Last updated on Feb 20, 2026

Get the free kansas deed

Show details

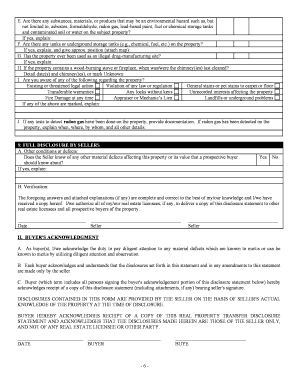

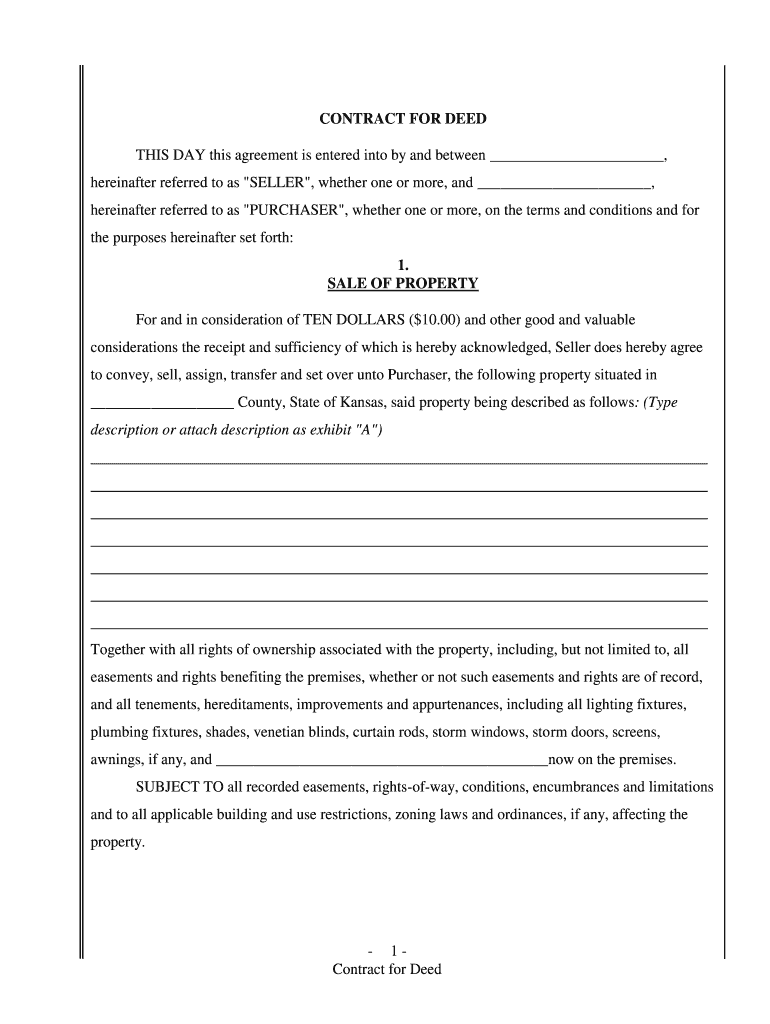

CONTRACT FOR DEED THIS DAY this agreement is entered into by and between, hereinafter referred to as “SELLER “, whether one or more, and, hereinafter referred to as “PURCHASER “, whether one

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is kansas deed

A Kansas deed is a legal document that conveys ownership of real property in the state of Kansas.

pdfFiller scores top ratings on review platforms

It is a great PDF's editor and convertor but sometimes it changes a little bit the format and the speed is not the best :3

een okay, wish you could save more forms in file such as several Proposal with changed name.

I've only used it a few times, but I think that I might be using it more over the next couple of years, as my daughter finishes high school and goes through the college application process! She's also on a couple of sports teams which require the same forms every year; it will be nice to have the info already entered and just modify some dates!

So far has been ok. IRS schedule D page 2 seems to be incorrect compared to form downloaded from IRS.gov.

too many pop up survey ads EVERY TIME I go to use it!!!!!

PDFfiller made everything so much easier.

Who needs kansas deed?

Explore how professionals across industries use pdfFiller.

Comprehensive Guide to Kansas Deed Form on pdfFiller

How to fill out a Kansas deed form

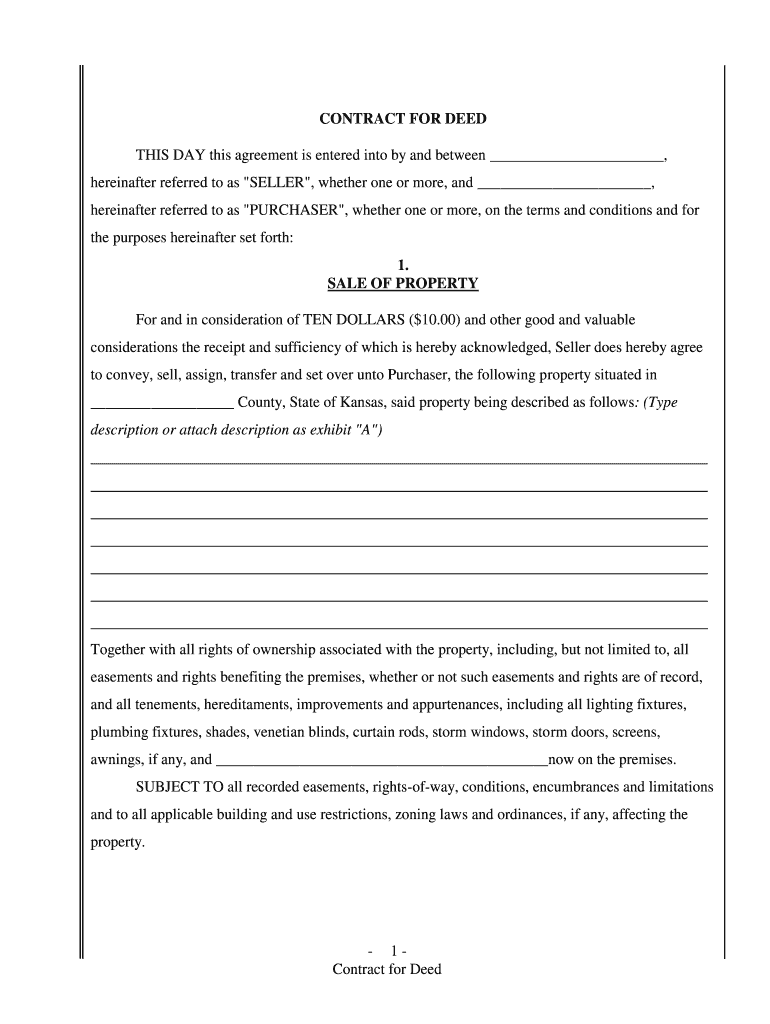

Filling out a Kansas deed form involves several important steps. Begin by clearly identifying the parties involved, detailing property information, and outlining payment terms as specified in the contract for deed. The guide offers insights into editing, signing, and managing these important documents using pdfFiller tools.

What is a Kansas deed form?

The Kansas deed form is a legal document that outlines the transfer of property from one party to another under specific conditions. It serves as both a contract and a means to officially document the sale or transfer of property. Understanding the implications of this form is crucial for both the seller and purchaser.

-

This deed is recognized under Kansas property laws, ensuring all transactions are legitimate and enforceable in court.

-

Typically, the seller (grantor) is the current property owner, while the purchaser (grantee) is the individual or entity buying the property.

-

A Kansas deed form is frequently used in real estate transactions where a contract for deed is preferred over traditional sales methods.

What are the essential components of a Kansas contract for deed?

A Kansas contract for deed contains several key components that ensure a smooth transaction. These components facilitate clarity between the buyer and seller, safeguarding rights and responsibilities.

-

Include full names, addresses, and legal identifiers for both parties to avoid any disputes.

-

Accurate descriptions of the property in question are essential to affirm ownership and boundaries.

-

This includes any easements or rights associated with the property which might affect its use.

How are purchase price and payment terms structured?

Establishing a purchase price and payment terms is essential for both parties. In the context of a contract for deed, negotiations may involve various payment schedules and amounts.

-

The price must reflect the market value of the property, and both parties should agree on it.

-

Purchasers can choose between a lump-sum payment or installments, affecting their financial arrangements.

-

Creating illustrative schedules can help elucidate how payments will be structured over time.

How do you fill out the Kansas deed form?

Completing the Kansas deed form requires meticulous attention to detail. Following a structured approach increases the likelihood of a successful transaction while minimizing errors.

-

Begin with identifying the parties and property before entering in payment and term details.

-

Avoid omitting important information or misrepresenting the property description.

-

Take advantage of the platform’s editing features for seamless entry and signing.

What legal language do you need to interpret in the contract?

The Kansas deed form may include complex legal terms that require careful interpretation. Understanding these terms ensures all parties are compliant and protect their interests.

-

These legal concepts impact how the property can be used by the purchaser and others.

-

Ensure that the contract adheres to Kansas laws to avoid possible legal issues.

-

Terms like 'encumbrance' need to be clearly understood to ensure legally sound decisions.

How can interactive tools assist you on pdfFiller?

pdfFiller provides robust interactive tools that simplify document management. These tools enhance collaboration for individuals and teams working on a contract.

-

Use the interactive interface to manage all your documents efficiently.

-

Real-time collaboration allows multiple users to edit and review the document concurrently.

-

eSigning within the platform is secure and straightforward, streamlining completion.

How do you manage your completed contract for deed?

Best practices for managing your contract after completion include securing and organizing the document effectively. This ensures easy access for future needs and revisions.

-

Utilize cloud storage solutions to ensure your documents are accessible from anywhere.

-

Keep your contract editable for any changes that may occur post-signing.

-

Use pdfFiller for continuous document support and updates as necessary.

How to fill out the kansas deed

-

1.Open the Kansas deed template on pdfFiller.

-

2.Begin by entering the grantor's information, including their full name and address.

-

3.Next, provide the grantee's information, ensuring to include their full name and address as well.

-

4.Fill in the legal description of the property being transferred. This can usually be found in previous deed documents or property records.

-

5.Include the consideration amount, which is the value exchanged for the property.

-

6.Clearly state any property restrictions or covenants if applicable.

-

7.Review all entered information for accuracy to prevent legal issues.

-

8.Sign the deed where indicated. Ensure that the signature is witnessed and notarized as required by Kansas law.

-

9.Save the completed deed and print it for recording.

-

10.Submit the original notarized deed to the county clerk's office for recording and retain copies for your records.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.