Last updated on Feb 20, 2026

AZ-01-03 free printable template

Show details

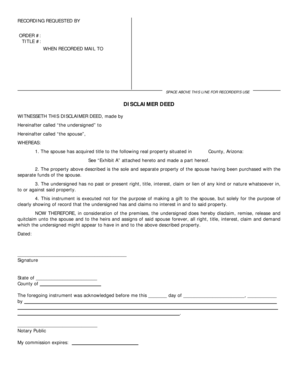

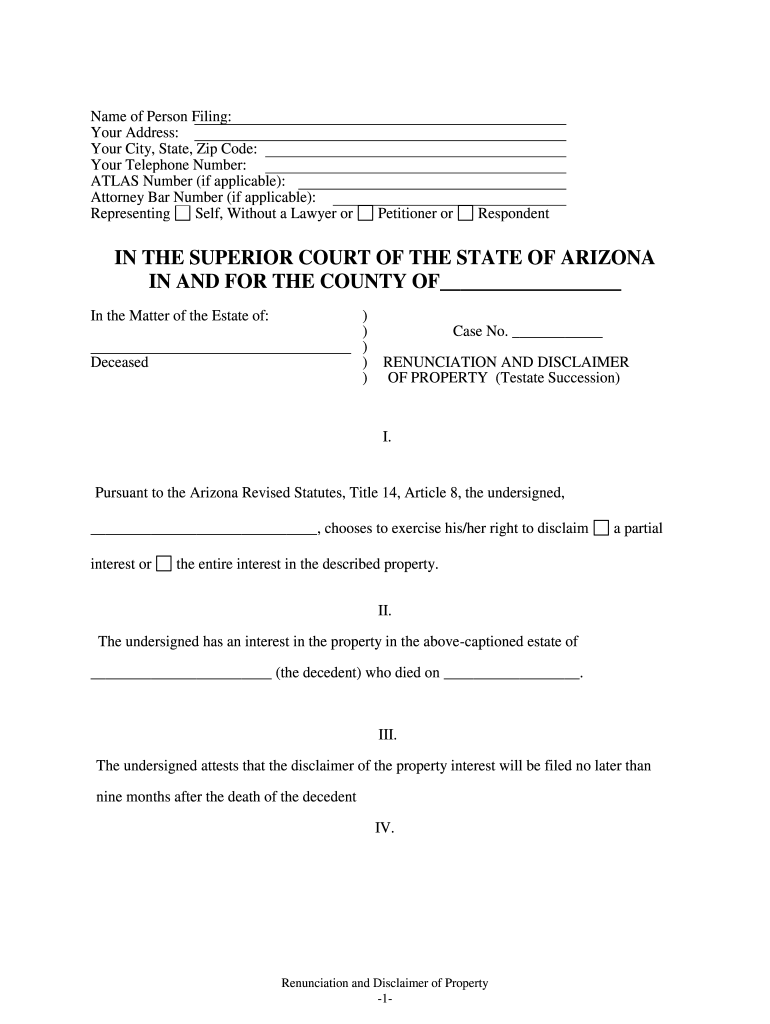

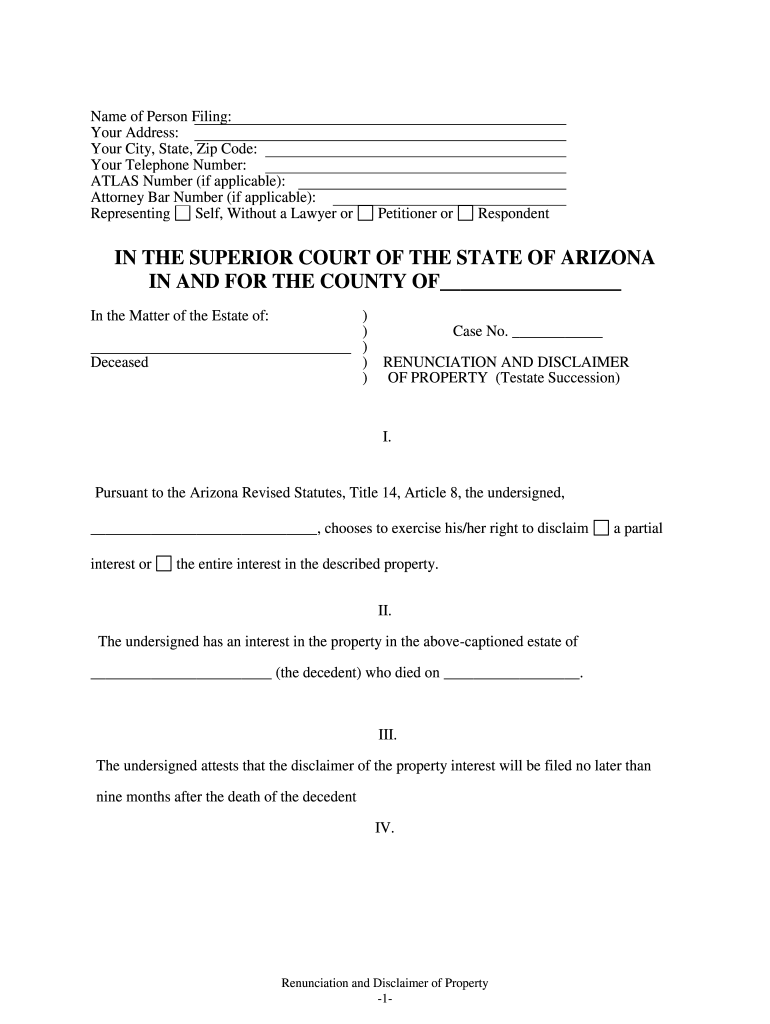

Prepared by U.S. Legal Forms, Inc. Copyright 2016 U.S. Legal Forms, Inc. STATE OF ARIZONARENUNCIATION AND DISCLAIMER OF PROPERTY TESTATE SUCCESSION Control Number AZ 01 031NOTE ABOUT COMPLETING THE

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is AZ-01-03

The AZ-01-03 is a standard form used for documenting and processing specific administrative procedures within the organization.

pdfFiller scores top ratings on review platforms

Enjoy the easy access and availabity of documents

Great for starting my transportation business. PDF filler help me to search and make documents that I needed for inspections, inventories, vehicle maintenance and more..

INGENIOUS APPLICATION!! Easy to use and is exactly what you need to make a PDF file come to life!

Editing it was not as easy as filling in the original form

Seems like a quality product. My company provides

Takes some time to get used to, and a little pricey, but acceptable. Will look around for cheaper alternatives when it comes to renewing subscription.

Who needs AZ-01-03?

Explore how professionals across industries use pdfFiller.

Comprehensive Guide to AZ-01-03 Form Submission on pdfFiller

Filling out the AZ-01-03 form correctly is essential for compliance with Arizona tax laws and ensuring accurate reporting of taxable income. In this article, we will explore how to navigate the form using pdfFiller, offering a detailed overview, tips for completing it, and additional resources to ensure you meet your obligations.

What is the purpose of the AZ-01-03 form?

The AZ-01-03 form is primarily used for reporting income in Arizona, catering to both individuals and fiduciaries managing estates or trusts. Understanding its legal implications is crucial as inaccuracies can lead to penalties. Moreover, by preparing key information beforehand, you can streamline the submission process, making it efficient.

-

The AZ-01-03 form is necessary for compliance with Arizona tax laws and accurate income reporting. Failing to submit this form correctly can lead to legal consequences.

-

Gathering required income documents, tax identification numbers, and estate details can facilitate a smoother form completion.

-

The AZ-01-03 fits within Arizona's comprehensive tax system, impacting how residents and fiduciaries manage taxable income.

How can edit the AZ-01-03 form on pdfFiller?

Using pdfFiller's intuitive interface simplifies the process of accessing and editing the AZ-01-03 form. The platform offers a range of editing tools, allowing users to customize their forms effectively.

-

Begin by logging into your pdfFiller account. Type in 'AZ-01-03 form' in the search bar to find the template.

-

Use the available form fields to fill in your information accurately. Take advantage of templates to ensure a seamless completion.

-

pdfFiller allows you to save multiple versions of your document and collaborate with others by sharing access.

What are the best practices for completing the AZ-01-03 form?

To avoid common pitfalls, it's essential to have a clear understanding of each section of the AZ-01-03 form. Attention to detail and document management will help ensure accuracy.

-

Understanding each section and its requirements can prevent mistakes that might lead to delays or penalties.

-

Double-check your entries to avoid errors such as misreported income or incorrect identification numbers.

-

Leverage pdfFiller's eSignature feature for secure document sharing and to maintain the integrity of your submission.

What compliance requirements should know?

Timely submission of the AZ-01-03 form is critical to avoid penalties. Understanding compliance deadlines associated with this form ensures you remain within legal bounds.

-

Stay updated on submission deadlines to ensure you're compliant, especially during tax season.

-

Ensure accuracy in reporting your taxable income to avoid potential fines or audits.

-

Regularly consult official Arizona Department of Revenue resources for the latest tax law changes.

How do troubleshoot issues with the AZ-01-03 form?

Addressing common errors while filling the AZ-01-03 form can save you from unnecessary delays. Knowledge of common troubleshooting techniques can help resolve issues quickly.

-

Recognizing frequent mistakes allows you to address them immediately instead of later during submission.

-

If form fields are not visible, checking browser compatibility or refreshing the document may help.

-

After making changes, save your work often to avoid losing any crucial data that has already been inputted.

How does pdfFiller enhance document management?

pdfFiller provides advanced features that improve document workflow for users. Its cloud-based system allows for quick access and collaboration, making it ideal for both individual and team use.

-

pdfFiller's user-friendly platform helps users efficiently manage documents, from creation to submission.

-

Incorporate the AZ-01-03 form into a larger document management system for a streamlined process.

-

Utilize features that allow for collaboration with team members in real-time, improving productivity.

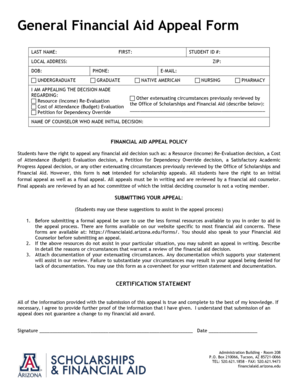

How to fill out the AZ-01-03

-

1.Open the PDF file of the AZ-01-03 form using pdfFiller.

-

2.Begin by entering your personal information in the designated fields at the top of the form.

-

3.Next, fill in the date of the request in the specified section.

-

4.Provide details of the request in the main body of the form, ensuring clarity and completeness.

-

5.If applicable, attach any supporting documents by using the upload feature on pdfFiller.

-

6.Review your entries for accuracy to prevent any errors.

-

7.Sign the form using the electronic signature tool provided in pdfFiller.

-

8.Once completed, save the filled form on your device or directly send it to the necessary department through pdfFiller.

-

9.If required, print a copy for your records.

Related Catalogs

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.