Last updated on Feb 20, 2026

US-PI-0009 free printable template

Show details

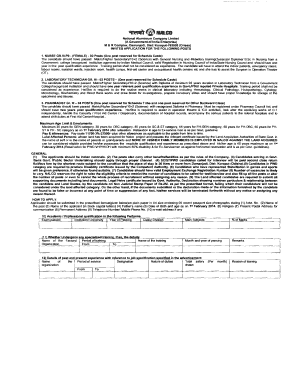

WAGE AND INCOME LOSS

NAME OF CLIENT

Please keep an accurate record of time you lost from work as a result of your accident; amount

you were paid by your employer or others; the reason for your absence.

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

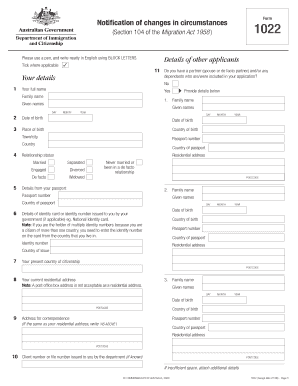

What is US-PI-0009

US-PI-0009 is a form used for submitting personal information for various official and administrative purposes.

pdfFiller scores top ratings on review platforms

PDFfiller is a GREAT program with INCREDIBLE customer service!

PDFfiller is a GREAT program! It is very easy to use. It helped me tremendously when I had a project and needed to fill out literally hundreds of documents online. The program worked very well, was incredibly responsive, & even kept all of my documents for easy access as well. Most importantly, however, is that they have absolutely INCREDIBLE customer service! I used the chat feature and it was totally painless and even enjoyable. I was treated very well by the chat rep (Paul)! I am a single mother who is trying to start a small business with VERY limited funds. I meant to cancel my plan before my 30-day trial was over. Like so many other times in my hectic life, I guess I forgot! I was quite anxious about it as many companies charge high cancelation fees if you fail to cancel during the trial. There was no need to worry though. I simply logged into my account and then I saw the chat feature. I chose to use it even though I was hesitant to do so (many companies do not provide very good customer service through chat). The response time was extremely fast. I asked to cancel my membership and he replied right away that he would do that for me. Here is the best part, he then proceeded to ASK me if I would like a refund as well!! Now that is WONDERFUL CUSTOMER SERVICE!! Thanks so much, PDFfiller & Paul! I will definitely use them in the future and recommend them to my family and friends. You just do not see that level of customer care combined with great products anymore. I was quite impressed!

fine fine

fine fine, everything is good. that is all.

amazing results simple to use

amazing results simple to use, I love it

Very easy template to use

Very easy template to use - very user friendly.I am still checking it out.

I couldn't find new forms to download…

I couldn't find new forms to download from within the app but once I did find them online they were easy to work with

Yes its perfect way to create editable…

Yes its perfect way to create editable PDFS

Who needs US-PI-0009?

Explore how professionals across industries use pdfFiller.

A comprehensive guide to the US-PI-0009 form

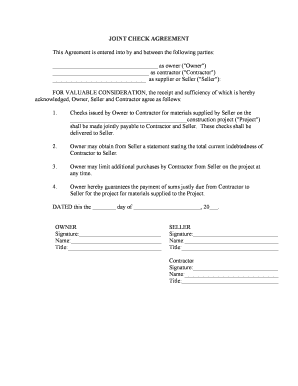

What is the US-PI-0009 form?

The US-PI-0009 form is a critical document used for documenting wage and income loss resulting from accidents or unforeseen events. Its primary purpose is to accurately capture financial losses incurred due to injuries that hinder the ability to work. Understanding its key components is essential for efficient claims processing and securing the necessary compensation.

-

The US-PI-0009 form serves as a formal declaration of income loss related to personal injury claims, ensuring that all financial impacts are recorded.

-

This form plays a crucial role in legal and insurance proceedings, substantiating claims related to both lost wages and medical expenses.

-

Essential sections include the wage and income loss details, medical treatment records, and other related expenses that validate the claims.

How do you fill out the wage and income loss section?

Filling out the wage and income loss section accurately is crucial for ensuring your claim is processed without delays. This part requires a detailed account of your lost work time, including specifics like employer payments and the reasons for your absence. Avoiding common pitfalls can significantly enhance the chances of a successful claim.

-

Clearly state the dates you were unable to work and include the hours impacted to provide a precise narrative of your loss.

-

Include detailed information such as employer payment records, reasons for absence, and any communication regarding your work status.

-

Double-check your entries for accuracy, ensuring that all documentation is consistent and well-organized to prevent misunderstandings.

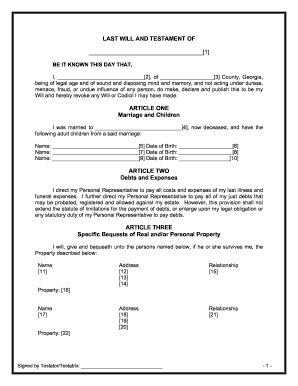

How should you document pain and discomfort?

Documenting pain and discomfort accurately is essential, as this information substantiates your claims related to physical suffering and associated medical costs. Stick to a clear and structured format while detailing your experiences, as medical professionals often need this information for future assessments and treatments.

-

Use specific dates and complaints to document your experiences, making sure to include any medications taken for pain relief.

-

Record any medical visits associated with pain management, as these details help build a comprehensive medical history.

-

If pain persists or worsens, consult with a healthcare professional for further examination and treatment, ensuring that all visits are documented.

What are the best practices for managing hospital expenses?

Accurate management of hospital expenses is vital for comprehensive claims. This involves collecting and organizing all bills, fees, and payment records, even those covered by insurance. By documenting every relevant expense, you create a clear picture of your financial burden post-incident.

-

Ensure all hospital bills, lab fees, and treatment charges are systematically organized for easy access during the claims process.

-

Record all expenses related to your treatment, no matter who paid, as this information could be crucial for reimbursement.

-

Upon discharge, request detailed bill statements to facilitate accurate tracking of your expenses.

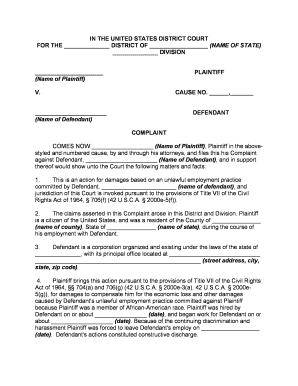

How to track doctor's expenses and transportation?

Maintaining a comprehensive record of doctor's visits, including costs and transportation expenses, is crucial for maximizing your reimbursement potential. This documentation helps to validate claims associated with diverse health services and additional transport costs incurred during the recovery period.

-

Maintain records of all visits, specifying if they were home visits, to provide accurate accounts of the services rendered.

-

Keep track of mileage, taxi, and parking costs incurred while attending medical appointments for full reimbursement.

-

Use a ledger or digital tool to list all cardiovascular visits and related travel to maintain an organized history.

What should you include for physiotherapy and rehabilitation costs?

Documenting costs related to physiotherapy and rehabilitation is essential for your claim, as these sessions often incur significant expenses. Keep detailed records of all sessions attended, including receipts and associated travel costs.

-

Keep receipts and notes from each therapy session, detailing the type of treatment and costs involved.

-

Record all transportation expenses to and from therapy appointments to include these in your overall claim.

-

Ensure all relevant documents are compiled together for easier processing and verification during claims.

How do you track prescription and non-prescription costs?

Tracking both prescription and non-prescription medication costs is critical to establishing the full extent of your medical expenses. Proper documentation helps you gather all necessary evidence for your claims related to treatment costs.

-

Log every medication prescribed post-accident, including dosages and costs, to create a detailed expense history.

-

Specify the prescribing doctor and reason for the medications to strengthen your claims documentation.

-

Keep all pharmacy receipts organized for easy reference during the filing of your claim.

What miscellaneous expenses should be declared?

Don't overlook miscellaneous expenses when filing your claims, as these can include essential costs like ambulance fees and domestic help. Detailed documentation of every relevant expense ensures thorough validation of your overall financial losses.

-

Document any expense not covered under main categories, such as domestic assistance or transportation service costs.

-

Gather necessary receipts and documents to support personal property loss claims, enhancing your overall claim narrative.

-

Ensure that all receipts are kept organized, as complex cases may require thorough evidence to substantiate claims.

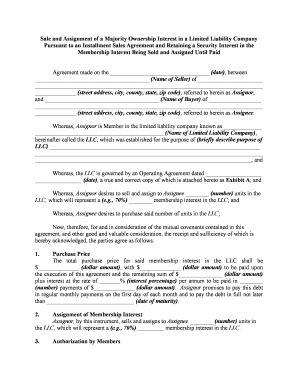

How to fill out the US-PI-0009

-

1.Open the US-PI-0009 form on pdfFiller.

-

2.Begin by entering your personal information in the designated fields, including your full name, address, and contact details.

-

3.Provide any required identification numbers, such as Social Security or taxpayer identification number.

-

4.In the next section, fill out demographic information as requested, ensuring accuracy.

-

5.If applicable, include information regarding any dependents or additional individuals related to the application.

-

6.Review all sections thoroughly for any missing or incorrect information.

-

7.Use the digital tools available on pdfFiller to adjust any text or checkboxes as needed.

-

8.Once complete, save your changes to avoid losing any data.

-

9.Finally, submit the form electronically through pdfFiller or download it for manual submission, following the specific guidelines provided.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

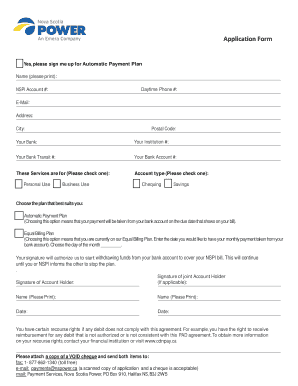

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.