NJ-02501 free printable template

Show details

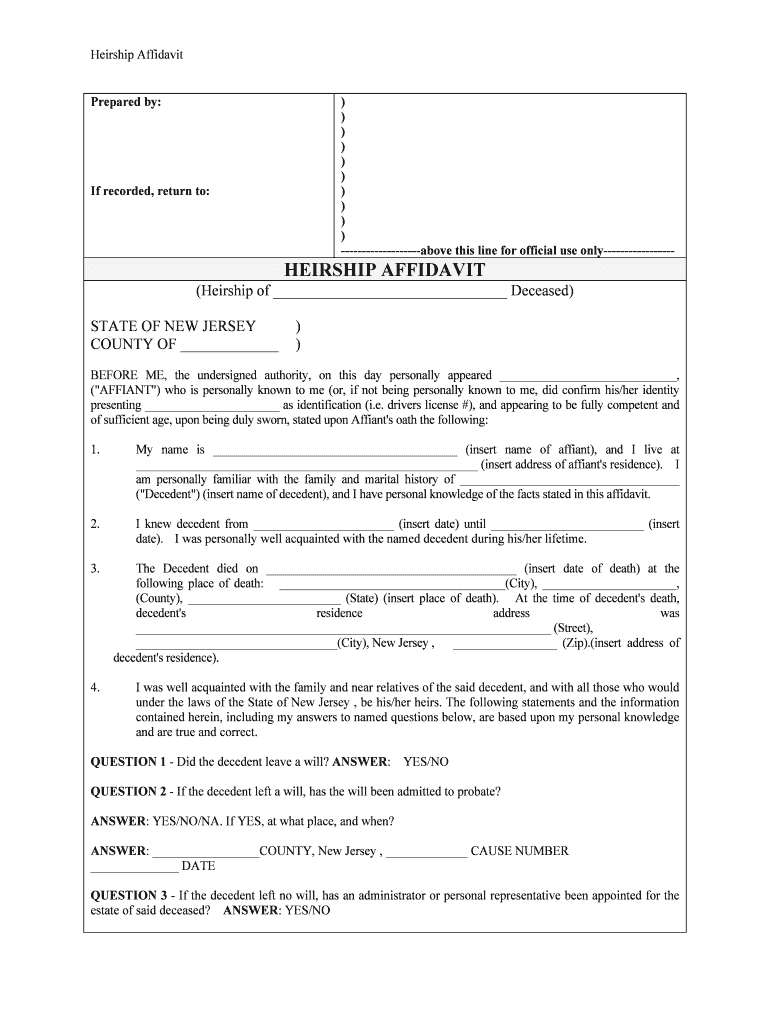

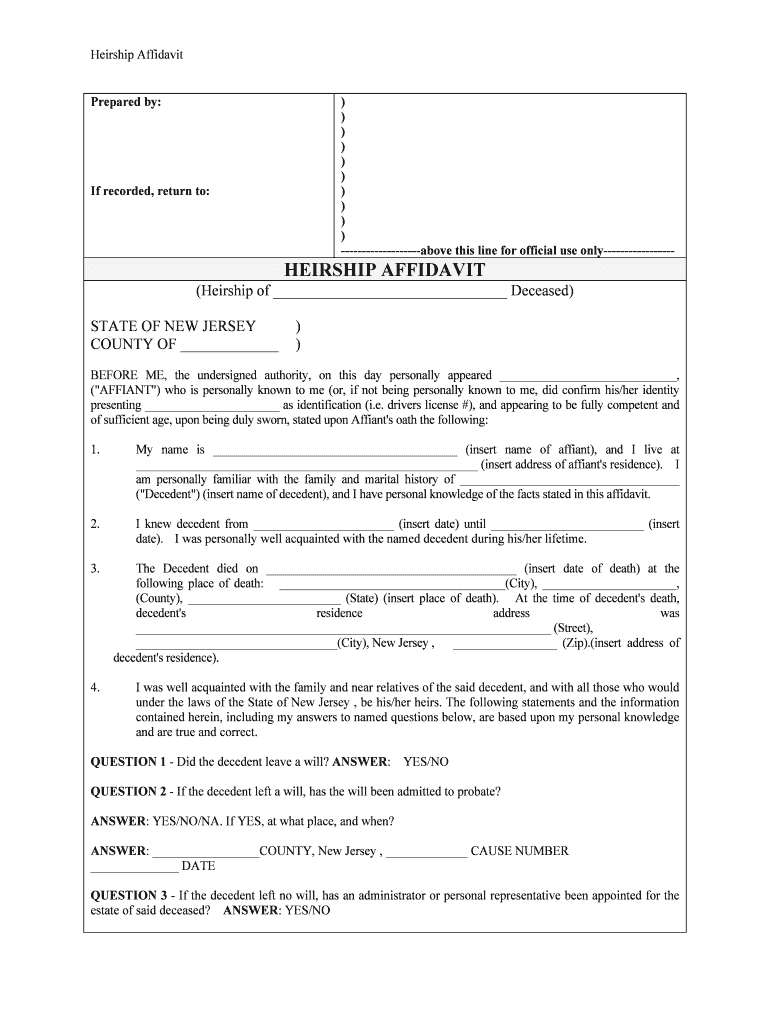

Warship AffidavitPrepared by:)))))))))) above this line for official use only recorded, return to:HEIRS HIP AFFIDAVIT (Warship of Deceased) STATE OF NEW JERSEY COUNTY OF))BEFORE ME, the undersigned

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

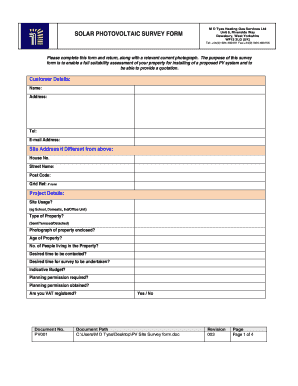

What is NJ-02501

NJ-02501 is a document used for reporting income tax withholding in New Jersey.

pdfFiller scores top ratings on review platforms

EXCELLENT SERVICE

EXCELLENT SERVICES

Too expensive for casual users

It's too expensive for third world countries. I just need to remove some watermarks. I need it to use it once a month

Very user-friendly and useful tips. Better than Adobe Acrobat in my opinion. Thanks!

Very user-friendly.

They have a very good service

ease of use and easy to find the help…

ease of use and easy to find the help you need when you get a little stuck.

Fabulous for filling out any forms online, especially...

Fabulous for filling out any forms online, especially when online applications are not quite right, you can line up any type of print in the boxes to look professional, even check mark in boxes!

Who needs NJ-02501?

Explore how professionals across industries use pdfFiller.

How to fill out the NJ-02501

-

1.Open the NJ-02501 form on pdfFiller.

-

2.Begin by filling out your business name and address in the specified fields at the top of the form.

-

3.Enter your New Jersey Employer Identification Number (EIN) in the designated box.

-

4.Complete the section regarding the tax period by selecting the appropriate year and quarter.

-

5.Proceed to the income and withholding section; report total wages paid and tax withheld accurately.

-

6.Make sure to provide any additional details if the fields require further explanation or specify any exceptions.

-

7.Double-check all entered information for accuracy and completeness to avoid potential issues.

-

8.Review the affirmation section, which may require a signature or an official company stamp.

-

9.Once the form is complete, save your changes and download it as a PDF.

-

10.Submit the NJ-02501 form as per local regulations, either electronically or by mail, ensuring it meets the deadline.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.