Get the free Texas Texas Southern District Bankruptcy Guide and Forms Package for Chapters 7 or 13

Show details

U.S. Legal Forms, Inc. Bankruptcy Forms and Information Package SOUTHERN DISTRICT OF TEXAS This package includes uniquely packaged forms and information for Chapter 7 or Chapter 13 Bankruptcies, with

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

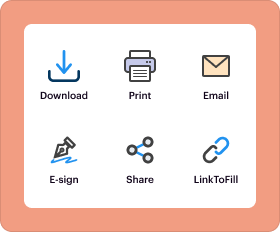

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is texas texas souformrn district

The Texas Texas Souformrn District is a specialized document related to educational or administrative procedures in Texas, outlining specific guidelines and requirements.

pdfFiller scores top ratings on review platforms

I have changed a few documents and so far seems Great.

I don't need legal documents very often & purchased to help a friend get through a difficult time. much better than hand writing all of the documents out. makes it look professional and I will probably use in the future as well, if needed.

LOVE IT!!!! I was going through sooo many missions printing contracts out and filling them pout by hand. But now with PDFfiller it has made my life sooooooooo much easier!!!

It's sometimes hard to navigate but I'm getting better at it. Needed something like this for some time.

wish I could fill in fields on multiple selected documents at once

Liked the program but too expensive to keep in order to make changes to about 1 or 2 pdfs a month.

Who needs texas texas souformrn district?

Explore how professionals across industries use pdfFiller.

Comprehensive Guide to the Texas Southern District Bankruptcy Forms

How does bankruptcy work in Texas?

Bankruptcy is a legal process that allows individuals or entities to discharge some or all of their debts while providing a structured way to pay creditors. In Texas, understanding the nuances of bankruptcy is vital for both individuals and businesses. There are various types of bankruptcy available, including Chapter 7 and Chapter 13, each designed to address different financial situations.

-

Bankruptcy aims to give individuals a fresh start by discharging debts they cannot repay. This legal status can help them regain control over their financial situation.

-

Texas residents can choose from different bankruptcy types, including Chapter 7 for liquidating assets and Chapter 13 for setting up a repayment plan.

-

Understanding terms like 'debtor', 'creditor', and 'discharge' is crucial for navigating the bankruptcy process successfully.

What types of bankruptcy are available in the Southern District?

The Southern District of Texas offers various bankruptcy chapters to cater to different financial circumstances. Knowing which chapter suits your situation can significantly impact your financial recovery.

-

Chapter 7 involves liquidating non-exempt assets to pay creditors. Individuals must meet specific income requirements to qualify.

-

Chapter 13 allows individuals to keep their property while repaying creditors over 3-5 years based on a court-approved plan.

-

The main difference lies in asset liquidation and repayment structure; Chapter 7 discharges debts quickly, while Chapter 13 focuses on structured repayment.

What are the filing requirements and process in Texas?

Filing for bankruptcy involves complying with specific requirements and a step-by-step process that can be complicated without assistance. Knowing these requirements is crucial for a successful filing.

-

Individuals must meet income criteria and have undergone credit counseling before filing. Understanding these criteria is essential to avoid denial.

-

Corporations have distinct filing procedures and need to consider different eligibility requirements compared to individuals.

-

1. Assess eligibility 2. Gather necessary documents 3. Complete bankruptcy forms 4. File with the court.

-

You'll need income statements, tax returns, a list of creditors, and other financial documents to complete your filing.

How to navigate the bankruptcy form landscape?

Understanding the required forms for bankruptcy can be overwhelming, but utilizing tools can simplify the process. That’s where resources like pdfFiller come in handy.

-

Certain federal forms are mandatory for every bankruptcy filing, regardless of the chapter.

-

Each bankruptcy chapter has its own set of forms tailored to its specific requirements. Make sure you're using the correct forms.

-

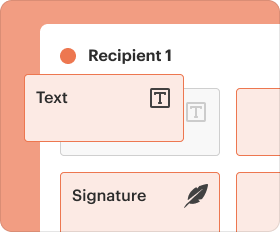

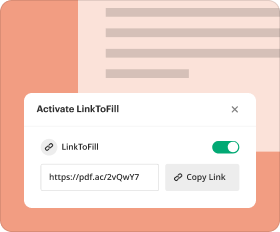

pdfFiller provides essential tools to help users fill out, edit, and manage bankruptcy forms seamlessly.

Why is legal representation important in bankruptcy?

Having an attorney can significantly ease the bankruptcy process, providing you with the expertise necessary to navigate complex legal landscapes. Their role is multifaceted and essential.

-

While individuals can file without an attorney, legal representation is strongly recommended for those with complicated assets or debts.

-

Look for attorneys specializing in bankruptcy law who have experience and a solid track record in the Southern District.

-

Attorneys facilitate filing, ensure compliance, and represent you in court, which can greatly improve the outcomes.

How to manage your bankruptcy journey?

After filing, the journey continues. Understanding what to expect and how to manage potential challenges can lead to a smoother process during your bankruptcy.

-

Communication from the court and creditors, plus the start of the bankruptcy process, are expected.

-

Challenges include potential objections from creditors, which can often be addressed with proper legal guidance.

-

Once filed, ongoing management of documents through platforms like pdfFiller ensures you stay organized.

What additional resources are available for bankruptcy filers in Texas?

Navigating banking isn't solely about forms; finding the right resources online can provide support and education for a successful outcome.

-

Always leverage resources provided by state agencies, including support hotlines for real-time assistance.

-

Joining support groups can offer shared experiences, motivation, and tips for navigating the bankruptcy process.

-

The government offers various resources aimed at educating individuals about the bankruptcy process and their rights.

How to fill out the texas texas souformrn district

-

1.Access pdfFiller and upload the Texas Texas Souformrn District PDF form.

-

2.Begin by reviewing the document layout to understand the required sections.

-

3.Start filling in the personal or organization information in the designated areas, including name, address, and contact details.

-

4.Proceed to complete any specific sections related to project or district information, being sure to provide accurate data.

-

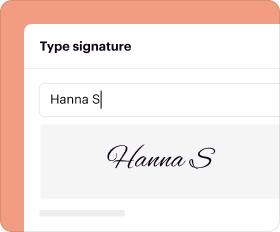

5.If applicable, add signatures or acknowledgment sections as required in the form.

-

6.Review all filled information for accuracy and completeness, correcting any errors.

-

7.Once the document is complete, save the form and select 'Submit' or 'Download' depending on your needs, ensuring you retain a copy for your records.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.