Get the free deed beneficiary form

Show details

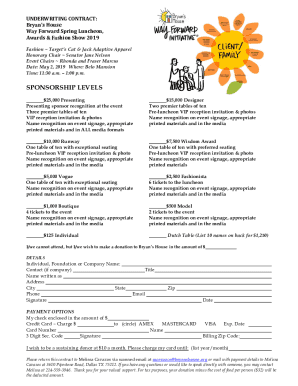

2016 U.S. Legal Forms, Inc. ARIZONA BENEFICIARY DEED Husband and Wife to Three Individuals Control Number: AZ03577I. TIPS ON COMPLETING THE FORMS The form(s) in this packet may contain form fields

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is deed beneficiary form

A deed beneficiary form is a legal document that designates a beneficiary to receive property upon the death of the owner.

pdfFiller scores top ratings on review platforms

This is great! Easy to use. I tried another company first and theirs would not work.

Everything I have done on PDFFiller has made life so much easier, and it is a fantastic tool all around! Nothing but good things to say about it.

-John Chatterton

Easy to navigate & create whatever document that you may need. (Even Older Forms)

Haven't found anything else that works this good.

Needs work in tabs, alignment of text to form, but otherwise, pretty good

Made it easy to complete and update employment application, provides a much cleaner and more professional document for submittal.

Who needs deed beneficiary form?

Explore how professionals across industries use pdfFiller.

How to fill out a deed beneficiary form

Understanding the deed beneficiary form

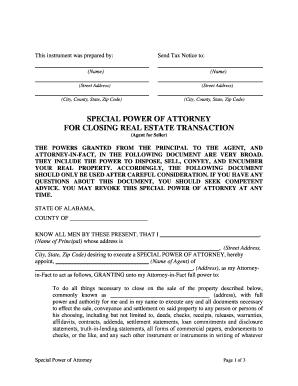

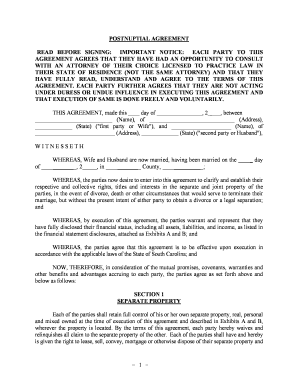

A deed beneficiary form, specifically a Transfer on Death (TOD) Deed, allows property owners to designate beneficiaries who will receive their property upon their death without going through probate. This legal document facilitates a smooth transition of ownership, ensuring that your wishes are honored posthumously.

-

A TOD deed is a legal instrument that lets property owners transfer their real estate to designated beneficiaries upon their death, bypassing the lengthy probate process.

-

The primary purpose is to simplify the transfer of property titles without court intervention, reducing stress and expenses for heirs.

-

The owner fills out the deed, naming beneficiaries. Upon the owner's death, the deed becomes effective, granting title rights directly to the beneficiaries.

What are the key elements of the deed beneficiary form?

Understanding the essential elements of the deed beneficiary form is crucial for proper completion. Various roles and legal specifications must be adhered to in order to ensure the document's validity.

-

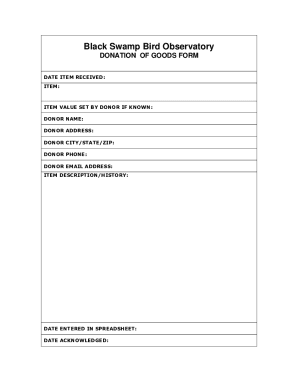

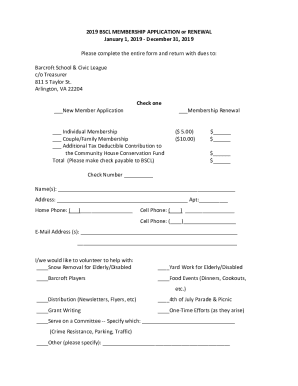

The form must include the grantor's (property owner's) name, the grantee's (beneficiary) details, and the property description.

-

The grantor is the property owner, while the grantee is the individual or entity receiving the property. Beneficiaries may include family members or trusted friends.

-

Each state has specific requirements for the form, including notarization or witnessing to ensure it is legally enforceable.

How do you fill out the deed beneficiary form?

Filling out the deed beneficiary form requires attention to detail. By following a structured approach, individuals can avoid common mistakes.

-

Begin by entering your name and address, followed by the name and address of your beneficiary. Complete property details clearly.

-

Common mistakes include incorrect beneficiary details or failure to obtain necessary signatures. Double-check all entries before finalizing.

-

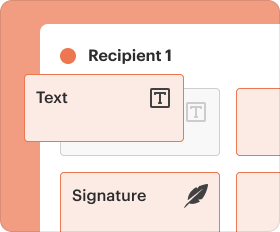

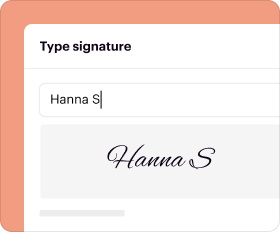

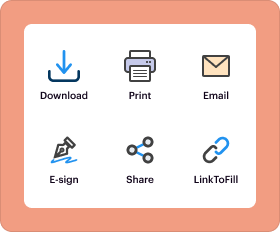

With pdfFiller, users can easily fill out the form online, using editing tools and eSign features to streamline the process.

How to navigate ownership transfer decisions?

Choosing the right beneficiary is paramount in the deed beneficiary form process. Various considerations can influence this decision.

-

Consider naming beneficiaries who can be trusted to manage the property responsibly and align with your wishes.

-

If the property is jointly owned, both owners may need to agree on the beneficiary, potentially requiring additional documentation.

-

Understand that you can revoke or change your beneficiary designation at any time before your death, but this must be documented correctly.

What legal considerations should be known for the deed beneficiary form?

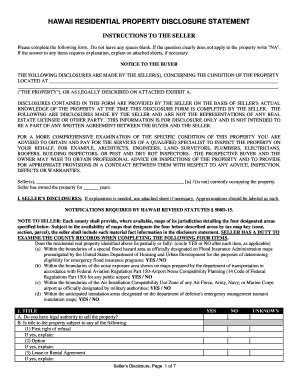

Legal aspects of deed beneficiary forms can vary significantly by state. Awareness of these variations is essential for compliance.

-

Different states have unique rules regarding TOD deeds, including filing requirements and tax implications.

-

Be aware of the potential for contested claims on the property from heirs or creditors, which may affect the transfer process.

-

Engaging a lawyer familiar with estate planning can provide valuable guidance and ensure compliance with legal standards.

What examples exist of completed deed beneficiary forms?

Having examples at hand can provide clarity on how a completed deed beneficiary form should look.

-

Arizona provides a standardized beneficiary deed form. Reviewing a filled version can illustrate proper completion practices.

-

Interpret the specific fields in the sample to correlate with terms you're familiar with, ensuring a clearer understanding.

-

A visual breakdown of the sample can help identify which sections require specific information, significantly aiding in the completion process.

How can pdfFiller assist with your deed beneficiary form?

pdfFiller brings innovative solutions to managing deed beneficiary forms, making the process seamless and efficient.

-

Users can access a variety of ready-made templates and guides specifically tailored for the deed beneficiary form.

-

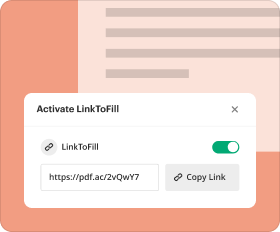

Utilize interactive features for editing, signing, and sharing documents with ease, keeping your paperwork organized and accessible.

-

If you’re working in teams, pdfFiller allows multiple users to collaborate on documents, ensuring everyone is aligned on updates and changes.

What are the final steps after filling out the deed beneficiary form?

Completing the deed beneficiary form successfully is just one part of the process; knowing the next steps is equally important.

-

Typically, the completed form must be filed with the county recorder's office where the property is located.

-

Make sure to notify your beneficiaries about the deed and provide copies for their records.

-

Maintain a copy of the deed and any related documents in a safe location to ensure easy access and future reference.

What are the advantages of digital document management with pdfFiller?

Utilizing pdfFiller for digital document management adds convenience and efficiency to form handling.

-

Cloud management allows for access from any device, ensuring you can work on your deed beneficiary form anywhere, anytime.

-

pdfFiller offers robust eSignature options making it easy to sign documents, thus expediting the entire process.

-

Retain control over all documents with continued access, enabling easy updates, sharing, and archiving.

How to fill out the deed beneficiary form

-

1.Access the deed beneficiary form in pdfFiller by visiting the website and clicking on 'Create New'.

-

2.Upload an existing form or choose a template for the deed beneficiary form.

-

3.Begin by entering the property owner's name and contact information in the designated fields.

-

4.Next, specify the property details including the address and legal description of the property.

-

5.Indicate the beneficiary's information, including their full name and relationship to the property owner.

-

6.Review the form for accuracy, ensuring all fields are filled appropriately and no mistakes are present.

-

7.If necessary, attach additional documentation that verifies ownership of the property.

-

8.Save your progress periodically using the 'Save' button to avoid losing any information.

-

9.Once all information is entered and verified, proceed to sign the document electronically or print it out for a physical signature.

-

10.Finally, submit the completed form as required, either electronically or by mailing it to the appropriate office.

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.