Get the free against estate file

Show details

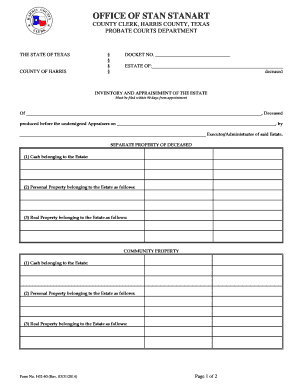

NO. IN RE: THE ESTATE OF, DECEASED IN THE PROBATE COURT NUMBER () OF HARRIS COUNTY, TEXAS SWORN STATEMENT SUPPORTING CLAIM AGAINST ESTATE TO: CLERK OF SAID COURT; and/or TO: INDEPENDENT EXECUTOR OF

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign against estate file

Edit your against estate file form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your against estate file form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing against estate file online

To use our professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit against estate file. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

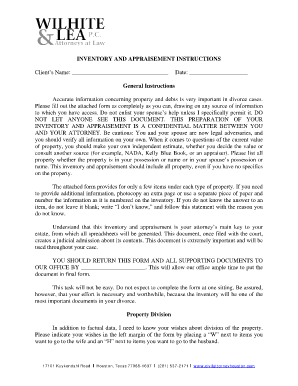

How to fill out against estate file

How to fill out TX-00781BG

01

Begin by downloading the TX-00781BG form from the official website or obtain a physical copy.

02

Fill in your personal information at the top, including your name, address, and contact details.

03

Enter the relevant identification numbers, such as Social Security Number or driver's license number.

04

Follow the instructions in each section carefully, providing accurate information as requested.

05

If applicable, include any supporting documents as specified in the instructions.

06

Review the completed form for any errors or omissions before signing.

07

Submit the form according to the guidelines, ensuring it is sent to the correct address.

Who needs TX-00781BG?

01

Individuals or businesses who are required to comply with the specific regulatory requirements associated with TX-00781BG.

02

Applicants seeking permits, licenses, or other approvals related to the governed activity highlighted in the form.

Fill

form

: Try Risk Free

People Also Ask about

What is Form 1041 vs 706?

In the United States, we have two types of taxes as they relate to death–Form 706, often referred to as an estate tax return, and Form 1041, an income tax return for estates and trusts.

Who must file Form 1041?

If the estate generates more than $600 in annual gross income, you are required to file Form 1041, U.S. Income Tax Return for Estates and Trusts. An estate may also need to pay quarterly estimated taxes.

What triggers an estate tax return?

An estate tax return (Form 706) must be filed if the gross estate of the decedent (who is a U.S. citizen or resident), increased by the decedent's adjusted taxable gifts and specific gift tax exemption, is valued at more than the filing threshold for the year of the decedent's death, as shown in the table below.

Do I have to file a 1041 as a beneficiary?

IRS Form 1041 is used to report any income a trust earns over $600. Like the estate, Form 1041 must be filed regardless of the amount of income earned if a beneficiary is classified as a nonresident alien.

What is claims against the estate?

A claim against an estate is a written request for the estate to pay money that the decedent owed. Because probate laws vary from one state to another, different states have somewhat different procedures for notifying creditors and filing a claim against an estate.

What is a 1041 form?

The fiduciary of a domestic decedent's estate, trust, or bankruptcy estate files Form 1041 to report: The income, deductions, gains, losses, etc. of the estate or trust. The income that is either accumulated or held for future distribution or distributed currently to the beneficiaries.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my against estate file in Gmail?

You may use pdfFiller's Gmail add-on to change, fill out, and eSign your against estate file as well as other documents directly in your inbox by using the pdfFiller add-on for Gmail. pdfFiller for Gmail may be found on the Google Workspace Marketplace. Use the time you would have spent dealing with your papers and eSignatures for more vital tasks instead.

How can I send against estate file to be eSigned by others?

When you're ready to share your against estate file, you can send it to other people and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail. You can also notarize your PDF on the web. You don't have to leave your account to do this.

How do I edit against estate file on an iOS device?

Use the pdfFiller mobile app to create, edit, and share against estate file from your iOS device. Install it from the Apple Store in seconds. You can benefit from a free trial and choose a subscription that suits your needs.

What is TX-00781BG?

TX-00781BG is a form used for reporting specific financial information to the relevant tax authority in Texas.

Who is required to file TX-00781BG?

Individuals and businesses that meet certain financial thresholds or engage in specific activities as defined by the tax authority are required to file TX-00781BG.

How to fill out TX-00781BG?

To fill out TX-00781BG, gather the required financial data, follow the instructions provided with the form, ensure all sections are completed accurately, and then submit it to the relevant tax authority.

What is the purpose of TX-00781BG?

The purpose of TX-00781BG is to collect necessary financial information to assess compliance with state tax regulations and ensure proper taxation.

What information must be reported on TX-00781BG?

The TX-00781BG requires reporting of income, expenses, and other financial data relevant to the specific tax obligations as outlined by the tax authority.

Fill out your against estate file online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Against Estate File is not the form you're looking for?Search for another form here.

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.