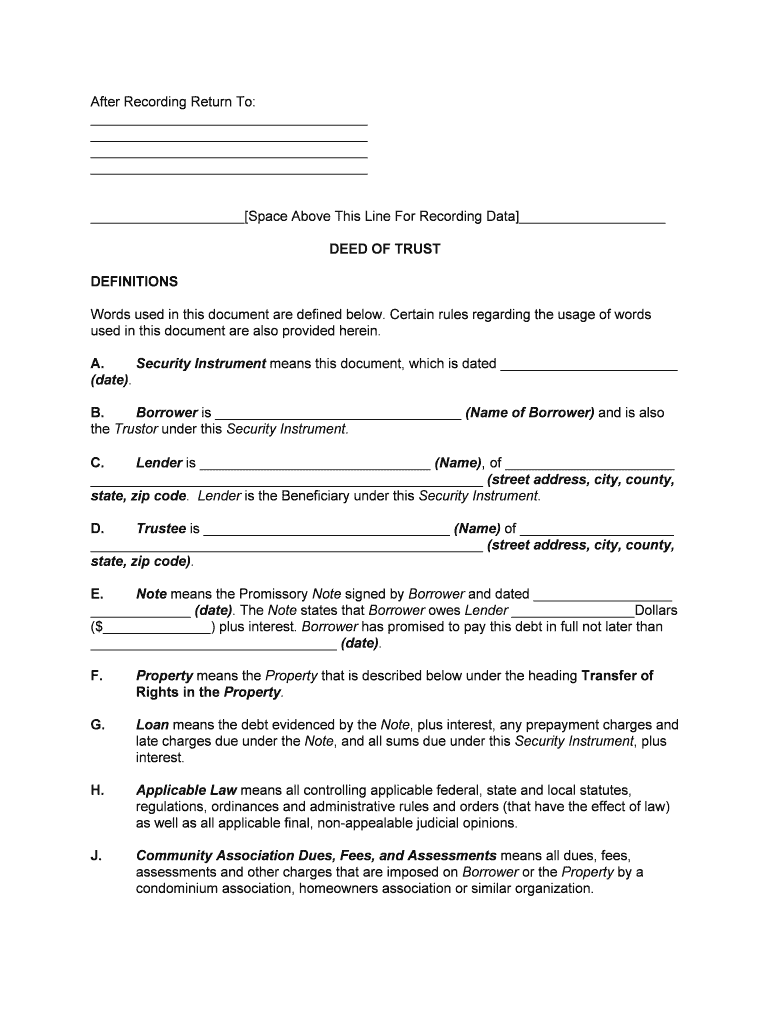

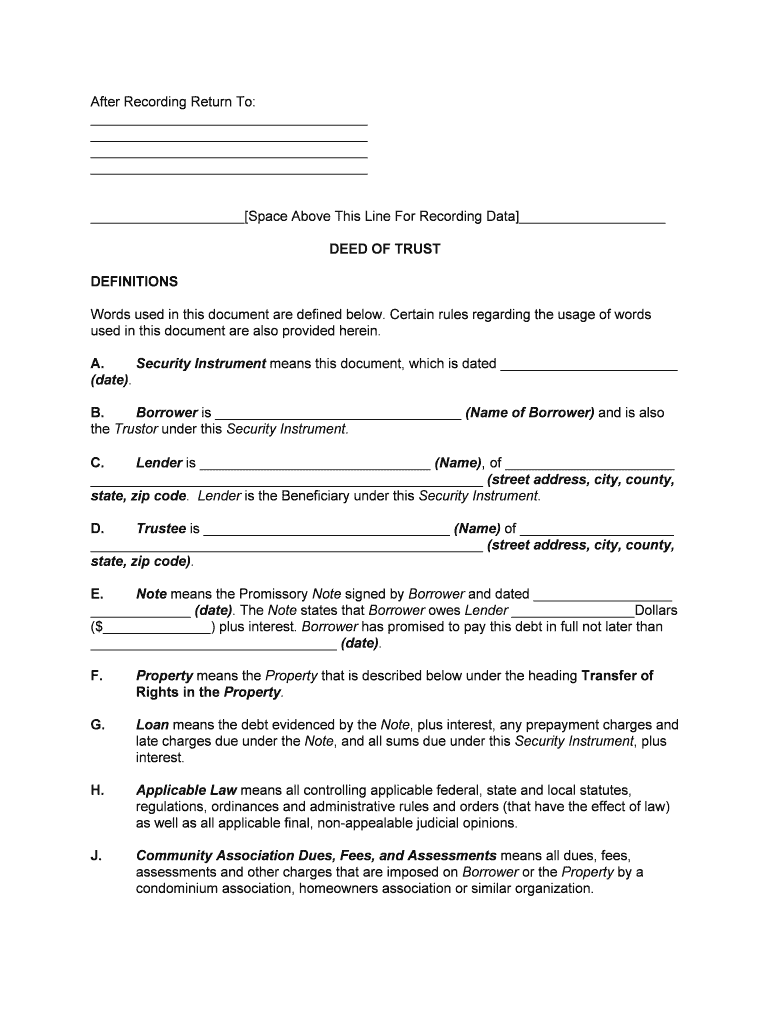

After Recording Return To: Space Above This Line For Recording Data DEED OF TRUST DEFINITIONS Words used in this document are defined below. Certain rules regarding the usage of words used in this

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is california note

A California note is a legally binding document that serves as a promise to repay a loan or debt, often secured by real estate.

pdfFiller scores top ratings on review platforms

once I figured it out, it was pretty straight forward. I have lots more to learn to take advantage of all the features!

I love the ease of using this program and the ability to convert files to PDF forms

Sometimes its a little difficult to navigate around especially for making an application, but once its set it up it works well. Ive noticed 2nd pages are difficult for customers to see and fill out. Wish there was something that would prompt them to go to it.

your software is simply to use. Makes my documents so much easier to send and receive back. Thank you!

I used pdffiller everyday to do my paper work for the company I work for I have not had any problems with pdf filler so far.

I appreciate the ability to save and use templates. I would have to say, it is really time consuming from finishing doc to printing the finished form

Who needs california note?

Explore how professionals across industries use pdfFiller.

Complete Guide to California Note Form

How does a California promissory note work?

A California promissory note is a legal document in which one party agrees to pay another party a specific amount of money, often under specific terms. It is a critical tool in real estate and personal finance, establishing the duties and rights of both the lender and the borrower. In essence, it documents a borrower's promise to repay a loan, and it must comply with California law.

What essential sections must be completed in the California note form?

-

Clearly state the full names and contact information of both the borrower and the lender to avoid confusion later.

-

Clearly document the date on which the note is issued and the total amount being borrowed to provide clarity.

-

Specify the interest rate — whether fixed or variable — and clearly outline when payments are due.

-

Include a precise description of the property to which the loan pertains, minimizing misunderstandings.

-

Document any additional fees or charges that may be incurred throughout the loan duration for transparency.

What legal considerations should be aware of?

In California, various laws govern the use of promissory notes, including state statutes and local regulations. Understanding the legal landscape is crucial for ensuring the enforceability of the note. Failure to comply with these statutes can result in penalties or unintended liabilities for the involved parties.

-

Ensure your note complies with California Civil Code sections that govern promissory notes.

-

Consider laws that might affect your agreement, including specific lending practices in California.

-

If the property is part of a community association, consider how dues may impact loan obligations.

-

Noncompliance could lead to foreclosure or other significant financial consequences.

How to edit and sign your California note form effectively?

Utilizing editing tools like pdfFiller streamlines the process of filling out your California note form. With features designed for easy document editing, you can manage your forms efficiently. Not only can you eSign your documents, but you can also collaborate with other parties involved, enhancing communication before finalizing the agreement.

-

Access intuitive tools that allow for quick edits and adjustments to your document.

-

Follow straightforward instructions to eSign your note, ensuring a legitimate signature without needing physical presence.

-

Use cloud-based functionalities to discuss terms or make amendments in real-time with relevant stakeholders.

-

Store your documents safely on pdfFiller, which offers back-end security measures to protect your sensitive information.

How to rate your promissory note form experience?

Evaluating your experience when filling out a California note form is essential for future improvements. Consider learning about user-friendly features that can make form editing more efficient and less time-consuming. Feedback mechanisms also allow for ongoing improvements, ensuring tools meet user needs effectively.

-

Evaluate how well the form served its purpose in meeting your needs and expectations.

-

Consider tools that simplify the editing and signing processes, which improves user satisfaction.

-

Reflect on how seamless the eSigning process was compared to traditional methods.

-

Engage with feedback tools that allow you to voice your thoughts on what could enhance the overall experience.

How to fill out the california note

-

1.Start by downloading the California note template from pdfFiller's website.

-

2.Open the document in the pdfFiller editor for modifications.

-

3.Enter the full legal names of the borrower and lender in the designated fields.

-

4.Specify the loan amount clearly, ensuring it matches the agreed terms.

-

5.Set the interest rate, ensuring it complies with California regulations.

-

6.Outline the repayment schedule, including the due dates and amounts due.

-

7.Add clauses regarding late payments and any penalties that may apply.

-

8.Include the property description if the note is secured by real estate.

-

9.Review the document for accuracy and completeness, making any necessary edits.

-

10.Sign the document either electronically or by printing it out for manual signatures.

-

11.Save the completed note in your account and share it with all involved parties.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.