Get the free in llc

Show details

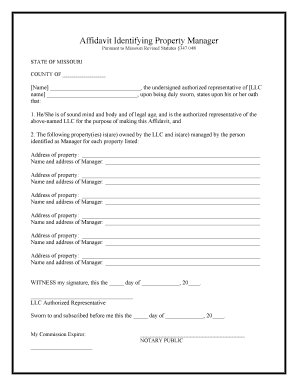

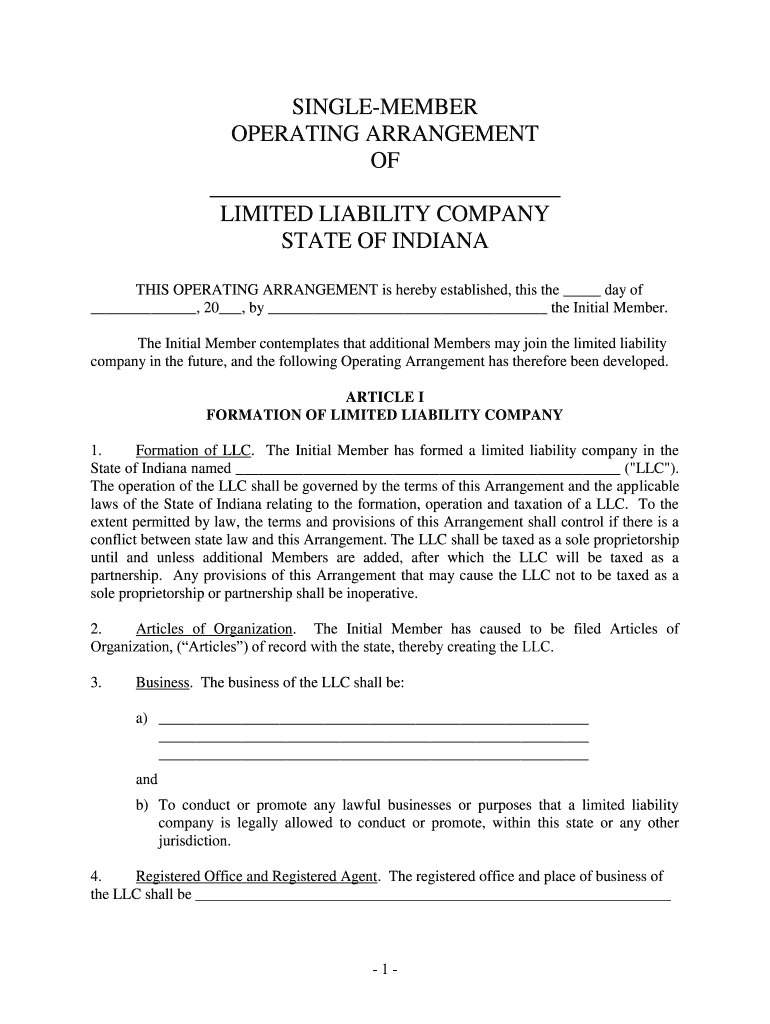

SINGLEMEMBER OPERATING ARRANGEMENT OF LIMITED LIABILITY COMPANY STATE OF INDIANA THIS OPERATING ARRANGEMENT is hereby established, this is the day of, 20, by the Initial Member. The Initial Member

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is in llc

An 'in LLC' refers to a Limited Liability Company that is being formed or registered in a specific state or jurisdiction.

pdfFiller scores top ratings on review platforms

Very user friendly which is a major plus for me

Works as advertised...easy to use...many options

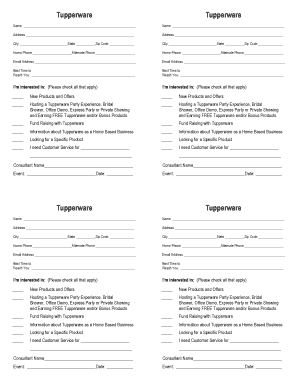

This is a great product to use in a home-based business or more.

So helpful and love how it has my actual signature!

No fee! Thankyou for your normality PDFfille

Overall good. Frustrated that I could not send the form 1065 and 8453 electronically to the IRS

Who needs in llc form?

Explore how professionals across industries use pdfFiller.

Comprehensive Guide to the Single-Member Operating Arrangement in Indiana

This guide provides an extensive walkthrough on forming a Single-Member LLC in Indiana, emphasizing the crucial components of the operating arrangement.

What is a Single-Member ?

A Single-Member LLC is a business structure that combines the benefits of incorporation with the simplicity of a sole proprietorship. It provides limited liability protections for the owner and allows for pass-through taxation, meaning profits are taxed on the owner’s personal tax return.

-

Single-Member LLCs protect personal assets from business debts while offering flexible management options and tax benefits.

-

Unlike sole proprietorships, Single-Member LLCs provide liability protection. Compared to partnerships, they allow for solo ownership, removing the need for shared decision-making.

-

Single-Member LLCs are useful for freelancers, consultants, and small business owners wanting liability protection and tax benefits.

How to form a Limited Liability Company?

Forming a Single-Member LLC in Indiana involves several key steps that ensure compliance with state laws.

-

Prepare and submit the Articles of Organization to the Indiana Secretary of State, which formally creates your LLC.

-

Ensure clarity in ownership, as a Single-Member LLC does not require additional partners or members.

-

Adhere to state regulations by understanding ongoing compliance needs, including annual reporting.

Why create an Operating Arrangement?

An Operating Arrangement is crucial for your Single-Member LLC as it outlines the management and operational framework of your business.

-

This document protects your limited liability status and clarifies your business processes.

-

Each arrangement should include member rights, management structure, and allocation of profits.

-

Include clauses for dispute resolution, breaking down responsibilities, and detailing tax approaches.

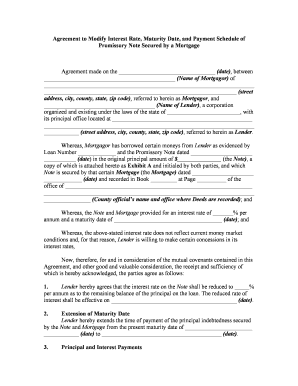

What are the tax considerations for Single-Member LLCs?

Understanding tax obligations is vital to ensure compliance and optimal financial planning for your Single-Member LLC in Indiana.

-

Single-Member LLCs typically file taxes as sole proprietorships, unless they elect to be taxed as a corporation.

-

Unlike partnerships, LLCs provide pass-through taxation, meaning business income reports directly to the owner's tax return.

-

It is essential to understand forms and schedules needed for timely tax filings.

How should business operations be conducted under this structure?

Conducting business as a Single-Member LLC offers flexibility but also requires adherence to legal obligations.

-

Ensure compliance with local licensing and permit requirements for your industry.

-

Define the scope clearly as this impacts both operations and tax treatments.

-

You control all aspects but must document decisions to maintain the LLC’s legal protections.

What are the responsibilities of a registered office and agent?

Selecting a registered office and agent is critical for ensuring your LLC's compliance within Indiana.

-

The registered agent acts on behalf of the LLC for legal documents and notices.

-

Maintain a physical office address in Indiana for official government communications.

-

Understand the steps involved in changing your agent or registered office, maintaining operational continuity.

How to maintain compliance and necessary filings?

Ensuring compliance involves regular checks and updates to keep your LLC in good standing.

-

Conduct audits to ensure compliance with all operational and financial regulations.

-

File your LLC’s annual reports reflecting current business status and information.

-

Maintain open communications with state agencies for timely updates and changes.

How can pdfFiller help manage documentation?

Utilizing pdfFiller can streamline document creation and ensure your LLC management is efficient and compliant.

-

pdfFiller offers tools to create and manage all LLC forms, emphasizing user-friendliness.

-

Easily sign documents electronically, speeding up the process for any required agreements.

-

Access the Operating Arrangement and related forms from anywhere, ensuring flexibility.

How to fill out the in llc form

-

1.Begin by accessing pdfFiller and logging into your account.

-

2.Search for the 'in LLC' form template in the search bar.

-

3.Once located, click on the template to open it in the editor.

-

4.Fill in your company name in the designated field, ensuring it complies with state requirements.

-

5.Provide the principal office address of the LLC in the next field.

-

6.Enter the duration of the LLC if it is not perpetual; otherwise, specify 'perpetual'.

-

7.List the registered agent’s name and address; this is the person or entity authorized to receive legal documents.

-

8.Include the members' details, indicating who will own the LLC and their percentage of ownership.

-

9.Allocate time to review all entered information for accuracy and completeness before submission.

-

10.Finally, save the completed form and select the option to either download, print or submit it directly online for processing.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.